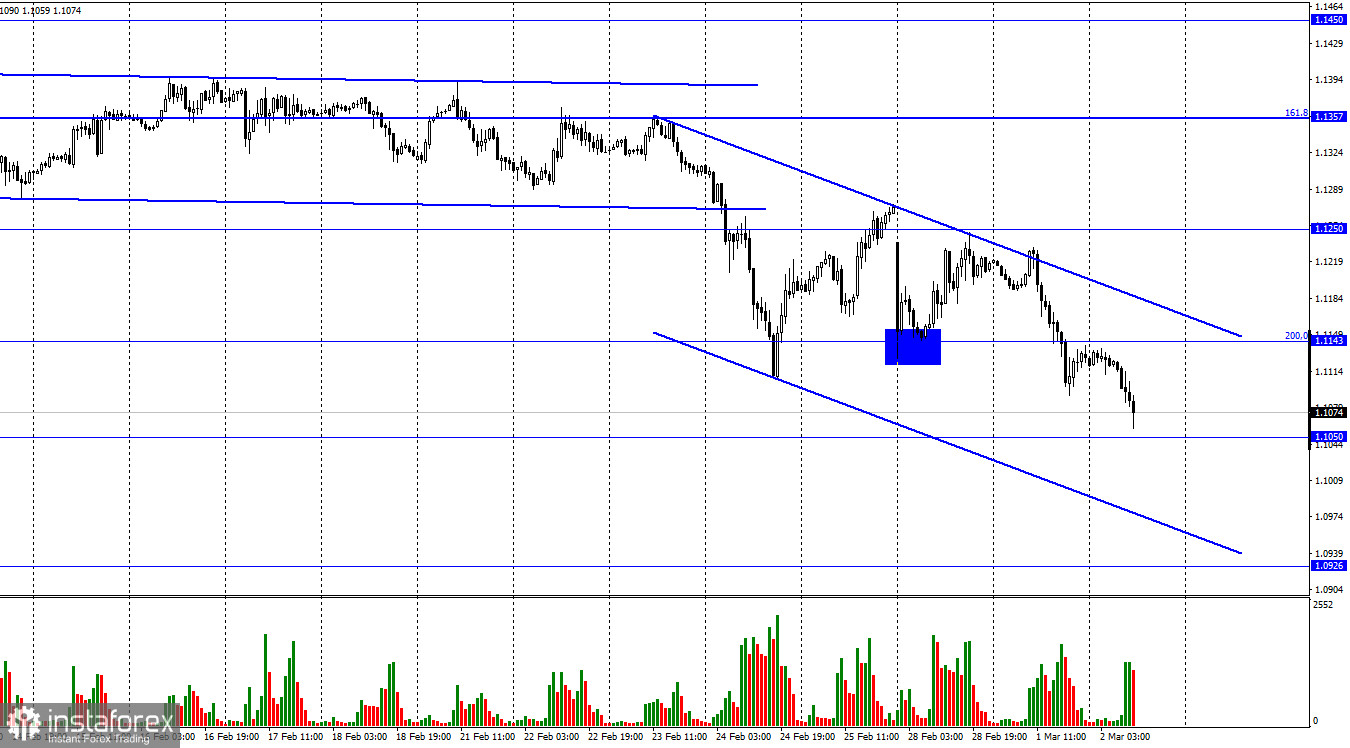

Hello, dear traders! EUR/USD reversed and went down on Tuesday, closing below the 200.0% retracement level of 1.1143. The quote is now heading towards 1.1050. A rebound from this level could halt the downtrend for a while, while consolidation below this mark could lead to a fall to 1.0925. Current events in the forex market are undoubtedly the consequence of the ongoing armed conflict in Ukraine. In other words, the quote may be going down for a long time. Of course, traders cannot just sell the euro. These are not shares of Russian companies and banks investors are selling off in a panic. Since the US dollar is a reserve currency, investors are now turning long on it. In addition, bitcoin, as well as other cryptocurrencies, has seen a rally in recent days, which shows growing demand for the coin at the time of upheavals.

Nevertheless, BTC remains a risk asset. The second round of peace talks between Russia and Ukraine will be held today. The first meeting that lasted for 5 hours ended without a breakthrough. Anyway nobody expected that the parties would find a solution to the conflict so quickly. Therefore, markets are now feeling pressure. The reports released in the United States and the eurozone yesterday had no effect on markets whatsoever. The manufacturing PMI in the eurozone dropped to 58.2 and the one in the US rose to 58.6. Meanwhile, the greenback showed growth all day long. ECB President Lagarde's speech was dedicated to inflation in the eurozone, but traders had little interest in the issue.

