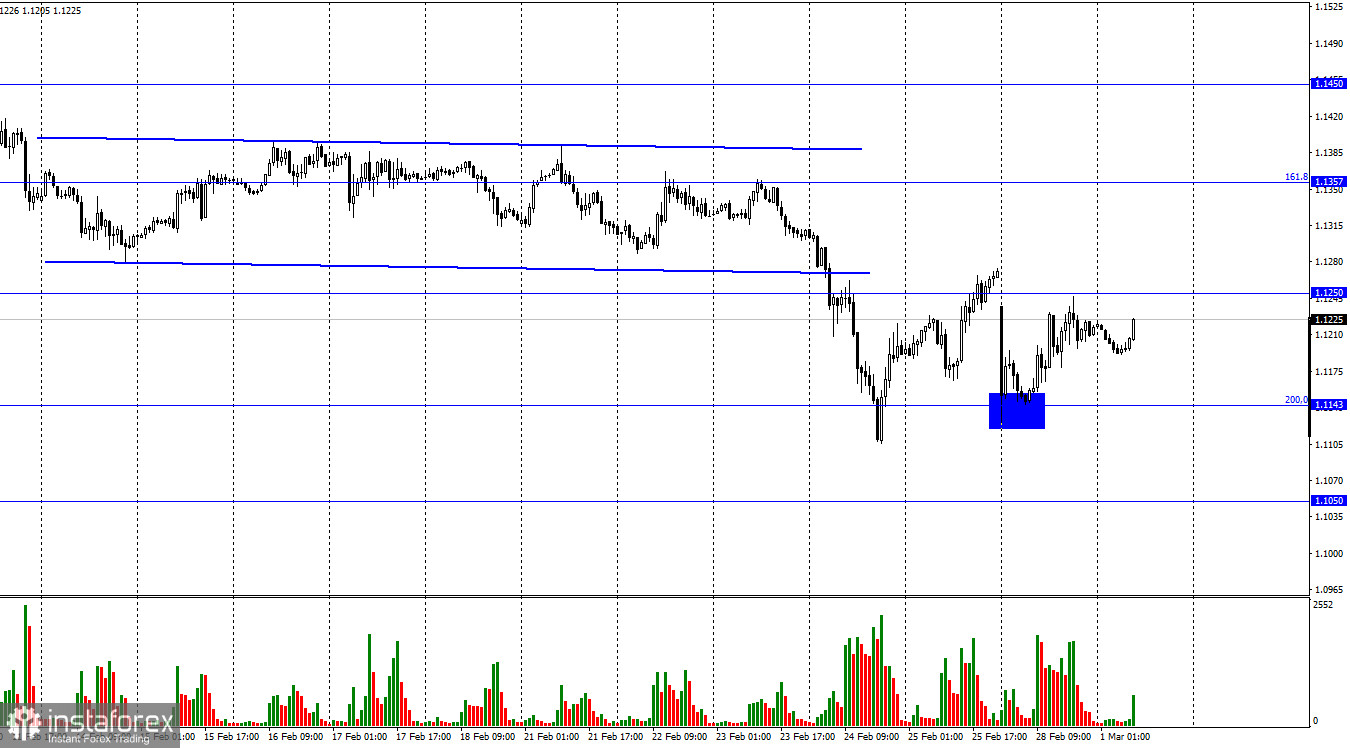

The EUR/USD pair on Monday performed a fall to the corrective level of 200.0% (1.1143), rebounded from it, a reversal in favor of the European currency, and began the process of growth towards the level of 1.1250. The rebound of the pair's quotes from this level will allow us to count on a reversal in favor of the US currency and a new fall in the direction of the 1.1143 level. Closing the pair's rate above the level of 1.1250 will work in favor of continuing growth towards the next Fibo level of 161.8% (1.1357). Meanwhile, the military operation in Ukraine continues. Active fighting continues in northern and western cities and towns. Traders coped with the first and second shock, so the bears retreated a little from the market, which allowed the euro to move away from its lows a little. However, the euro currency continues to trade very low, which is visible on the older charts. I believe that in the long term, the bearish mood persists and it may intensify in the coming months. Few people believe that the Ukrainian-Russian conflict will last one or two weeks. Negotiations between Kyiv and Moscow began, but their first-round ended in nothing. No joint decisions were made. The announced second round of negotiations may take place in a few days, but given how far the positions of the parties are from each other, it can be assumed that the negotiations will be as complex and lengthy as between the UK and the EU on Brexit. All this time, Russia will continue to be under sanctions from the West and the European Union, and also risks falling under new sanctions packages, as the EU and US authorities have already stated, if the conflict continues to worsen and Moscow refuses to withdraw its troops from the territory of Ukraine. Consequently, any new package of sanctions may cause a new fall in the euro currency or the British dollar. Or any important geopolitical news. Therefore, I believe that the worst is yet to come. The market may repeatedly experience a shock in connection with what is happening now in Ukraine.

