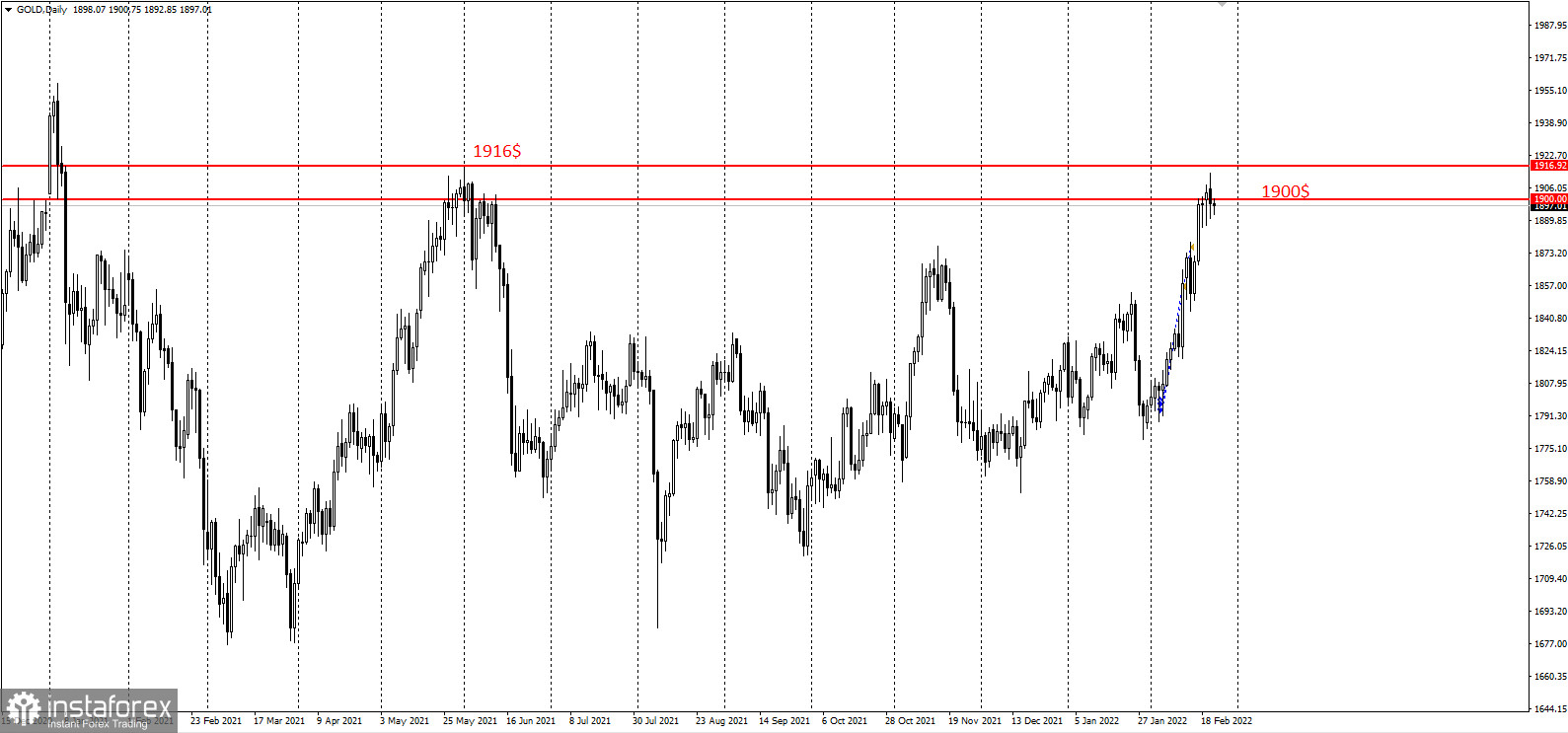

Gold is trading above $1,900, in part due to geopolitical concerns that rose amid tension in Ukraine. Many experts say it could go even higher as it emerged as the leader of the commodity sector.

For the past two weeks, the yellow metal is performing better than other commodities, said MKS head Nicky Shiels. She noted that over the same two weeks, gold prices rose by 5.5%, while the Bloomberg commodity ex-precious metals index rose 1.5%.

April gold futures also traded at $1,905 on Tuesday.

But Shiels warned investors that it is too early to think about a rally in precious metals, and there are several criteria due to which a continuation of the trend is possible.

She explained that investors are shifting to consumer goods to hedge against the growing threat of inflation and to gain access to the trend towards electrification and the transition to clean energy. She also said there should be a more active rotation in the commodity sector as such will benefit gold and precious metals.

In any case, the latest economic news did not provoke a dip in gold even though US consumer optimism turned out much higher than expected. Prices remained above $1,900 despite consumer confidence falling to 110.5 in February, from 113.8 in January.