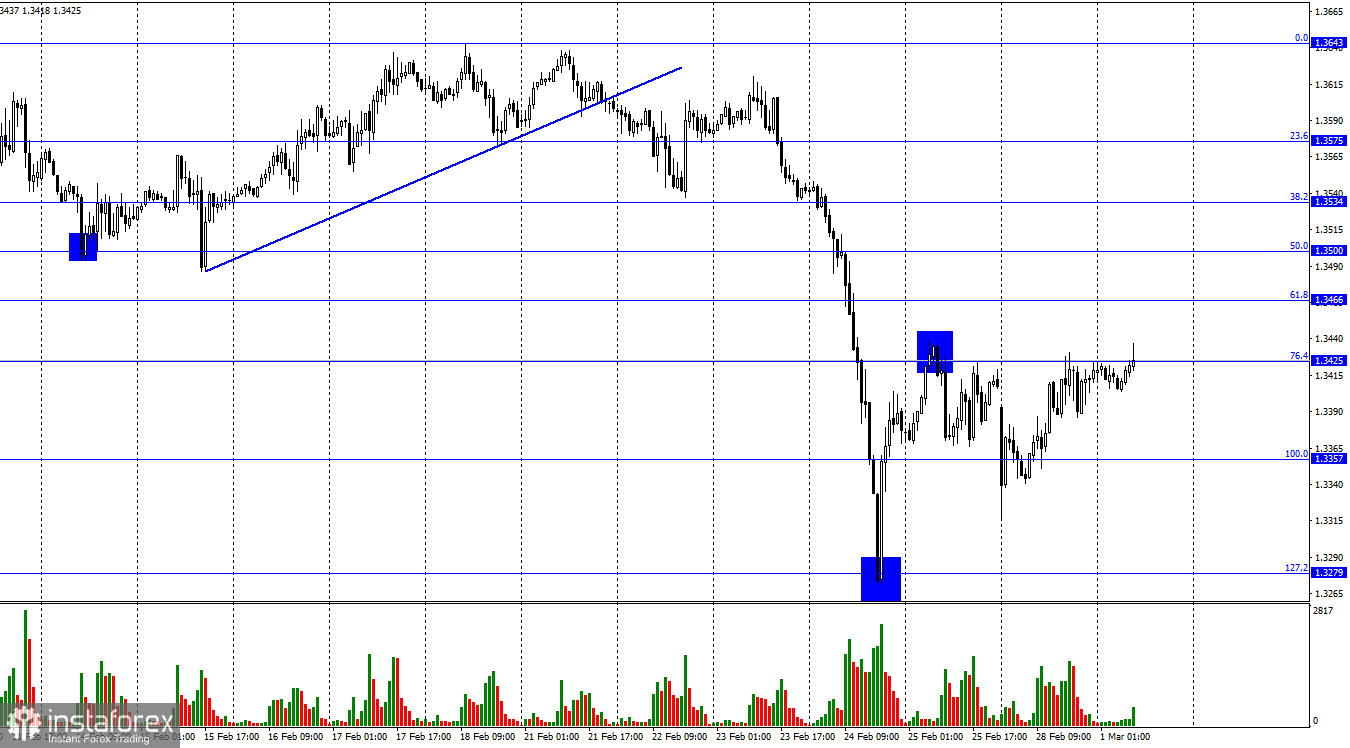

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the British currency on Monday near the corrective level of 100.0% (1.3357) and an increase to the Fibo level of 76.4% (1.3425). The rebound of quotes from this level will allow us to count on a reversal in favor of the US currency and a resumption of the fall towards the levels of 1.3357 and 1.3279. Closing above 1.3425 will allow us to expect further growth towards the levels of 1.3466 and 1.3500. However, the pound has big problems with growth right now. The information background has been almost completely absent in recent days, but there is plenty of geopolitical background. The whole movement of the last days was entirely caused by geopolitics. Thus, I conclude that traders may not always react to geopolitical events, and they do not work out all the news, but still, they do not stay away. Otherwise, how else to explain the collapse of the British last week? On Friday, Monday and Tuesday, the British currency is doing its best to move away from its lows of 2022. However, there are few growth factors now. Geopolitics puts pressure primarily on the most risky assets. Although the US stock market and the cryptocurrency market have started to recover now, this does not mean that tomorrow or after tomorrow they will not fall again. The main idea that I want to convey to traders is that there is no stability in the markets right now. And if there is no stability, then the movements in any pair can be very "steep". Today, the information background will remain very weak, as only business activity indices in the manufacturing sectors of the UK and the US will be released today. I don't think traders will even remember that there will be these publications today. All attention will continue to be focused on the speeches of the leaders of the United Kingdom, the United States, the European Union, Ukraine, and the Russian Federation. Negotiations between Russia and Ukraine have begun, but they are unlikely to be quick and easy. Moreover, Finland intends to decide on joining NATO within 24 hours. Let me remind you that Moscow opposes the expansion of the NATO bloc and has already warned Helsinki that "it will have to react." A geopolitical conflict could engulf most of Europe.

