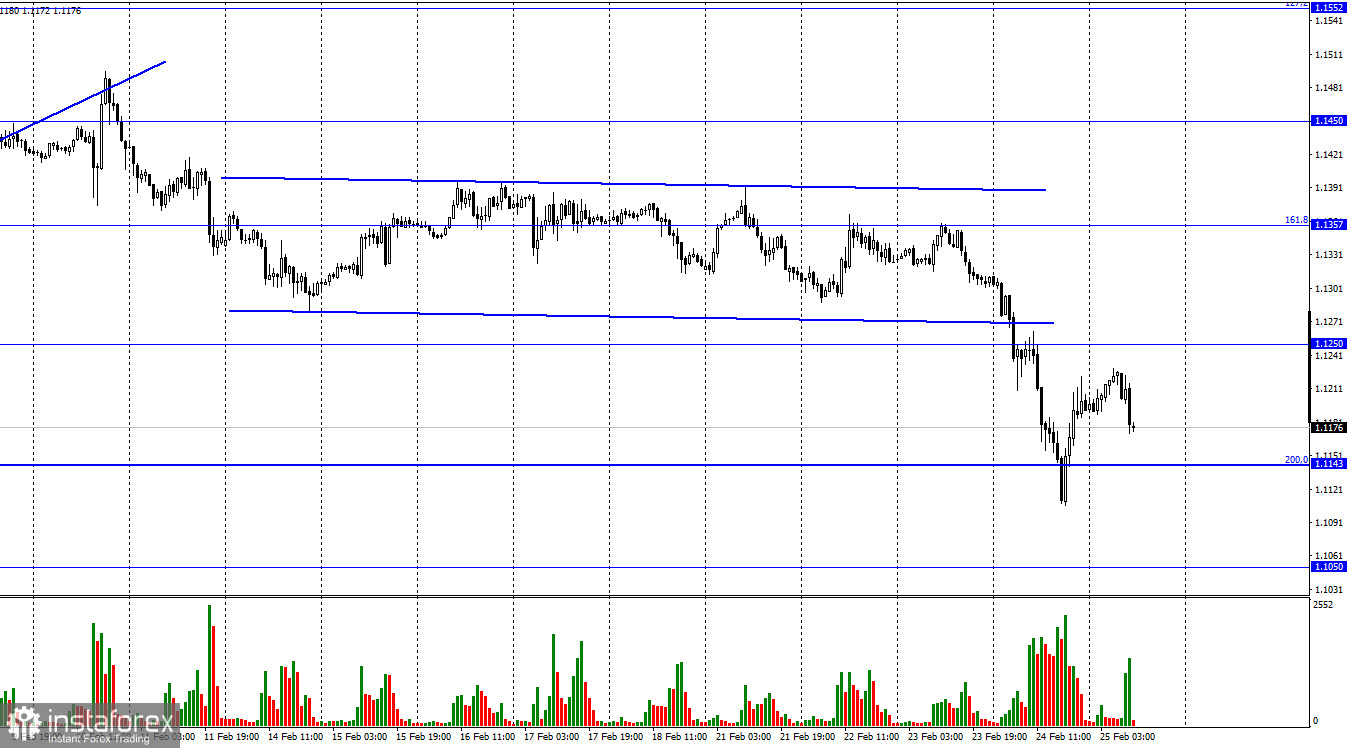

EUR/USD made a strong drop on Wednesday after rebounding from the retracement level of 161.8%, 1.1357. The decline only stopped when it approached 1.1100. In total, the European currency lost more than 250 pips in the first 24 hours of the war between Ukraine and Russia. Last night the bullish traders already tried to regain some losses, but today the pair's fall has already resumed towards the Fibonacci level of 200.0%, 1.1143. It is obvious that the main reason for the drop in the Euro currency is the war that has started in Ukraine. At the moment, only large supermarkets and pharmacies are open in Ukraine. That is why the situation is difficult, primarily in Ukraine. However, the world markets, in particular the foreign exchange market, are an aggregate of a huge number of traders, some of whom are in Ukraine and Russia.

