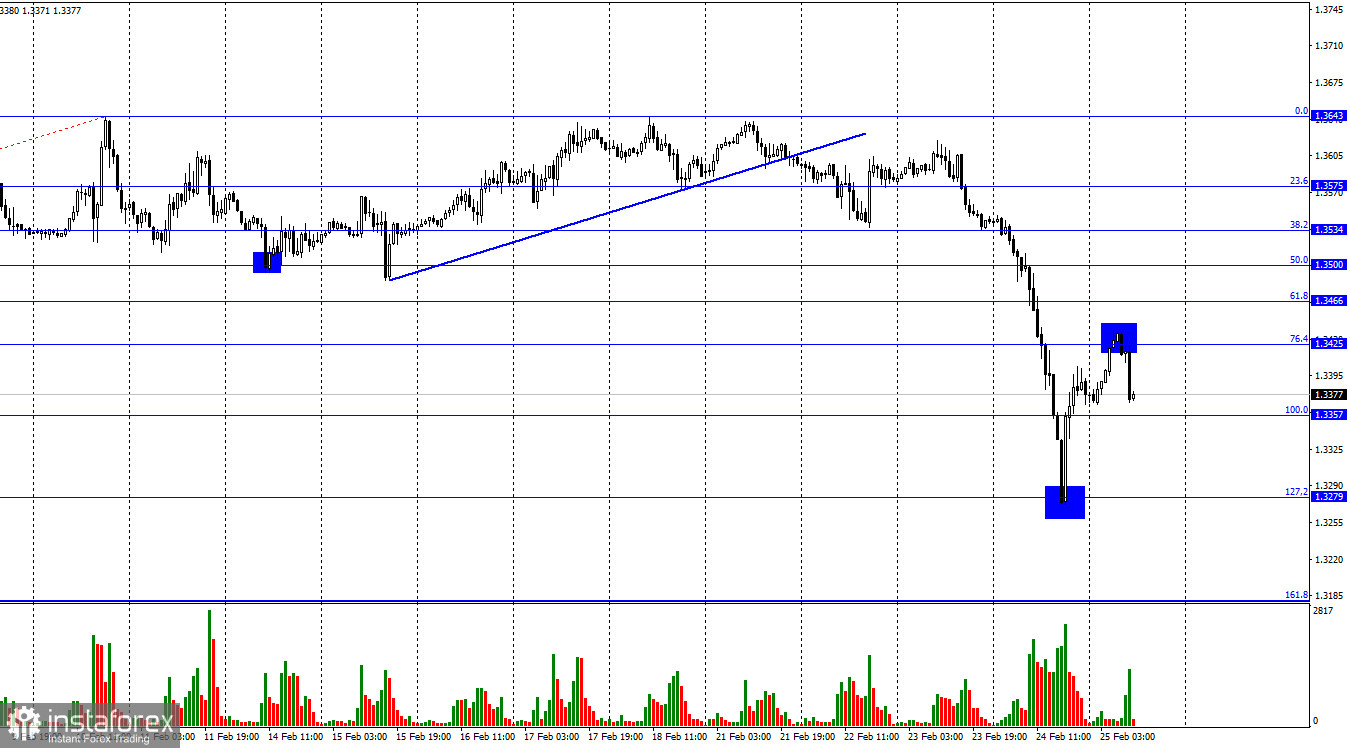

According to the hourly chart, the GBP/USD pair on Thursday performed a drop to the corrective level of 127.2% (1.3279). The rebound of quotes from this level made it possible to perform a reversal in favor of the British currency and an increase to the Fibo level of 76.4% (1.3425). And the rebound from this level already led to a new reversal in favor of the American and the beginning of a new fall of the pair. As a result, today's quotes can make a return to the Fibo level of 127.2% (1.3279). As I have already said, the strongest movements that were observed yesterday were caused by only one event and may continue today. However, I suggest moving away from the Ukraine-Russia conflict for a while and focusing on the Fed, which should raise the interest rate on March 15-16 as part of the fight against rising inflation. After the military conflict in Ukraine began, energy prices skyrocketed. This means that all prices for products and services, as well as various goods, will also rise.

