Hi, dear traders!

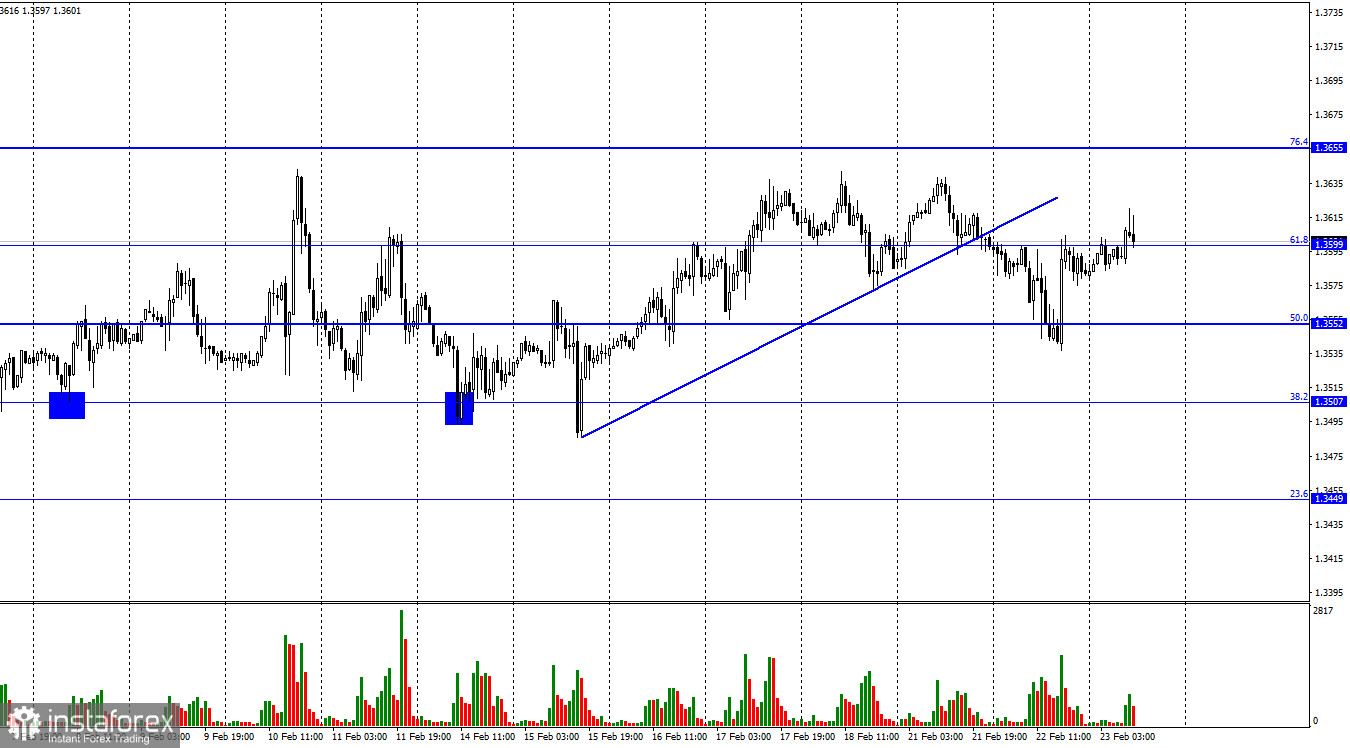

On the 1-hour chart, GBP/USD declined to 1.3552, the 50% Fibonacci level, on Tuesday. Then, the price bounced off and spiked to 1.3599 that matches the 61.8% Fibonacci level. The underlying reason for this growth is a mystery for me. In the second half of the day, a series of economic data was released in the US. Let's have a look at them. The manufacturing PMI rose to 57.5 in February from 55.5 in January. The services PMI grew notably to 56.7 from 51.2 a month ago. The CB consumer confidence index dropped to 110.5 from 111.1. All in all, the two crucial indicators of business activity increased in February, but the less important indicator slipped a bit. Nevertheless, the US dollar plummeted in response. This prompts the conclusion that the economic data has nothing to do about the US dollar's fall. The greenback's weakness was triggered by something else. What exactly pushed it down? Interestingly, EUR/USD was trading flat at the same time.