Sanctions against the Russian Federation have already begun to be imposed. Almost all major Russian banks have been blocked from operating abroad. Sanctions have been imposed on many of Russia's top officials, businessmen and oligarchs. Some countries have started cancelling visas for all Russians. The heads of the UK, France, Germany and the US are now discussing the complete isolation of Russia from the outside world. The Nord Stream 2 project is suspended indefinitely. However, what is important now is that the war is over as quickly as possible so that people on both sides stop dying. Foreign exchange traders will have to continue to react to what is happening in Ukraine. The US dollar has already shown on the first day of the war how trading in pairs involving it will play out. Given its stable currency status, traders can continue to forgo other currencies in its favor. Thus, I believe that each new day of war will only lead to a new rise in the US currency. It does not matter which currency will be the second in the pair. I would also like to point out that there is almost no economic news this week, and the ones, which was published, do not interest traders now.

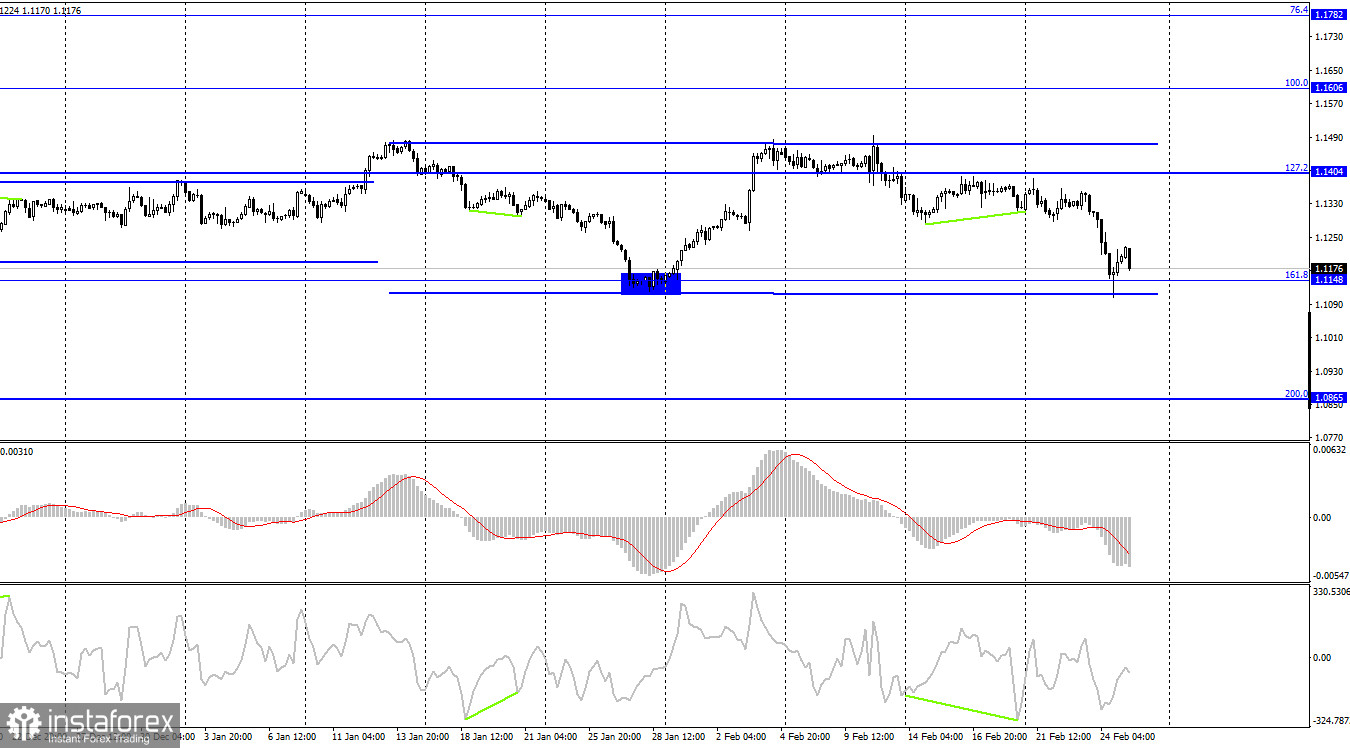

On the 4-hour chart, the pair declined towards the lower boundary of the sideways corridor, which still characterizes the current mood as flat. The rebound from this boundary favored the start of a rise, but given the ongoing hostilities in Ukraine, the pair could consolidate below it and continue the downward process towards the next retracement level of 200.0%, 1.0865.

