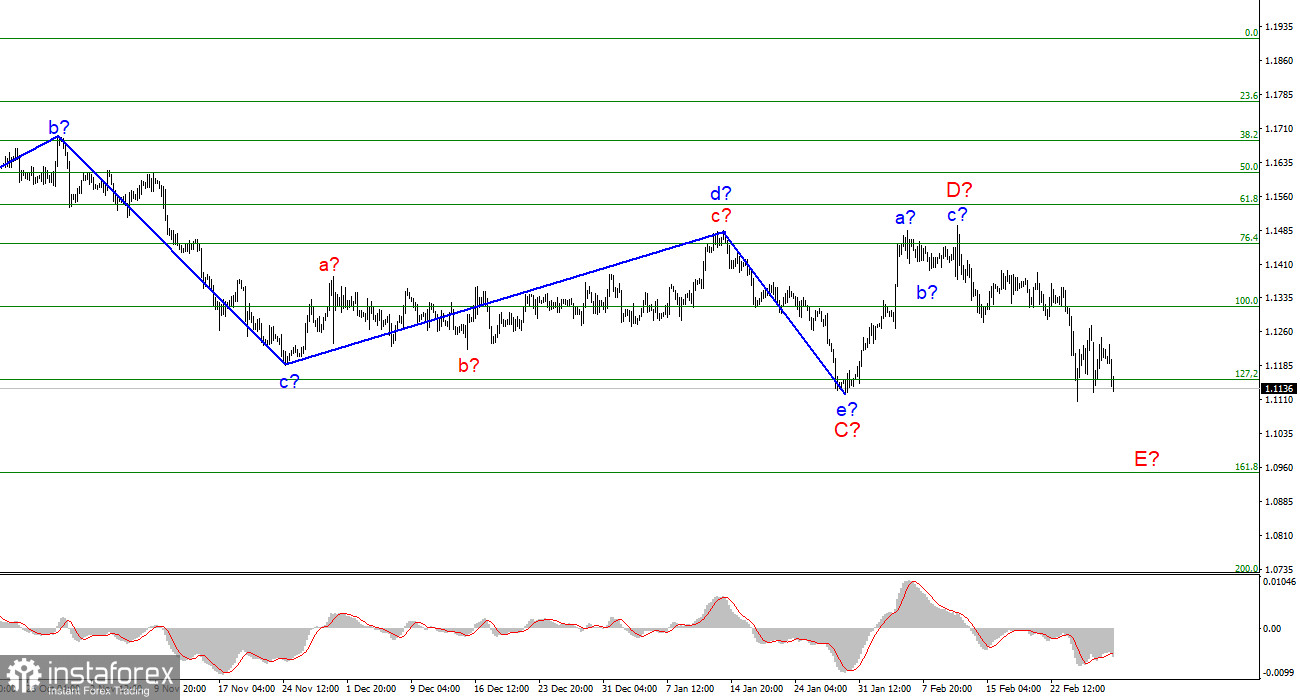

As seen in the wave picture of the 4H time frame, the EUR/USD pair has barely changed recently. Last week, the single currency took a nosedive that corresponds to the current wave count. On Monday, the euro tried to stay afloat but gave in on Tuesday. The current decline in quotes is seen as wave E and this wave can turn out to be strong and long. As of the current state of things, wave D is completed and the news background favors a rise in demand for the American currency. Based on that, I expect the pair to continue moving within a falling wave with an 80% probability. There is a 20% chance that the wave count will be revised. For the time being, the market sentiment is shaped by the geopolitical news that remains downbeat. So, I anticipate that the decline will continue. Given the current conditions, the wave picture may become complicated.

De-escalation is not on cards

On Tuesday the EUR/USD pair shed 90 pips, starting a new round of a bearish run after a two-day pause. As I mentioned before, the market behavior totally corresponds to the current global developments and to the wave count. The market reaction to the raging war is obvious, and the US dollar, being a safe-haven currency, is strengthening. The situation in Ukraine is dominating the global headlines. The first round of negotiations has brought no tangible results.

