The EUR/USD currency pair was trading very restlessly again on Monday. The fall began immediately at the opening of trading at night, but, fortunately for the euro, it was short-lived. Already in the morning, the pair began to recover, but at the same time, nervousness and panic now rule the market. In principle, this is very clearly seen from the last three trading days: how exactly the pair was trading at that time. Thus, formally, we now have a downward trend, as the price continues to be located below the moving average line. However, as we have said many times before, the direction of movement can change at the speed of light. Now it is impossible to conclude similar to what could have been done a week ago. It does not matter now whether the Fed will raise the key rate at the meeting in March and how many times it will raise it during 2022. Of course, there will be a certain market reaction to these events. However, ask yourself the question, why did the pair collapse on Monday immediately at the opening of trading? What happened on the weekend that traders immediately rushed to sell the pair? Certainly, nothing macroeconomic would directly concern the European Union or the United States.

And this is what happened. New sanctions were imposed against Russia. The airspace of almost all European countries was closed. Sanctions have been imposed against Russian banks (including the Central Bank of the Russian Federation), against Russian companies, and personal sanctions. At this time, the country risks becoming isolated from the whole world. And the flow of news of a sanctioned nature does not dry up. For example, Boris Johnson proposes to completely disconnect the Russian Federation from SWIFT. Football unions propose to exclude the Russian Federation from all competitions under the auspices of FIFA and UEFA. It would seem, what does football have to do with the ruble exchange rate? But all this is interconnected, though not directly. The point is that sanctions are always bilateral. If roughly speaking, the British authorities refuse to accept Russian planes, this means that passenger traffic will fall, that is, fewer tickets will be sold, fewer flights will be made. Europe is ready to make such sacrifices, but this does not mean that it will not suffer losses.

The Russian-Ukrainian talks are an exchange of views.

Of course, negotiations between all parties to the conflict at the highest level would be very useful now. The negotiations that took place yesterday on the Belarusian border are nothing more than an "attempt to get out of the crisis." Let's be honest with each other. Did anyone expect that 5 days after the unfolding of a full-scale military conflict, the parties would sit down at the negotiating table somewhere in a small Belarusian town and sign a truce pact in two hours? Moreover, the positions of the Ukrainian and Russian authorities differ radically. Moreover, Ukraine has already suffered huge material damage and it will certainly demand its compensation. Moreover, Europe and the West are going to supply weapons to Kyiv. Moreover, all EU and Western countries have imposed "deafening" sanctions against the Russian Federation. Did anyone think that the parties would be able to come to a common opinion in a couple of hours?

We are probably dealing with another long-running conflict. And, as we have said many times before, this is not a Ukraine-Russia conflict. This is the Ukraine-NATO-EU-USA conflict against the Russian Federation. Accordingly, the opinions of all parties to the conflict should be taken into account. Consequently, there can be no question of any imminent end of hostilities in Ukraine. This means that there can be no question of Russia's withdrawal from European and American sanctions, which both Japan and Australia have already joined. Consequently, the markets will continue to be in a state of "storm". After all, by and large, why are all the markets storming? Because now there is a flow of capital between countries, between industries, between stocks, bonds, cryptocurrencies, and assets. And since during any geopolitical conflict these flows increase many times, that is why we observe such "wonderful" movements in the currency and other markets. And until the conflict is over, the markets may continue to remain tense.

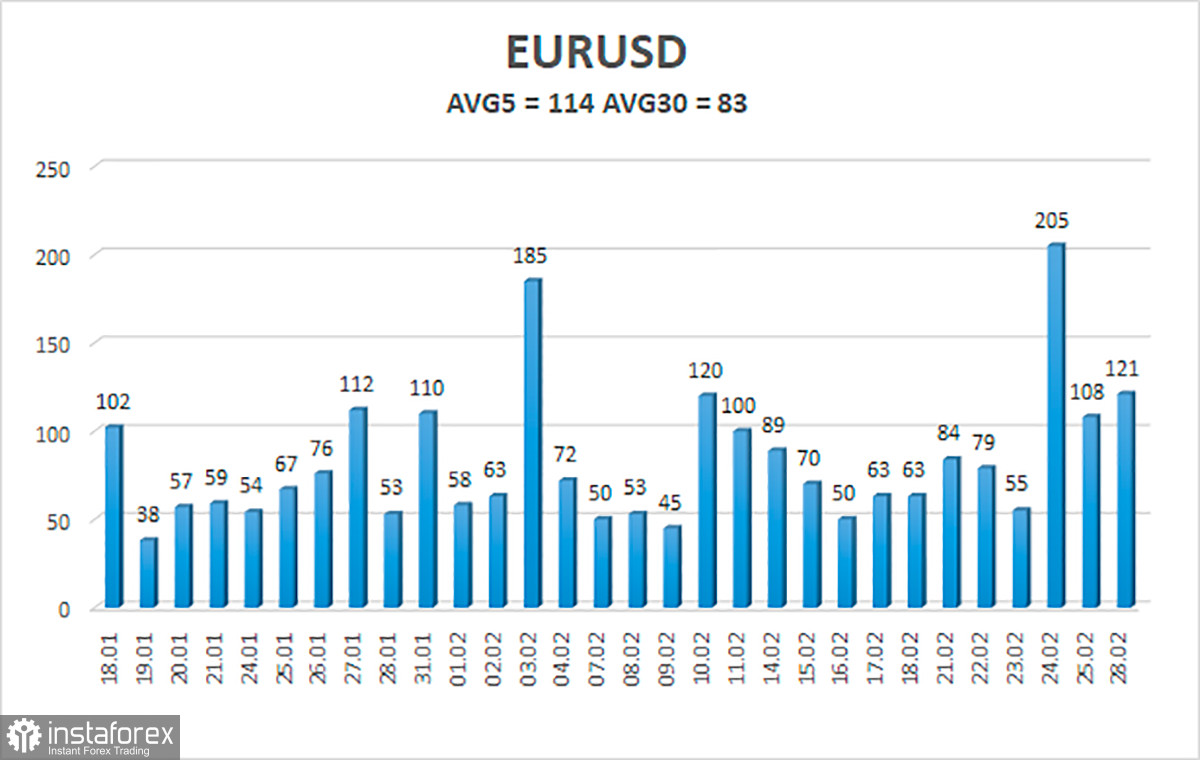

The volatility of the euro/dollar currency pair as of March 1 is 114 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1112 and 1.1340. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.1169

S2 – 1.1108

S3 – 1.1047

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1292

R3 – 1.1353

Trading recommendations:

The EUR/USD pair is trying to adjust after a strong collapse. Thus, now we can consider new short positions with targets of 1.1230 and 1.1169 in the case of a reversal of the Heiken Ashi indicator down. Long positions should be opened no earlier than the price-fixing above the moving average line with targets of 1.1340 and 1.1353.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.