Importantly, the economic calendar for the UK was empty yesterday. On the political front, British Prime Minister Boris Johnson announced that the Kingdom slapped sanctions on the Kremlin. Today, the market suggests more interesting moves because of some events. The highlight of the day will be a speech by Bank of England Governor Andrew Bailey at the parliamentary hearings. Besides, some other members of the central bank are due to speak today. So, the sterling's dynamic today depends on the content of speeches by Andrew Bailey, Ben Broadbent, Silvana Tenreyro, and Jonathan Haskel. Traders will be looking for clues as to whether the Bank of England intends to raise interest rates again or, on the contrary, to take a pause for some time. From my viewpoint, this information could make an impact on market sentiment. Recently, the sterling bulls were eager to set the tone on the market.

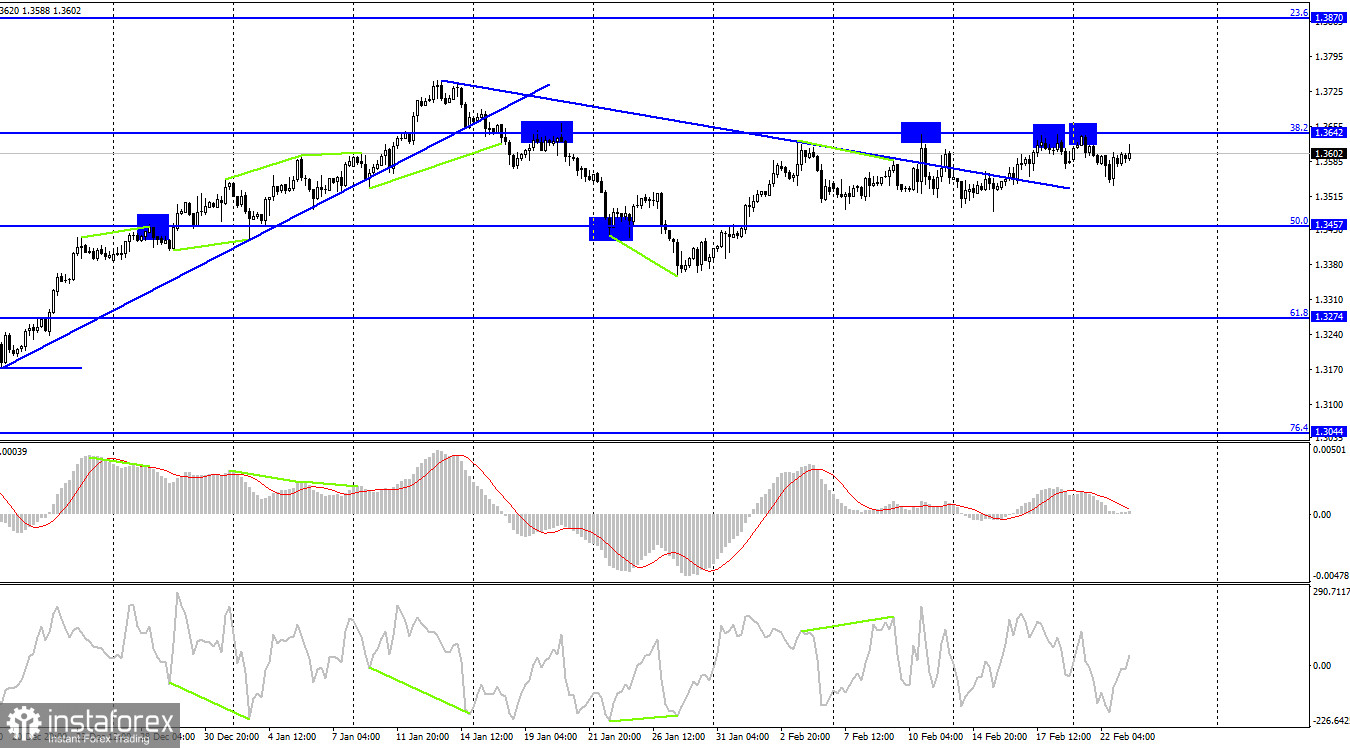

Thus, the odds are that the price might settle above the important level of 1.3642. The price has already kicked out of this level at least 3 times. For the time being, the currency pair has not been able to settle above it. GBP/USD remains in a trading range on the 4-hour chart like EUR/USD.

In the same timeframe, GBP/USD is returning again to 1.3642, the 38.2% Fibonacci correction. A new drop off will again play in favor of the US dollar and the price will make a new correctional move towards 1.3457, the 50.0% Fibonacci level. In case the currency pair settles above 1.3642, traders will expect a further growth towards 1.3870, the 23.6% Fibonacci level. Today none of the indicators signal any looming divergences.