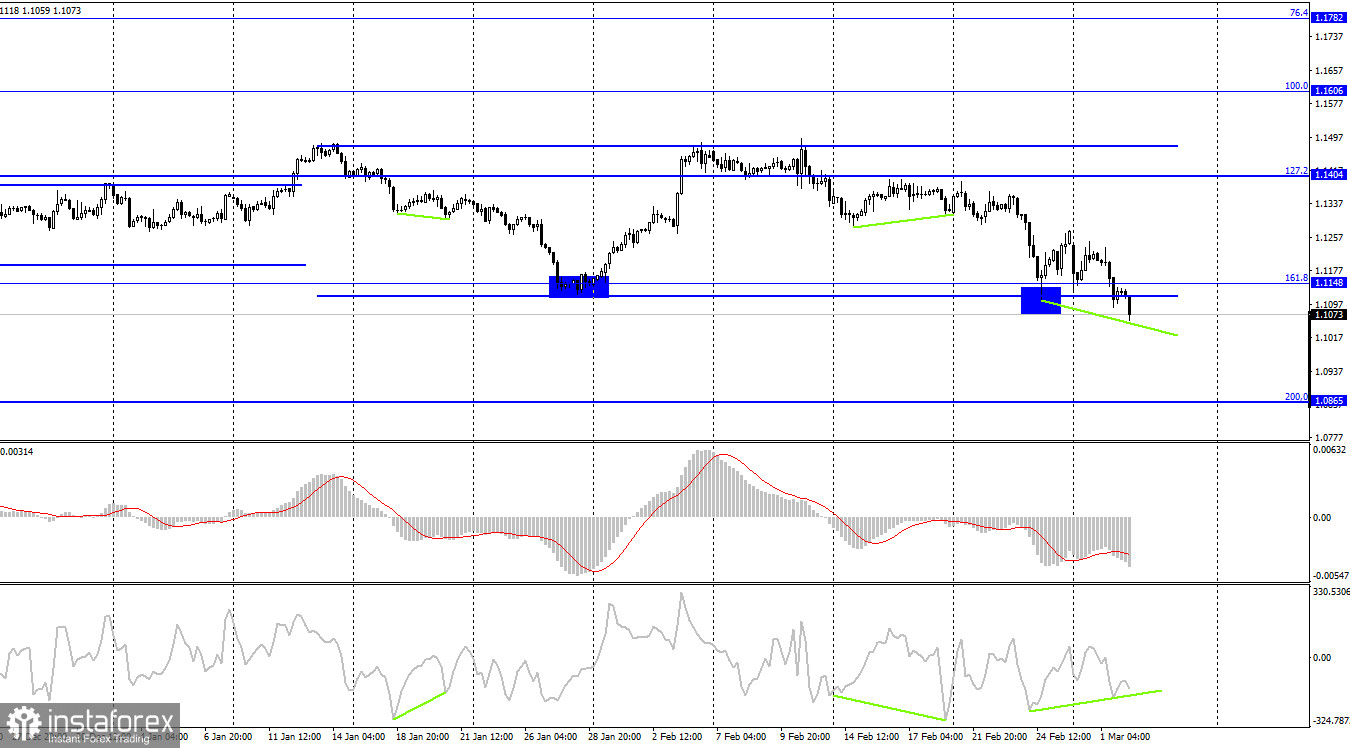

In the 4-hour time frame, the pair has fallen to the lower limit of the sideways corridor and may actually close below it this time. The price is now moving within the sideways corridor. However, if the quote consolidates below it, the downtrend may extend to the 200.0% retracement level of 1.0856. The impending bullish divergence of the CCI indicator may provide support for the euro for a while.