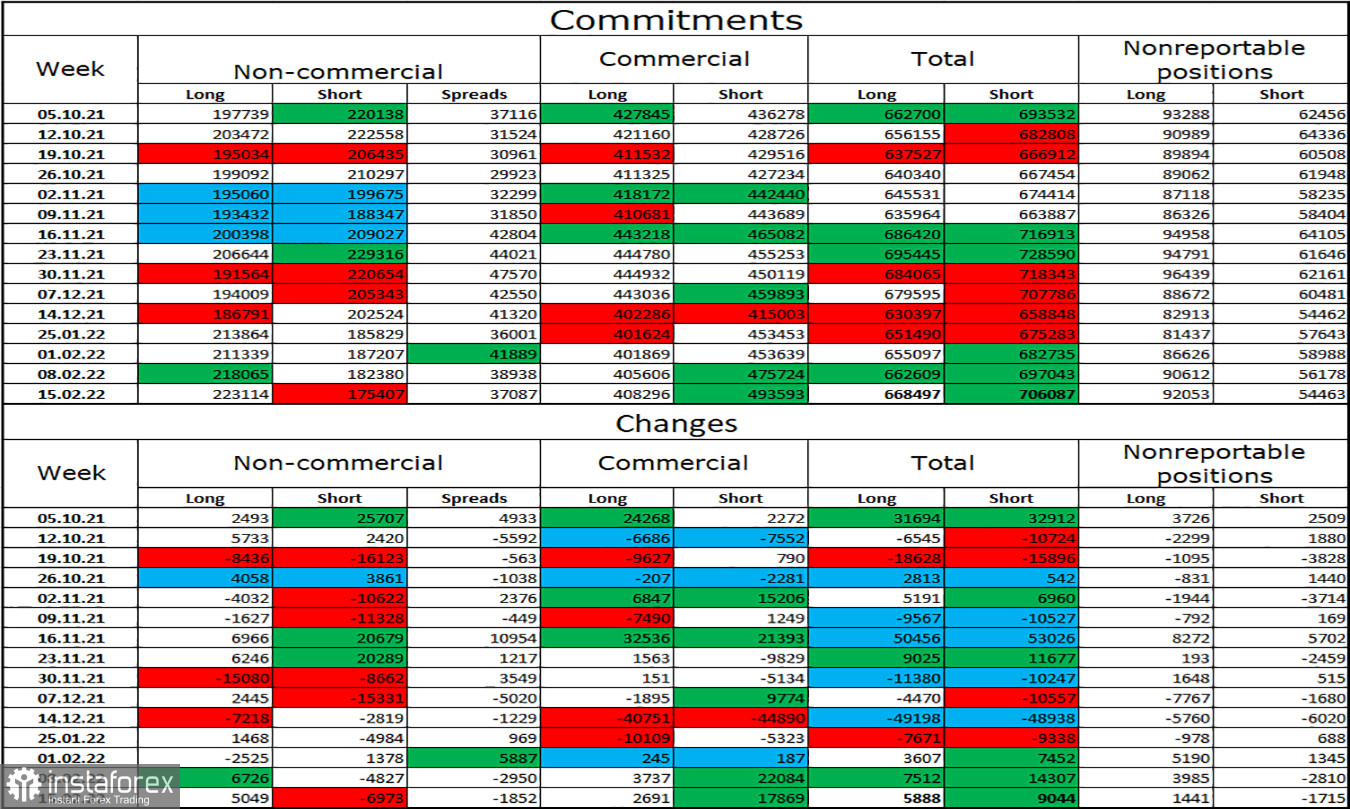

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 5,049 long contracts and closed 6,973 short contracts. This means that the bullish mood has intensified. The total number of long contracts concentrated on their hands now amounts to 223 thousand, and short contracts - 175 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is also characterized as "bullish". This makes it possible for the European currency to count on growth, if not for the information background, which now supports the American currency to a greater extent. I believe that now the data from the COT reports can be neglected since the situation in the world is tense and the mood of major players can change rapidly.

News calendar for the US and the European Union:

EU - Speech of ECB President Christine Lagarde (11-15 UTC).

US - Household spending and income (13-30 UTC).

US - Durable goods orders (13-00 UTC).

On February 25, the EU calendar contains a speech by the ECB president, which could be very important given that the military crisis is unfolding precisely in Europe. Traders are unlikely to pay attention to reports in the US today. The information backdrop will be weak today, with traders continuing to monitor the situation in Ukraine closely.

EUR/USD outlook and tips for traders:

I recommend to open short positions with targets of 1.1050 and 1.0865, if a close below 1.1143 on the hourly chart is executed. I do not recommend to open long positions, as traders are now only considering buying the US currency. Opening long positions is risky, though a rise in the pair is also possible.