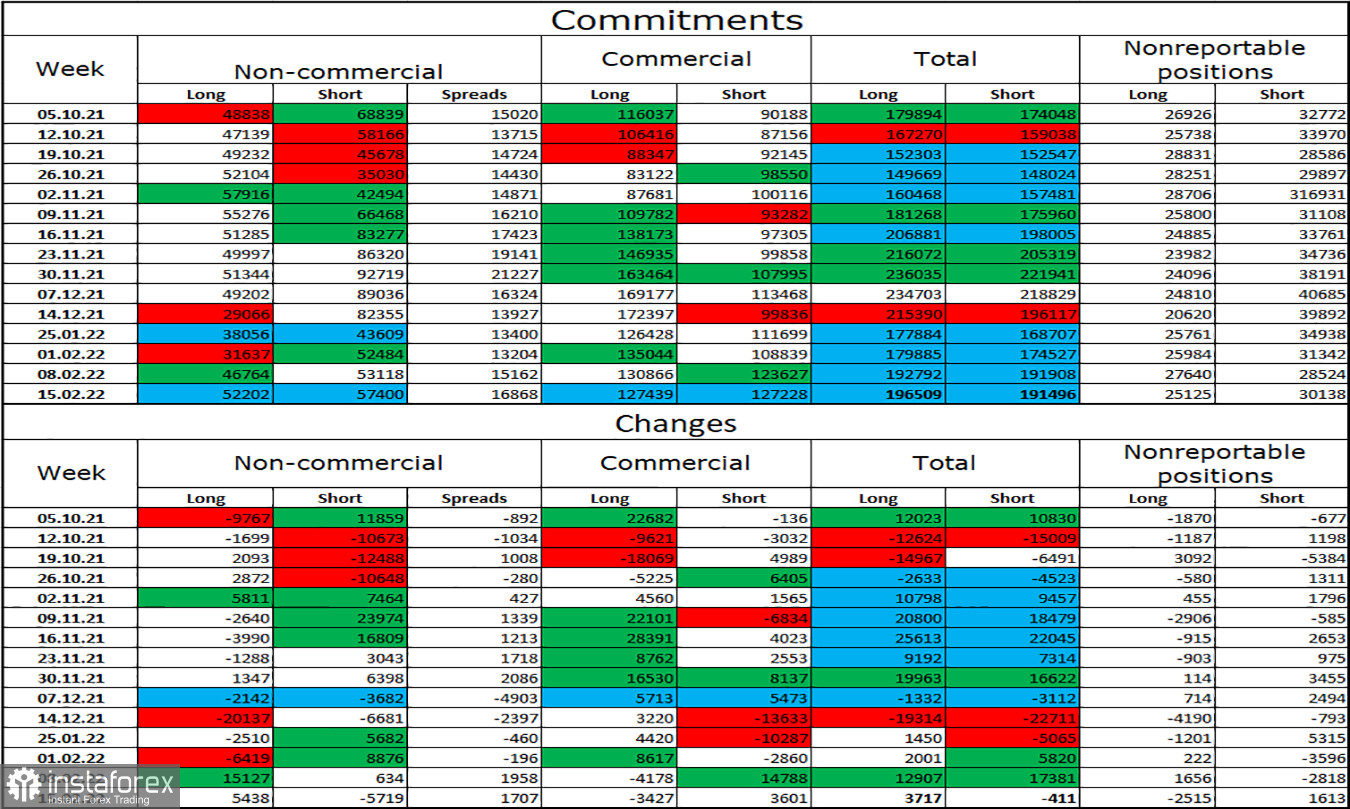

Commitments of Traders (COT):

Sentiment of non-commercial traders again changed sharply over the last trading week. For two weeks, speculators have been increasing long contracts whose number expanded by 20,000. Last week, traders were closing short positions. The conclusion is clear-cut. Large market players are turning bullish. At the same time, the number of long contracts remains roughly the same as short contracts. Hence, the bearish mood matter a lot on Forex. By and large, the pound sterling has been growing slowly but surely that coincides with the data on COT reports.

Economic calendar for US and UK

UK: Parliamentary hearings on inflation report (09-30 UTC)

UK: Bank of England Governor Andrew Bailey testifies on inflation and economic outlooks before Parliament's Treasury Committee (09-30 UTC)

On Wednesday, the economic calendar is absolutely empty for the US. Thus, information background is weak. However, if Andrew Bailey or his colleagues tell something important, it will serve as a market catalyst for GBP/USD. The GBP bulls are still holding the upper hand in the market.

Outlook for GBP/USD and trading tips

At the moment, I would recommend selling GBP/USD because the price kicked out of 1.3642 on the 4-hour chart. However, the bears are weak, unable to retain the downtrend. Alternatively, long positions on GBP/USD could be opened with the target at 1.3731 on condition the price closes above 1.3642.