Overview of trading on Tuesday

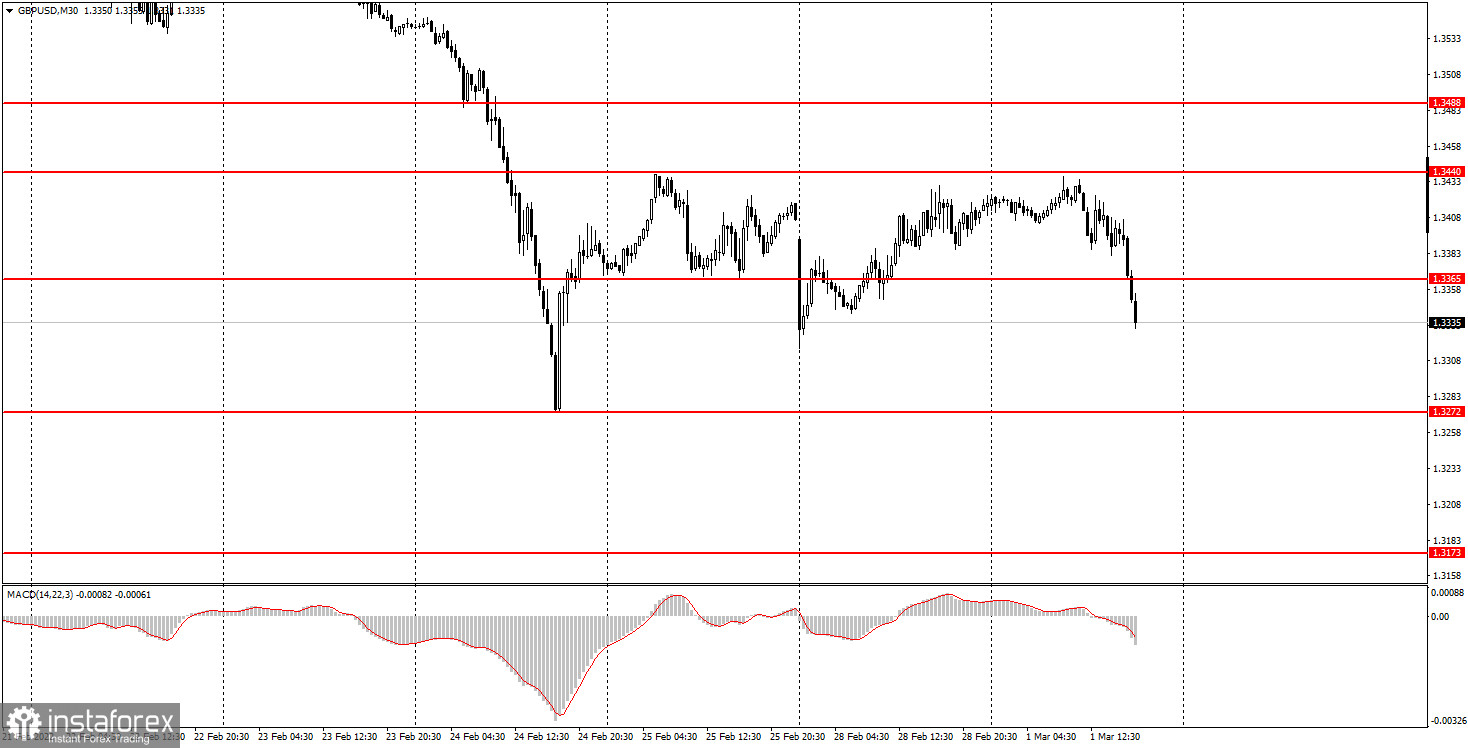

30m chart of GBP/USD

GBP/USD was trading almost perfectly on Tuesday. Early on the morning, mainly overnight, there were sluggish attempts to push the pair into a correction mode. However, all of them failed like in the case for EUR/USD. As a result, GBP began a new downward move from 1.3440. You're probably aware that GBP belongs to risky assets like EUR and in contrast to USD. In the second half of the day, the moderate decline turned into a slump. By the moment of writing, GBP/USD has lost nearly 120 pips from the intraday high. No doubt, the macroeconomic statistics has nothing to do with market moves on Tuesday. GBP set about falling in the morning when the UK released the only economic report, the manufacturing PMI. The index rose to 58 in February. But it didn't provide GBP with a helping hand. So, the sterling could not hold at its highs. At the moment when the US statistics was published, GBP had been already in a downward spiral. Therefore, geopolitics is the culprit for market sentiment on Forex. Currently, risk aversion is setting the tone on the market.