Today, President Zelensky made several statements that give hope for a resolution to the conflict in the near future. In particular, he said that Kyiv may abandon its intention to join NATO if Moscow provides security guarantees. This is a key disagreement between the parties, but there are other arguable issues. In particular, Kyiv has applied for EU membership and most EU countries support Ukraine's entry into the alliance. If Ukraine joins the EU sometime in the future, any new conflict between Ukraine and the Russian Federation will be regarded as a conflict between the EU and the Russian Federation. Even if NATO won't get involved, this will be enough for a new world war. Thus, the key disagreement is that Moscow does not want to allow Ukraine to integrate into the European Union or NATO. At the same time, Ukraine has quite the opposite intentions. What is the way out of this situation? Either one of the parties makes concessions or the war continues. Thus, against the backdrop of a further escalation of the conflict, the euro may continue to decline. Where it will find a bottom depends on how long this conflict will persist. Many aspects now depend on the answer to this question.

General conclusion

Based on the above analysis I can conclude that wave D is completed. If so, this condition opens selling opportunities with targets placed near 1.0949 which is 161.8% of Fibo. MACD signals a downtrend. A successful break of 1.1154 will indicate the market readiness to continue selling.

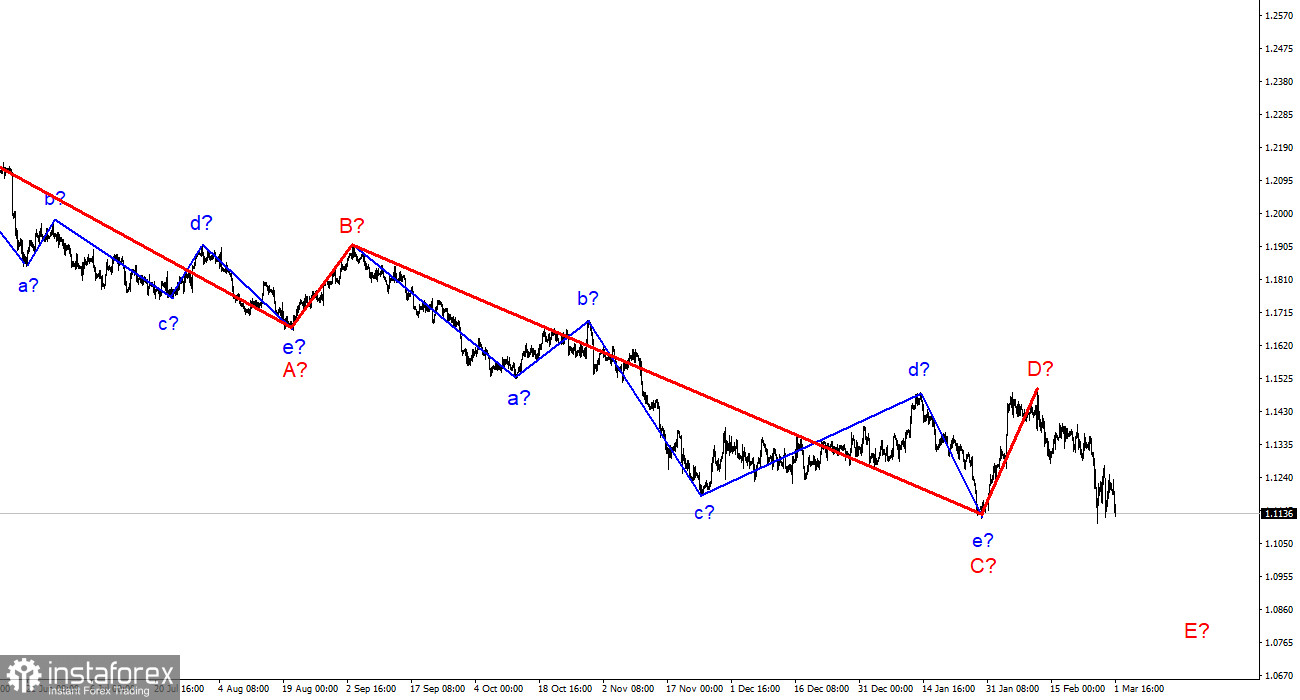

The bigger time frame shows that the suggested wave D is being formed. This wave can turn out to be short or consist of three waves. Bearing in mind that the previous waves were not too long, the current wave is likely to be the same. If the wave D is already completed, then we are witnessing the formation of the wave E.