Macroeconomic reports have been overshadowed by the geopolitical news about Russia's decision to recognize the independence of the Donetsk and Luhansk Peoples' Republics. However, the reports were quite strong. Thus, in Germany, the Ifo index advanced to 98.6 points, significantly exceeding the forecast of 96.5 points. In the US, the Markit PMI also surpassed expectations, providing hope for better data on ISM manufacturing PMI. However, there was no information that may alter forecasts for the Fed's key interest rate.

The Ukrainian crisis is still on the agenda. That fact is that sanctions that could be imposed by many countries may influence energy prices and demand for bonds. However, the influence is likely to be limited.

A representative of Japan's Mizuho Bank commented on the situation, saying that the key problem was that the US and other Western countries had not even offered Russia a compromise.

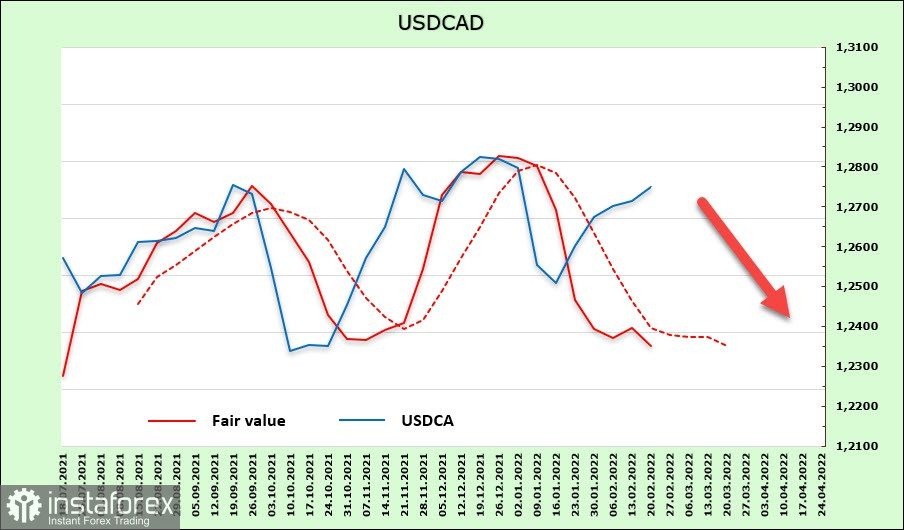

USD/CAD

The main factors that may affect future actions of the Bank of Canada remained the same. Thus, in January, house prices advanced by almost 7%, showing the highest monthly growth since 1989. According to the research conducted by the Bank of Canada, the number of people who buy new houses is dropping, whereas the number of investors is increasing, pointing to a speculative bubble.

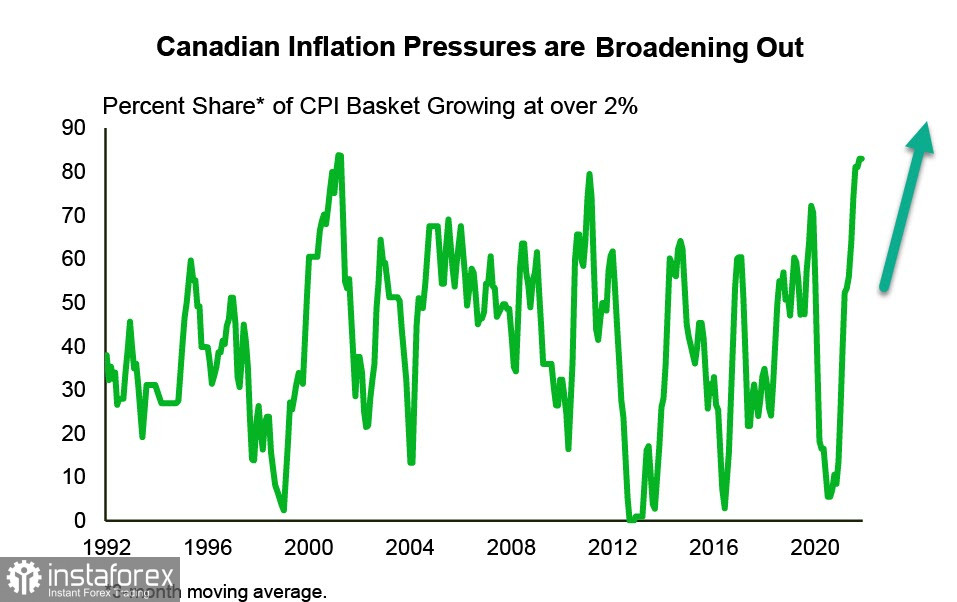

In February, the situation will hardly change since in January, inflation was above the forecast and oil prices failed to decline. In other words, pressure on the Bank of Canada is increasing. A month ago, analysts foresee 6 hikes of the key interest rate. Now, they expect 7 hikes. It means that the pace of the interest rate hike will be almost the same as in the US. Notably, more than 20 years ago, inflation also reached 5.7%. Then, the key interest rate also hit this level.

