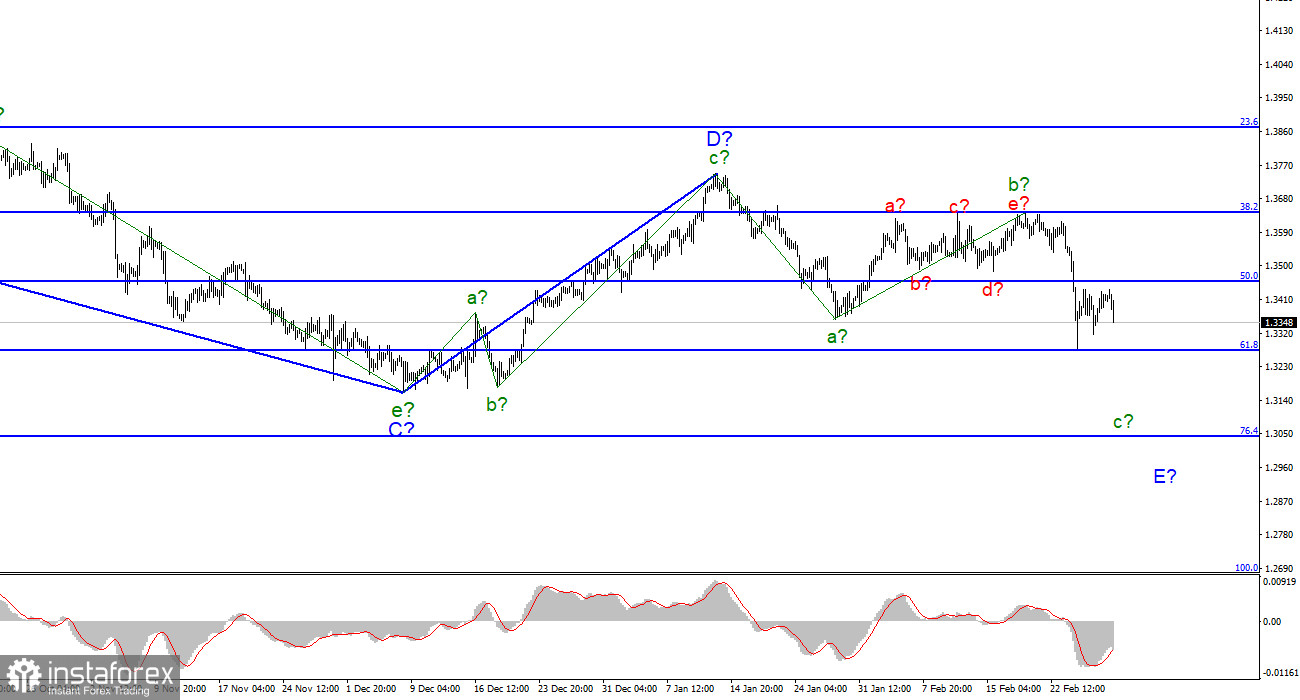

The wave layout for GBP/USD still looks convincing although with a complicated structure. The supposed wave b in E within the downtrend took a very complex form, but after several unsuccessful attempts to break through the level of 1.3642, it completed its formation. The decline in the past few days indicates the transition to wave c, which can also turn out to be quite extended. At the moment, the low of the expected wave a has been broken. So the construction of the descending section will surely continue within wave E. Thus, the entire descending section of the trend has taken a five-wave form, and its expected wave E should also acquire a five-wave form with a rather extended structure. An unsuccessful attempt to break through the 1.3272 level made the quotes retreat from the lows reached. Yet, this situation is unlikely to last long. Wave c in E does not look complete yet as it is too short. The current news background may continue to increase demand for the US dollar.

GBP has only one direction to follow

On March 1, the pound/dollar pair fell by 80 pips. In the past two days, the sell-off wave on the pound has slowed down. However, on Tuesday, markets were nervous again as the first round of negotiations between Kyiv and Moscow ended without any clear outcome, and the "special operation in Ukraine" continued. Naturally, this sparked the demand for the US dollar. I would like to stress that both the pound and the euro are falling amid geopolitical factors rather than economic ones. There is simply no important macroeconomic background at the moment. On Tuesday, the UK released the index of business activity in the manufacturing sector for February. It turned out to be stronger than expected. Yet, the pound began to decline almost immediately after the release. By the time a similar business activity index came out in the US, which also exceeded market expectations, the dollar had already jumped by nearly 70 pips. This is additional evidence that market participants tend to downplay the economic data. Most likely, this tendency will persist as long as the conflict between Ukraine and Russia continues.