And this means that inflation will only accelerate now. At least, this conclusion looks quite logical. In America, inflation is already 7.5%, and by the end of February, it may rise to 8%. Even without the February value, the Fed urgently needs to do something about consumer prices. Thus, I think that a 0.5% rate increase is almost inevitable. The dollar has been growing strongly since the start of the war in Ukraine, and if the Fed also raises the rate in mid-March, this could lead to even greater growth. I want to believe that the conflict will not last for a long time. As soon as the situation begins to improve, the dollar will begin to lose ground, as traders' appetite for risk will grow again. However, the Fed's actions will still contribute to the growth of the US currency. This is also almost inevitable. Now we are talking about 5-7 increases this year. And after the war in Europe began, the Fed can raise the rate even more strongly and faster, since the danger of a new increase in inflation is very high.

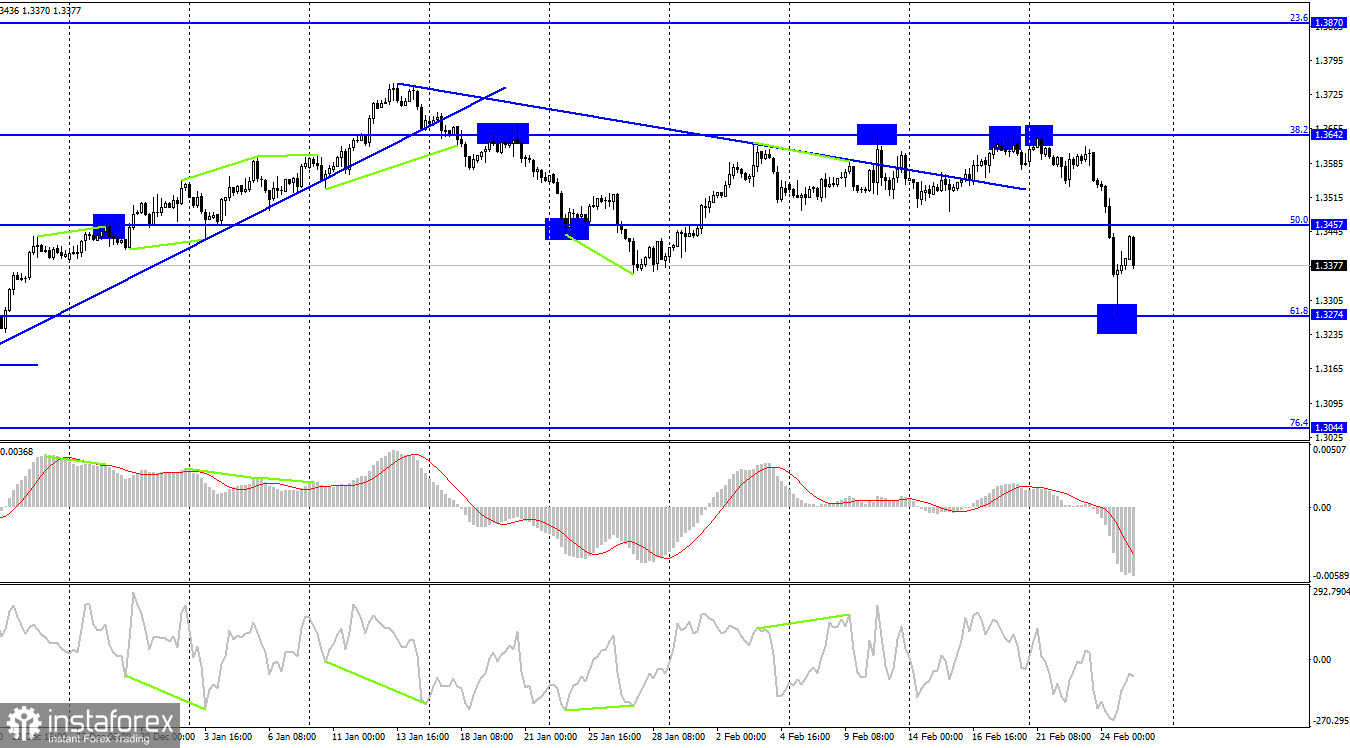

On the 4-hour chart, the pair performed a drop to the corrective level of 61.8% - 1.3274. The rebound of quotes from this level allowed the pair to perform a reversal in favor of the British and begin to grow in the direction of the Fibo level of 50.0% - 1.3457. However, a new reversal in favor of the American has already been made on the hourly chart, so the pair can return to the corrective level of 61.8%. Brewing divergences are not observed in any indicator today.