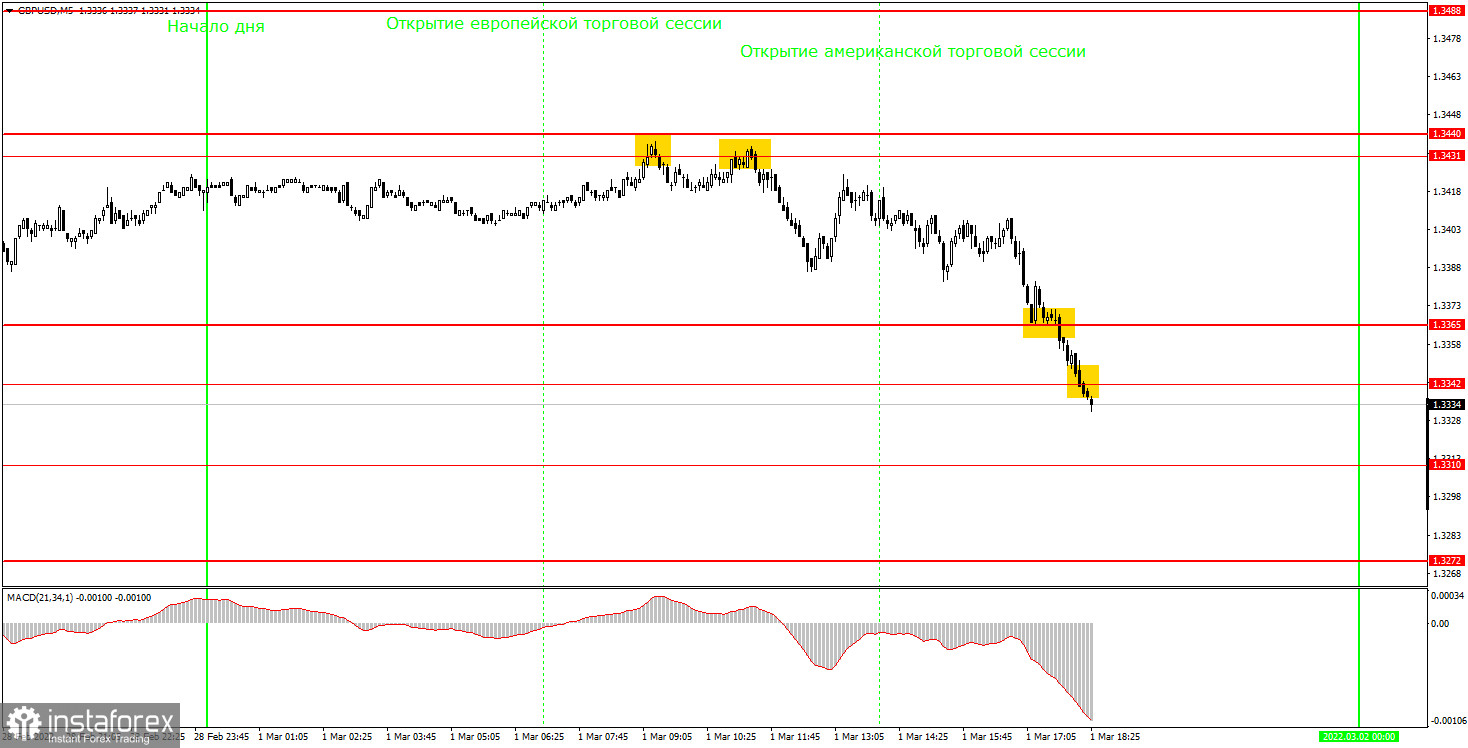

5m chart of GBP/USD

On the 5-minute chart, all moves and trading signals were perfect on Tuesday. First, the currency pair worked well the area of 1.3431 – 1.3440. Then, it rebounded off it twice. So, beginners had two nice opportunities to open short positions. By mid-American session, GBP/USD approached the nearest target at 1.3365 and passed it with ease. The price did not face any resistance at 1.3342. Beginners managed to close the only position of the day at 1.3310. They could have earned nearly 100 pips. Well done! Thus, beginners had an opportunity to see themselves how the currency pair could move when it was influenced by strong geopolitical factors. The Russia – Ukraine crisis has not been settled yet and any solution is still in question, forex instruments are likely to make vigorous moves in the coming days and even weeks. T doesn't mean that GBPUSD is set to continue its fall. It could make strong bounces. On the whole, the US dollar has a sheer advantage than the sterling.

How to trade GBP/USD on Wednesday

On the 30-minute chart, the trend is clearly bearish. Notably, there is still neither a trend line nor a downward channel. The geopolitics is ruling the market. A market response could be extremely unpredictable. So, beginners should be ready for sharp price swings up and down. For the time being, it is extremely hard to predict further moves as investors are alarmed. How long the shock sentiment will persist will depend of developments in Ukraine. It is recommended to trade the pair with the following levels in focus: 1.3241, 1.3272, 1.3310, 1.3342, 1.3365, 1.3431-1.3440 on the 5-minute chart. When the price moves 20 pips in the expected direction after opening a position, make sure you set a stop loss at break even. The economic calendar for the UK is empty today. As for the US, the ADP report that logs changes in the private sector employment will be of no importance to markets. The only newsworthy event will be a speech by Jerome Powell, but the market will gave any response depending on the content of his remarks.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it takes, the stronger the signal.

2) If two or more trades were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat market, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a sideways movement, it is better to stop trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one, when all positions must be closed manually.

5) On the 30-minute timeframe, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

What's on the chart:

Support and resistance levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.