The GBP/USD currency pair also started on Monday by collapsing against the US dollar. However, like its "big brother" euro, the pound was still able to resist a new fall during the day and recovered all the overnight losses. However, these movements of the pound/dollar pair are not talking about anything right now. We have already said earlier that the movements now can be any and it is extremely difficult to predict them. Simply because any news of a geopolitical nature can greatly affect traders and investors. Accordingly, there is no way to predict their behavior. In the same way as to anticipate the news that we have yet to get acquainted with this week and in the near future in general. Thus, formally, we are now dealing with a downward trend. And this trend can easily persist for a certain time since the US dollar is a "reserve currency" and a "safe-haven asset".

Right now, high inflation in the US doesn't even matter to investors. The dollar has always been, is, and will be. This is the opinion that traders and even not only them are guided by. For example, the Central Bank of the Russian Federation also holds a certain part of its reserves in dollars. Thus, the more the geopolitical situation in Eastern Europe deteriorates, the stronger the US dollar can potentially grow. However, not everything is so clear. We see that immediately after the fall on Thursday, a correction began (albeit weak). Immediately after the fall on Monday night, the correction also began. That is, the market does not rush headlong to buy American currency. Thus, we are inclined to the point of view that one way or another the dollar will continue to rise in price, but at the same time, everything or almost everything will now depend on geopolitics.

Boris Johnson is launching a large-scale campaign against the Russian Federation.

The UK currently attracts most of the attention. If earlier it was because of Brexit, because of the record number of victims of the pandemic, because of all the scandals involving Boris Johnson and his sometimes absurd decisions, now everything concerns London's geopolitical position. It was London that first initiated most of the sanctions against the Russian Federation, which were then supported by the EU and the USA, as well as some other countries of the world. At this time, Britain is also going to impose sanctions against the Central Bank of the Russian Federation, calls for the exclusion of Russian football teams from all international competitions, calls on Europe to completely abandon Russian gas and oil, has closed the airspace for Russian ships, and is also thinking about banning Russian ships from entering UK ports.

Currently, the issue of creating limits on the purchase of Russian gas and oil is being actively considered. However, this decision, according to Elizabeth Truss, the British Foreign Minister, should be made "not alone." The UK, as well as the US, as well as the EU, refused to send their military units to participate in the conflict in Ukraine, but at the same time officially stated that their military could go to participate in it voluntarily if they wished. In addition, the European Union and the United Kingdom supply weapons to Ukraine, so it can hardly be said that they are not parties to the conflict. Directly - no, indirectly - yes. And that's exactly what we're talking about in our recent articles. In the modern world, everything is so interconnected that one cannot even count on the fact that sanctions in one country will not affect the interests of another, which may be located on the other side of the world. Thus, one way or another, everyone will suffer from this conflict. And we should also pray that this conflict does not flow smoothly into the Third World War. Or it didn't end with nuclear strikes. In general, the world is now really on the verge of a profound crisis. And it is unlikely that in such a situation one can count on calm movements in the markets, which can be easily and simply worked out.