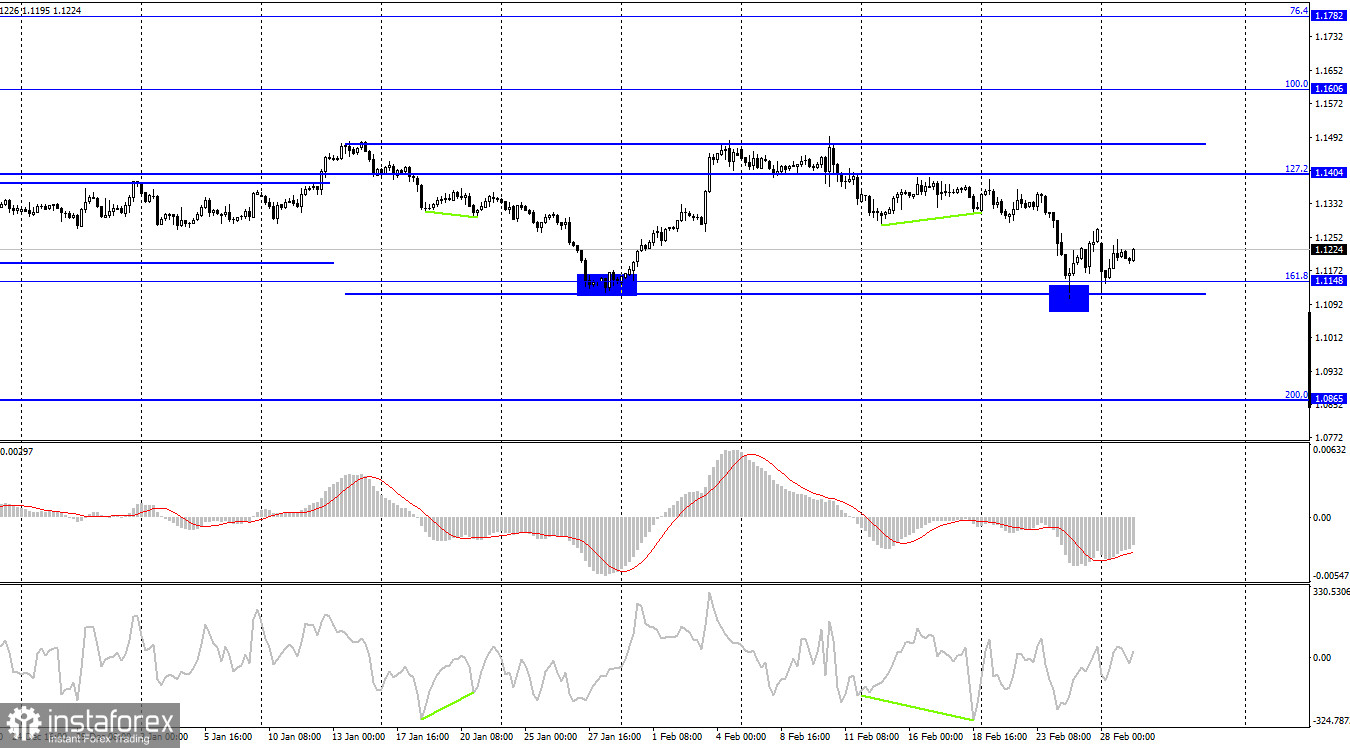

On the 4-hour chart, the pair performed two falls to the lower boundary of the side corridor and two rebounds from it. Thus, the side corridor continues to characterize the current mood of traders as "neutral". Fixing the pair's exchange rate under the corridor will work in favor of the US dollar and may lead to a powerful fall of the pair in the direction of the corrective level of 200.0% (1.0865). Emerging divergences are not observed in any indicator.

