On February 24, Russia invaded Ukraine. The crypto community assumed that bitcoin's bullish trend was likely to end. It was true that the cryptocurrency hit a local low of $34,200 at some point. However, later the situation changed and the bulls managed to seize the initiative.

After a short-term flat, bitcoin formed a strong bullish candle and consolidated near the local high of $44,000. The cryptocurrency surged on February 28 when the EU and US imposed extremely draconian sanctions on Russia.

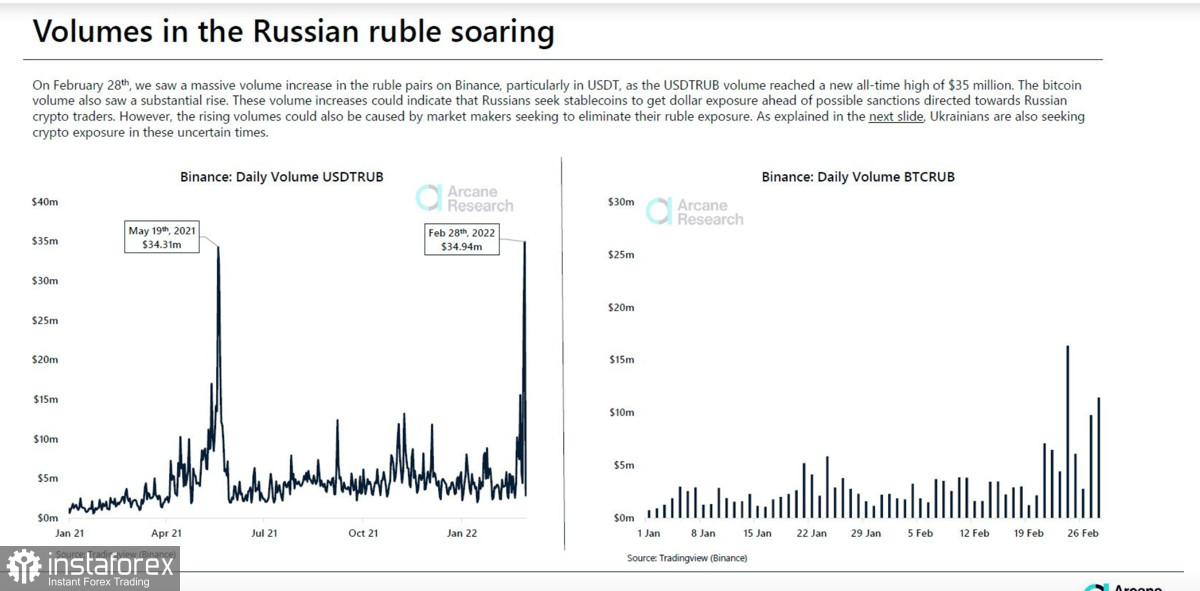

Moreover, analysts at Arcane Research noted that bitcoin "real" trading volumes increased significantly, following Russia's invasion of Ukraine. Indicators returned to their December highs, indicating strong demand for the cryptocurrency as an alternative to classic financial instruments, which have been banned.

Notably, during the same period, trading volumes of the USDT/RUB pair hit an all-time high of $10 billion during the same period. This fact suggests that most of the transactions were carried out by Russian citizens amid tightening Western sanctions. At the same time, experts note an unprecedented demand for digital assets among Ukrainian citizens.

Taking into account Arcane Research data, it is possible to conclude that the Russia-Ukraine war was the reason why the citizens of both countries used cryptocurrencies as a hedge against inflation. Besides, the use of digital assets should be associated with the inaccessibility of other financial instruments. However, when investors had an opportunity to buy gold, they preferred risky assets. This fact indicates growing confidence in digital coins, as well as gold's local peak, at which market players are not willing to enter the asset.

Moreover, the growth of the cryptocurrency market amid geopolitical tensions is associated with large amounts of donations to the Ukrainian army and refugees. During the first day of the war, cryptocurrency investors sent $14 million worth of digital assets to Ukraine. In the following days, this amount increased many times and became a significant part of the crypto market's recovery.

Bitcoin also rose by more than 14% during the day. Moreover, this tendency was not typical for the asset for more than a year. Notably, bitcoin did not collapse to the nearest support zone afterwards. As of March 2, the asset is trading near a local high of $44,000. Besides, there are strong signals to form a bullish trend. Bitcoin makes another attempt to form an inverted head and shoulders pattern. Bitcoin should complete the formation of the second shoulder and break the shoulder line at $44,800. In case an inverted head and shoulders pattern is formed, the potential for price movement is $54,400.

Technical indicators show positive dynamics. The MACD indicator entered the green zone and crossed the zero mark. The stochastic oscillator is in the overbought zone and is declining to the bullish zone. At the same time, bitcoin is not falling. It suggests that the demand for the asset is high. The RSI index is also around the 60 mark, indicating an active buying period.

On the one hand, the increased demand for bitcoin is caused by the military actions in Ukraine and the Western sanctions against Russia. However, it is evident that cryptocurrencies are becoming safe-haven assets amid geopolitical crises and limited availability of financial instruments.