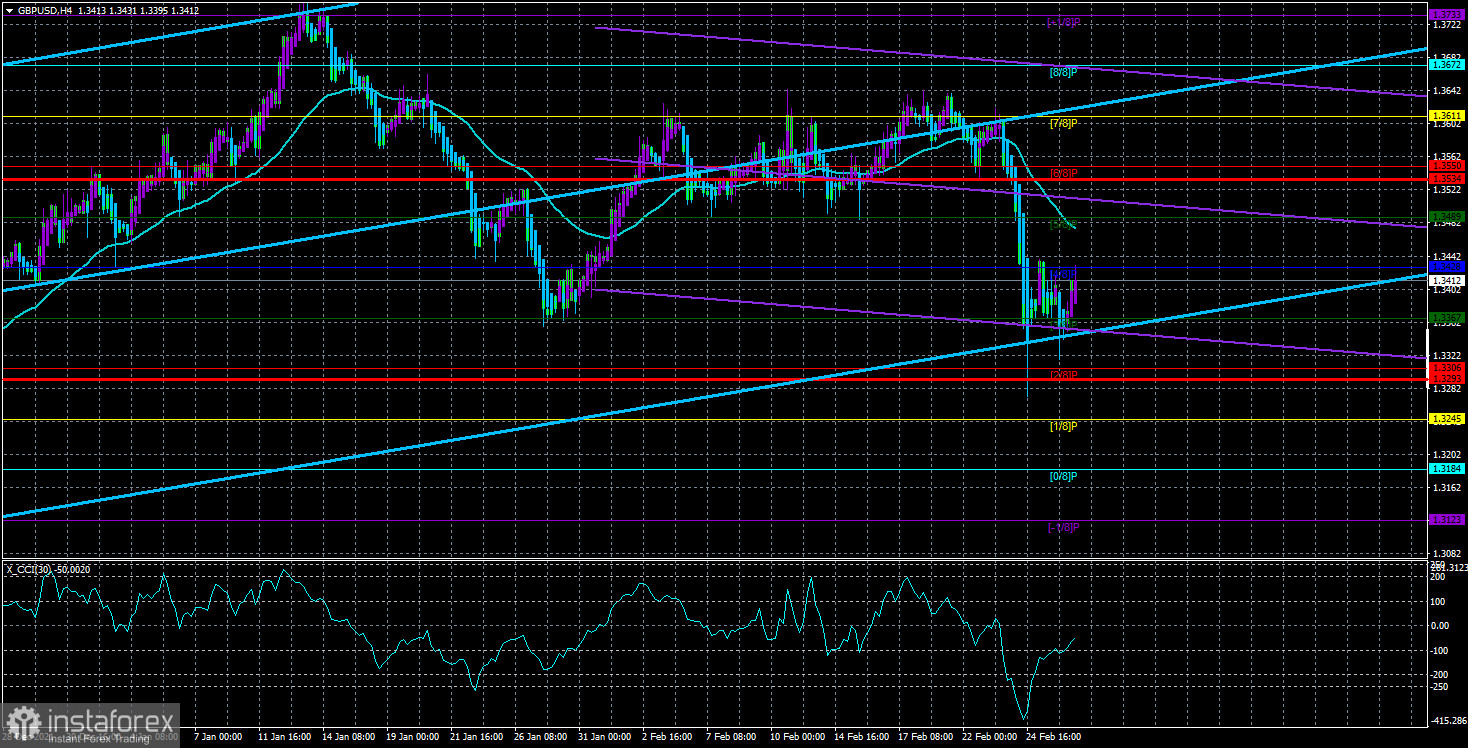

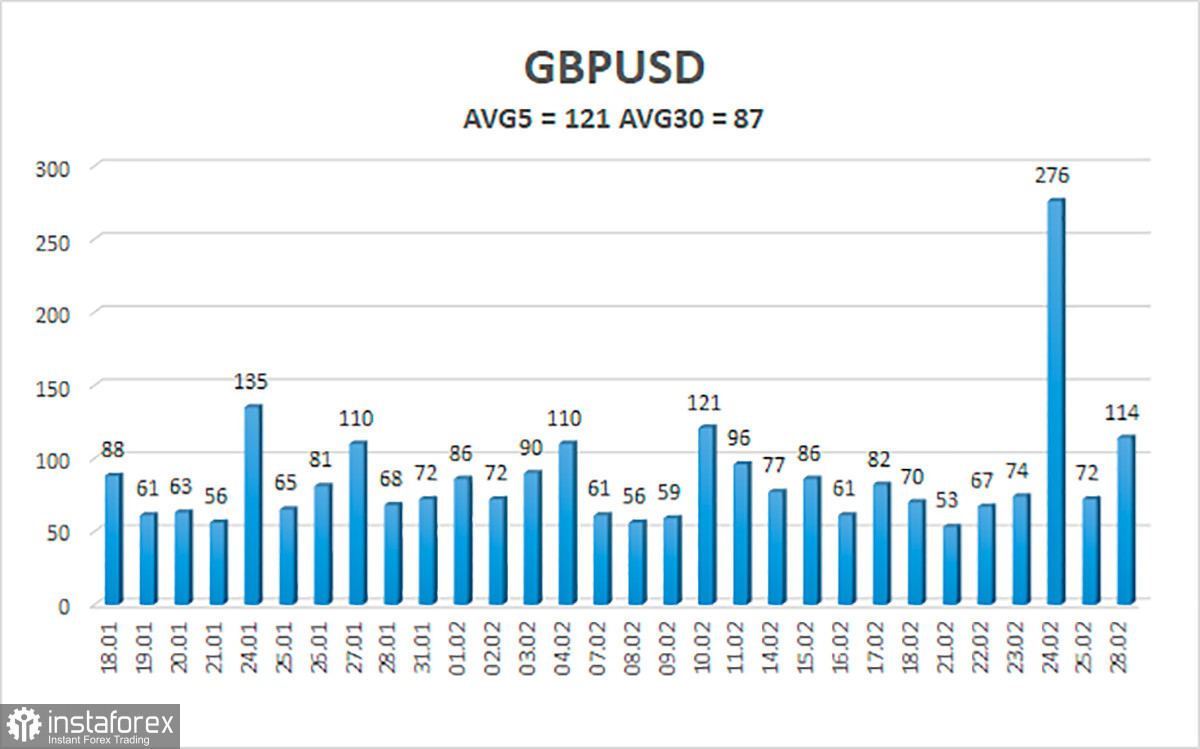

The average volatility of the GBP/USD pair is currently 121 points per day. For the pound/dollar pair, this value is "high". On Tuesday, March 1, thus, we expect movement inside the channel, limited by the levels of 1.3293 and 1.3534. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.3367

S2 – 1.3306

S3 – 1.3245

Nearest resistance levels:

R1 – 1.3428

R2 – 1.3489

R3 – 1.3550

Trading recommendations:

The GBP/USD pair has fallen on the 4-hour timeframe and the "bearish" mood persists. Thus, at this time, it is possible to open new short positions with targets of 1.3367 and 1.3306 after the reversal of the Heiken Ashi indicator down. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3534 and 1.3550.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.