On the 4-hour chart, the pair performed a drop to the corrective level of 61.8% (1.3274) and rebound from it. The growth process has begun and continues in the direction of the corrective level of 50.0% (1.3457). The rebound of quotes from the level of 1.3457 will work in favor of the US currency and the resumption of the fall in the direction of the corrective level of 61.8% (1.3274). Emerging divergences are not observed in any indicator today.

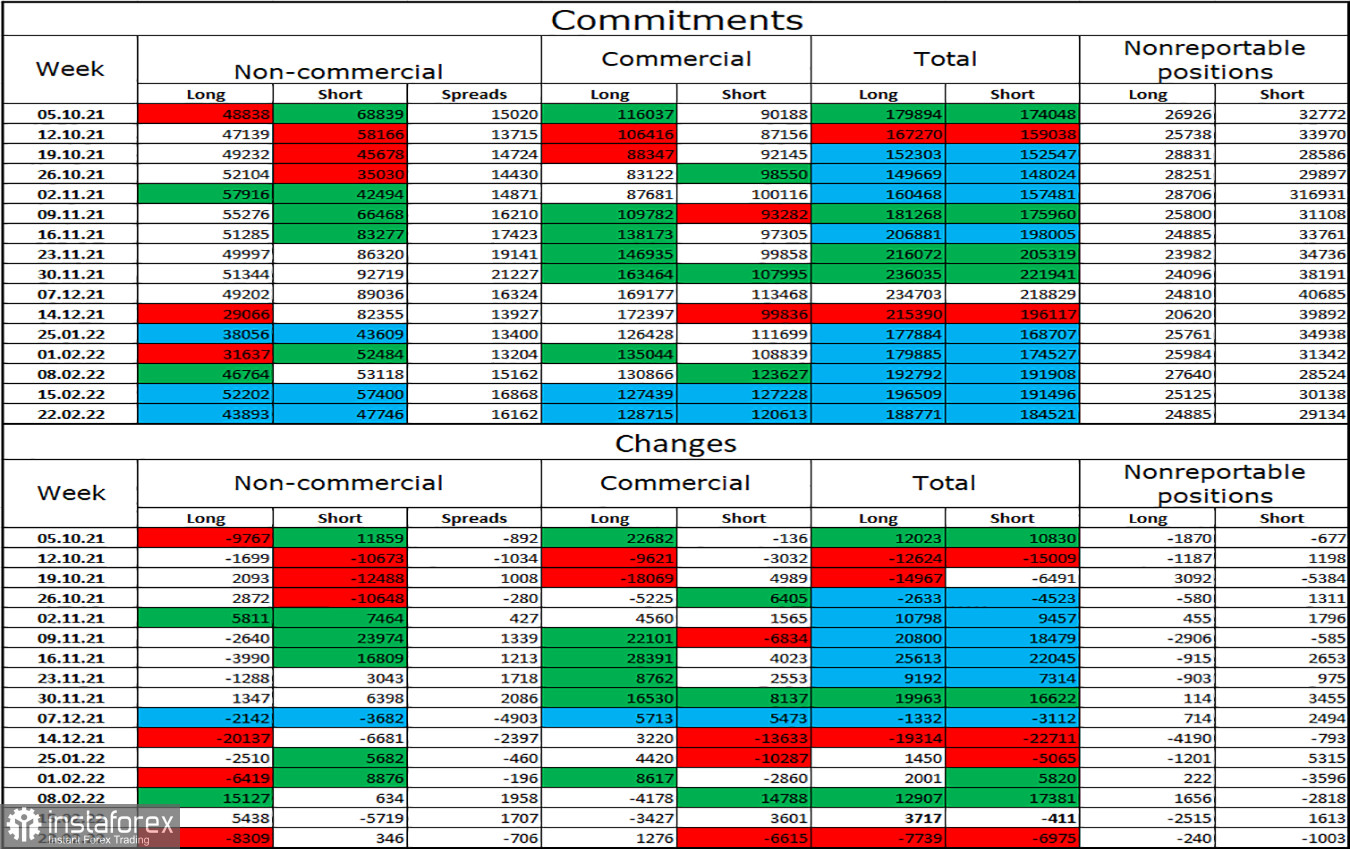

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts decreased in the hands of speculators by 8,309, and the number of short contracts increased by 346. Thus, the general mood of the major players has become more "bearish", but at the same time, equality in the number of long and short contracts is now observed in almost all categories of traders. Thus, I conclude that the mood is now more neutral than bearish. But even this does not matter much, since geopolitical factors can continue to have a very significant impact on the mood of traders. Therefore, their mood can change very sharply and quickly.

News calendar for the USA and the UK:

UK - PMI index for the manufacturing sector (09:30 UTC).

US - ISM manufacturing index (15:00 UTC).

On Tuesday, the calendars of economic events in the United States and the United Kingdom do not contain important events. Two indices of business activity in manufacturing are unlikely to affect the current mood of traders.

GBP/USD forecast and recommendations to traders:

At this time, I would recommend selling the British if the rebound from the corrective level of 76.4% (1.3425) with targets of 1.3357 and 1.3279 is completed. I would recommend buying the British if the closing is above the level of 1.3425 with targets of 1.3466 and 1.3500 is completed.