Markets will probably keep an eye on such key events as central bank meetings or the Nonfarm Payrolls report which is due to be out on Friday. But the demand for USD is already high. So, even if Nonfarm Payrolls turn out to be weak, this may only lead to a small decline in the greenback. The fact is that the US currency is benefiting the most from what is happening now. There is no doubt that the demand for USD will continue to surge until the conflict in Ukraine de-escalates. Besides, the wave layout fully confirms the further downtrend of the pound/dollar pair.

Conclusion:

The GBP/USD wave pattern suggests the formation of wave E. The construction of the expected wave b is completed. There were two unsuccessful attempts to break through the 1.3645 level which resulted in a new decline. A failed attempt to break through 1.3274 pushed the pair a bit higher. I would recommend selling the pair with the targets near 1.3046, which corresponds with Fibonacci 76.4%, following each sell signal of the MACD indicator. The wave E still does not look complete.

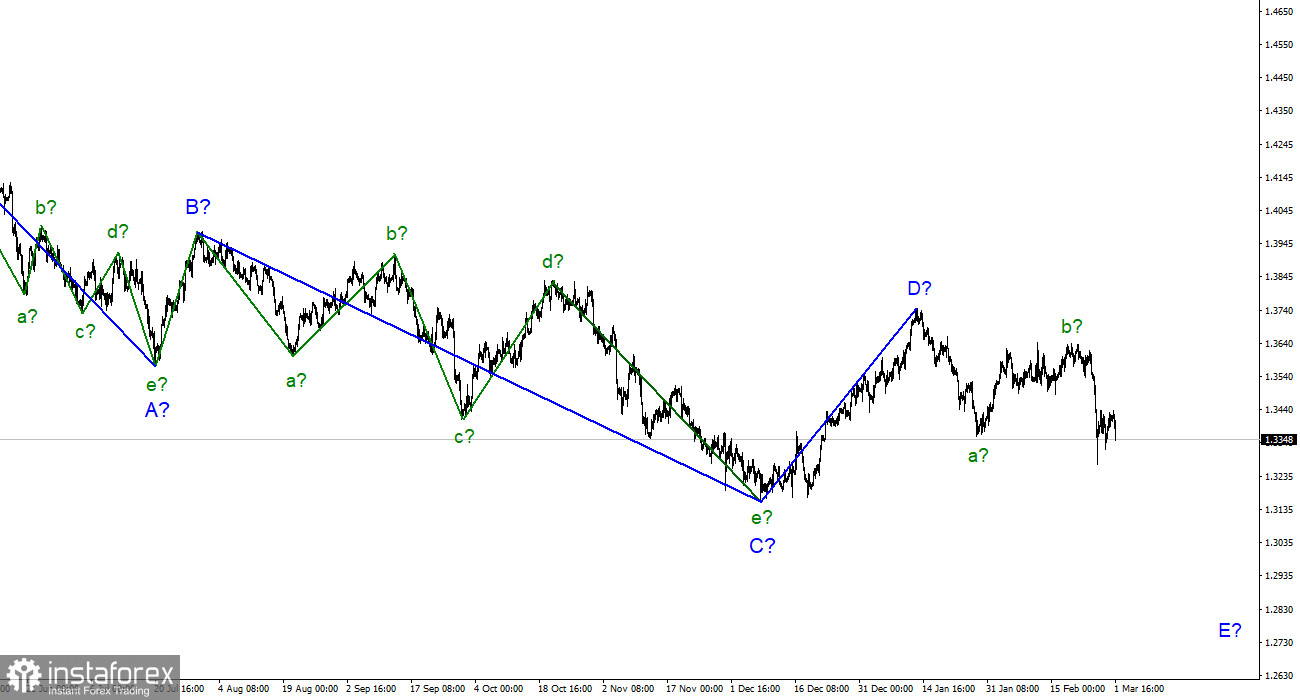

On the higher time frame, wave D also looks complete, unlike the descending section of the trend. Therefore, I expect the pair to decline in the coming weeks towards the targets located below the low of wave C. Wave D turned out to have a 3-wave structure, so I cannot consider it the wave of the first ascending section of the trend.