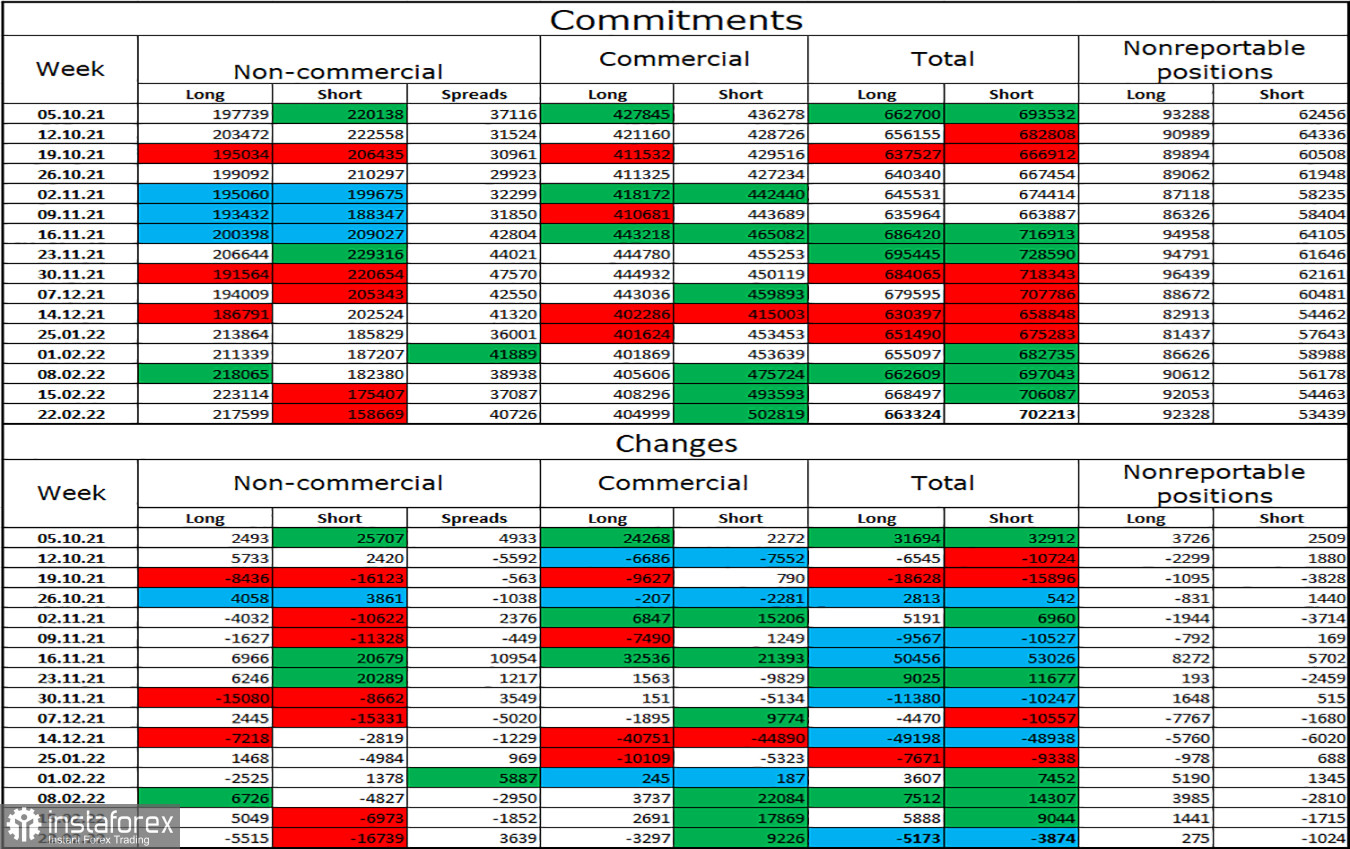

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 5,515 long contracts and 16,739 short contracts. This means that the bullish mood has intensified. The total number of long contracts concentrated on their hands now amounts to 217 thousand, and short contracts - 158 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is also characterized as "bullish". This makes it possible for the European currency to count on growth, if not for the information background, which now supports the American currency to a greater extent. I believe that now the data from the COT reports can be neglected since the situation in the world is tense and the mood of major players can change rapidly.

News calendar for the USA and the European Union:

EU - index of business activity in the manufacturing sector (09:00 UTC).

EU - ECB President Christine Lagarde will deliver a speech (13:00 UTC).

US - ISM manufacturing index (15:00 UTC).

On March 1, the EU calendar contains the speech of the ECB president and the manufacturing business activity index, while the US calendar contains only the ISM business activity index. I believe that these reports will have very little effect on the mood of traders, and Lagarde's speeches have not carried any important information for a long time.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair with targets of 1.1143 and 1.1050 if a rebound from the level of 1.1250 is performed on the hourly chart. I recommend buying the pair if a close is made above the level of 1.1250 with a target of 1.1357.