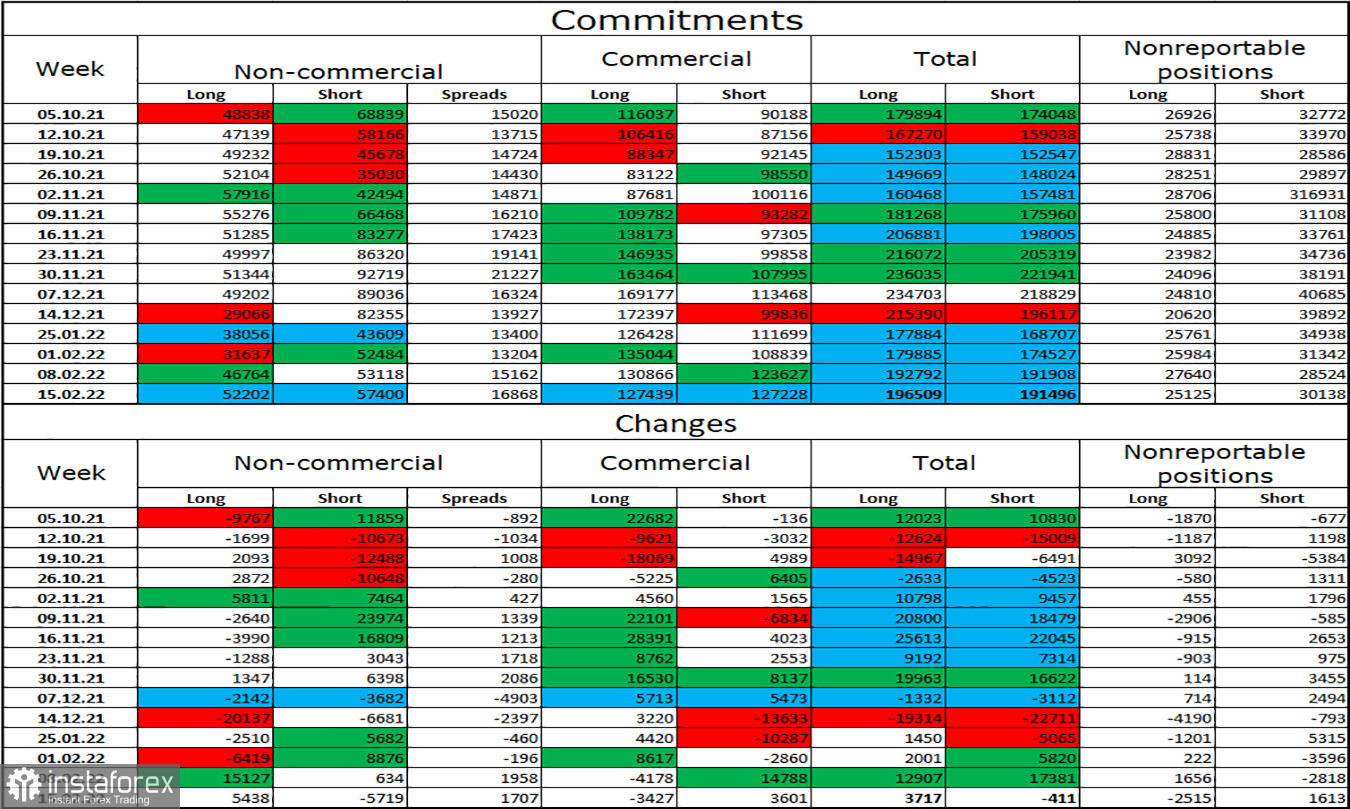

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. In the last two weeks, speculators have been increasing the number of long contracts, the number of which has increased by 20 thousand. In the last reporting week, they also got rid of short contracts, so there is only one conclusion: the "bullish" mood is increasing among the major players. However, at the same time, it remains "bearish", since the total number of long contracts does not exceed the total number of short contracts. However, the pound has still shown modest growth in recent weeks, which coincides with the COT reports, but what will happen now that hostilities have begun in Europe?

News calendar for the USA and the UK:

US - change in the level of expenditures and incomes of the population (13:30 UTC).

US - change in the volume of orders for long-term goods (13:00 UTC).

On Friday in the United States, the calendar of economic events does not contain really important and interesting events. In the UK, the calendar does not contain anything at all. Thus, the influence of the informational economic background on the mood of traders today will be minimal or absent.

GBP/USD forecast and recommendations to traders:

At this time, I would recommend selling the British, as the rebound from the level of 1.3425 was performed on the hourly chart, with targets of 1.3357, 1.3279, and 1.3181. I would not recommend new purchases by the British now due to the critical situation in Ukraine, due to which risky currencies are falling.