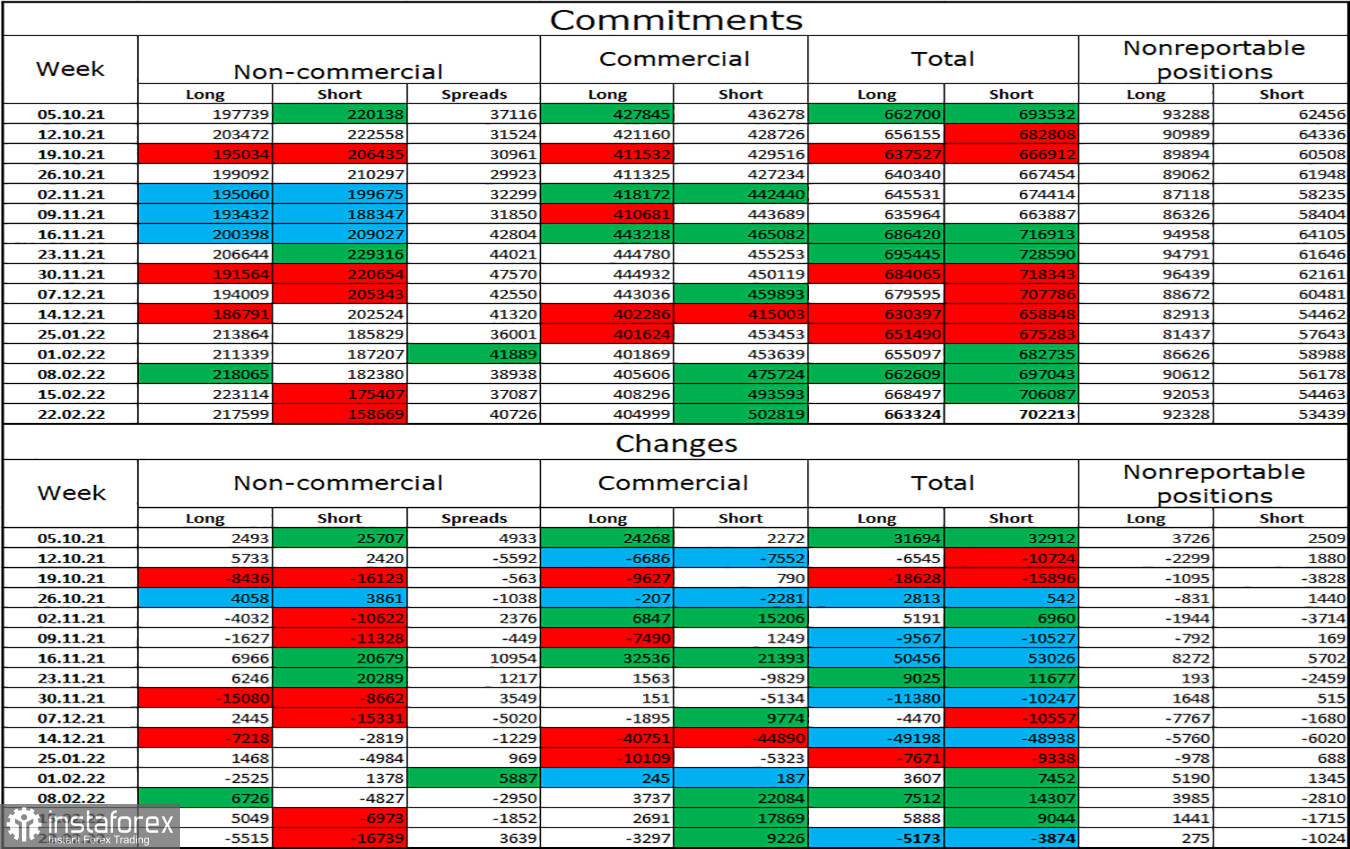

Commitments of Traders (COT):

Last week, speculators closed 5,515 long positions and 16,739 short ones, confirming bullish bias. The total number of long and short positions held by speculators now totals 217K and 158K respectively. In general, non-commercial traders are now bullish, which indicates a possible growth in the euro, if not for the information background, which is now providing support for US dollar. Amid the tense geopolitical situation, the result of the COT report can be neglected as the sentiment of major players might change rapidly.

Macro events in the United States and the eurozone:

Eurozone: CPI (10-00 UTC).

US: ADP employment change (13-15 UTC) and Fed Chairman Jerome Powell's testimony (15-00 UTC).

The events contained in the macroeconomic calendar on March 2 - eurozone inflation and Fed Chairman Jerome Powell's testimony - may somewhat affect the market. Therefore, they deserve your close attention.

Outlook for EUR/USD:

If the price closes below the sideways corridor in the 4-hour time frame, short positions could be opened with targets at 1.0926 and 1.0850. If the pair closes above the descending corridor in the 1-hour time frame, you could go long with the target at 1.1250.