Against the backdrop, the regulator cannot raise the benchmark rate to the level similar to the inflation rate. The fact is that businesses and households have considerable debts. However, it is still necessary to take decisive measures. Thus, reasons for a decline in CAD are fading away.

Bullish sentiment in the futures and options markets remained intact. The USD/CAD pair failed to find grounds for an upward reversal and it is still below the long-term average. Thus, the pair is likely to fall.

The price reached the upper limit of a triangle pattern. It may make an attempt to rise, but a drop to the lower limit of 0.2550/70 is more possible.

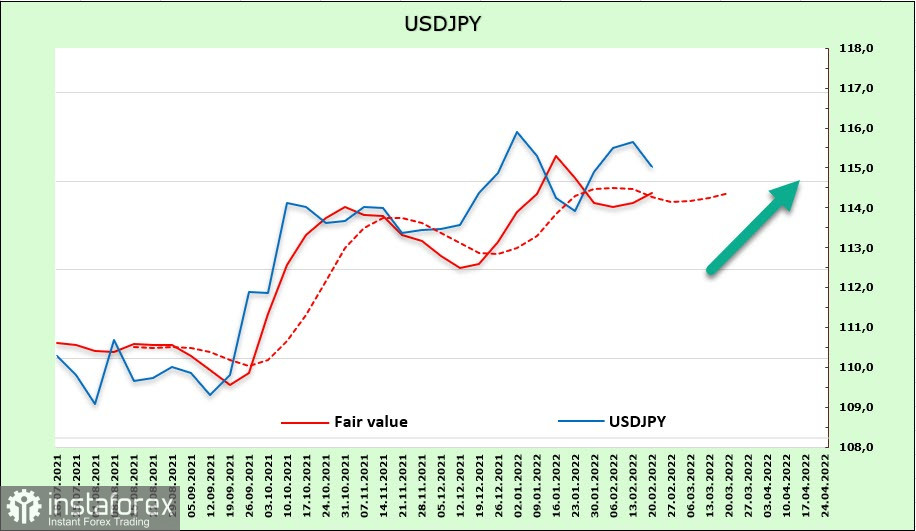

USD/JPY

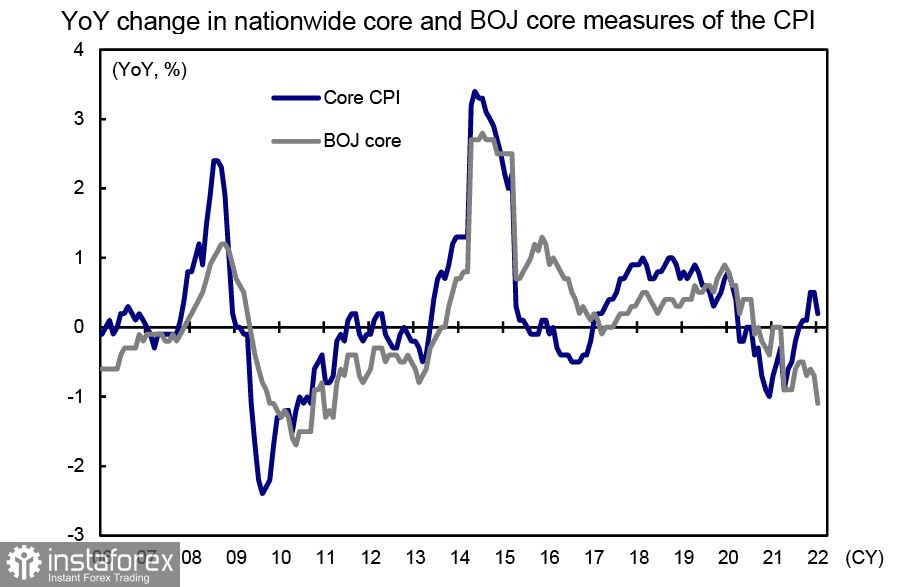

At the moment, the Japanese yen has no reason to leave the sideways channel. The Bank of Japan has a goal to push the yield of 10-year JGB to the near zero level. It means that the regulator allows the yield to hover within a narrow range of +/-0.25%. Last week, the yield hit 0.23%. The regulator immediately conducted several operations to cap its growth.

The approach of the Bank of Japan differs from the one chosen by the Fed and the ECB, who are striving for monetary policy normalization. This means that the yen will continue losing value against other currencies, unless there are factors that may boost demand for the safe-haven asset.

It is quite possible that the dollar/yen pair will go on climbing. The nearest target is located at the resistance level of 116.36 and the next target is at 118.60.