Stocks fell early on Thursday, pushing indices into a correction, as the imposition of sanctions against Russia over its belligerence against Ukraine added pressure to a market that has shown signs of buckling under the Federal Reserve's efforts to subdue inflation.

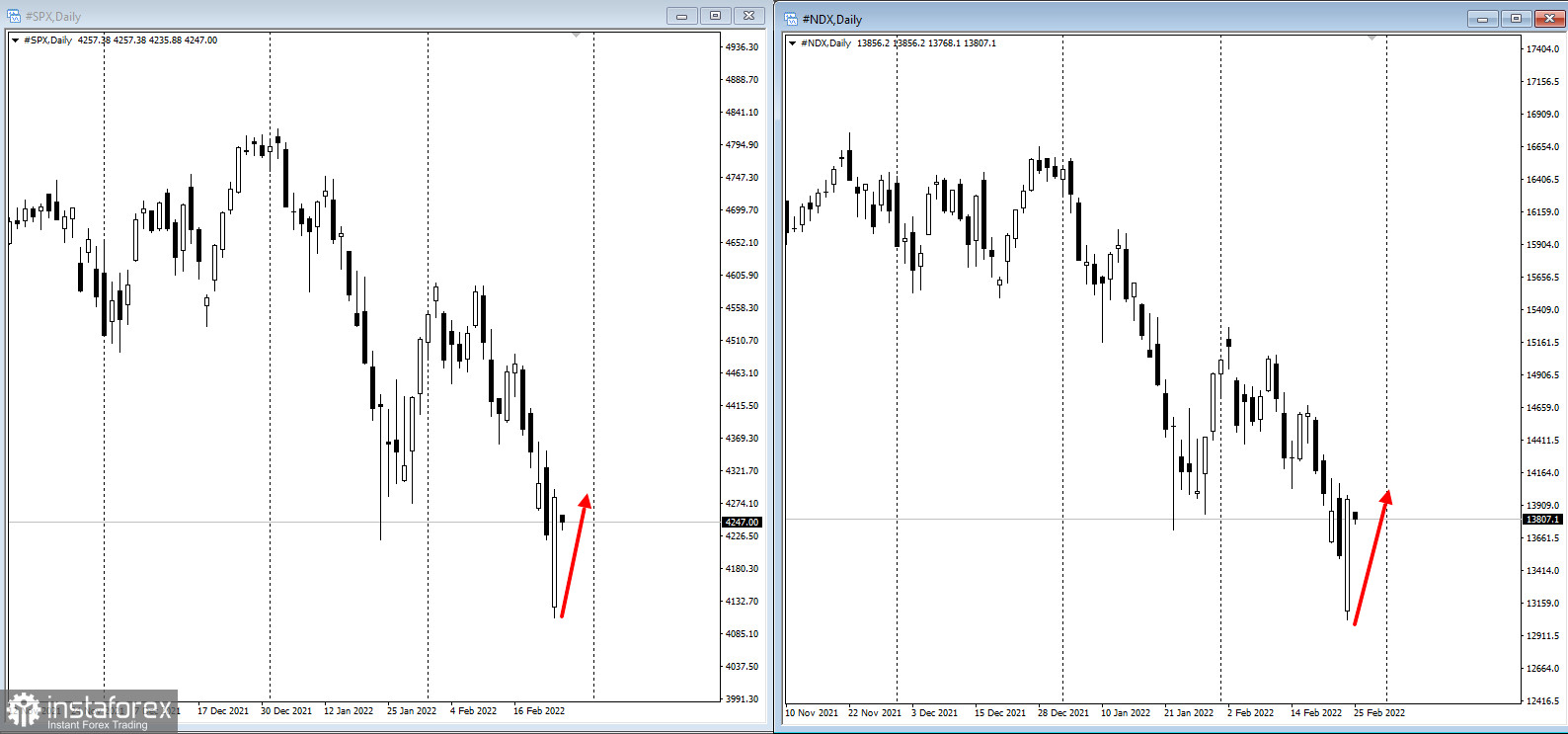

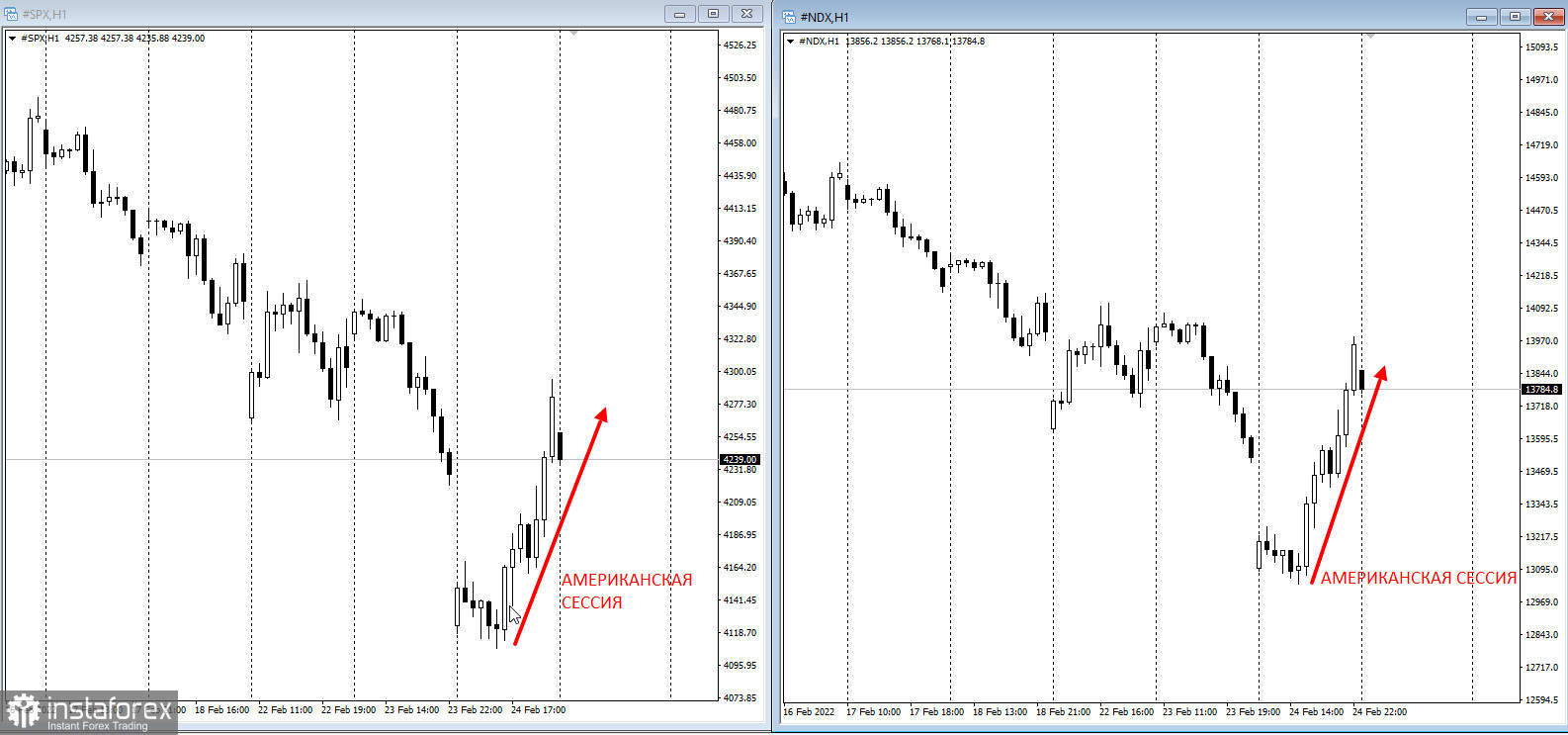

The S&P 500 and Nasdaq had been declining until the opening of the US session, where the US stock market went on an unprecedented rally:

The remarkable thing is that this happened in the US session, which has not happened for a long time.

Biden said US troops would not be involved in the conflict in Ukraine. The US is working closely with Germany on halting the Nord Stream 2 pipeline, which sent European natural gas futures 11% higher earlier in the session. He also said the administration was keeping an eye on the energy sector as the threat of supply disruptions kept oil prices elevated. West Texas Intermediate crude traded close to $92 a barrel.

Biden said US troops would not be involved in the conflict in Ukraine. The US is working closely with Germany on halting the Nord Stream 2 pipeline, which sent European natural gas futures 11% higher earlier in the session. He also said the administration was keeping an eye on the energy sector as the threat of supply disruptions kept oil prices elevated. West Texas Intermediate crude traded close to $92 a barrel.

The stock market is right to be concerned about current tensions between Russia and Ukraine, which run the risk of exacerbating the challenging inflation backdrop that many investors and companies have expected to improve in the back half of 2022. The bad news is that the investment community still appears to be in the early days of understanding the potential implications of this conflict.

Geopolitical risks have already led investors to pare bets on how aggressively the Federal Reserve may tighten monetary policy this year to fight inflation.

"The market had gotten way ahead of itself in terms of expecting Fed rate hikes and now we have this heightened political risk that's going to mean potentially tighter financial conditions, and that means a slower process of rate increases from the Fed and probably a flatter yield curve," Charles Schwab's Kathy Jones said

Markit manufacturing and services PMI data beat estimates, suggesting that recent growth fears were driven by the Omicron strain. However, US consumer confidence is at its lowest level since September.

"The market is worried about a lot of different things and it certainly doesn't want to be thinking about Russia/Ukraine on top," Marko Papic, partner and chief strategist at Clocktower Group, said. "It's a catalyst for further selloff."

Here are some events to watch this week:

- US new home sales, gross domestic product (GDP), initial jobless claims

- US consumer income, US durable goods, PCE deflator, University of Michigan consumer sentiment Friday