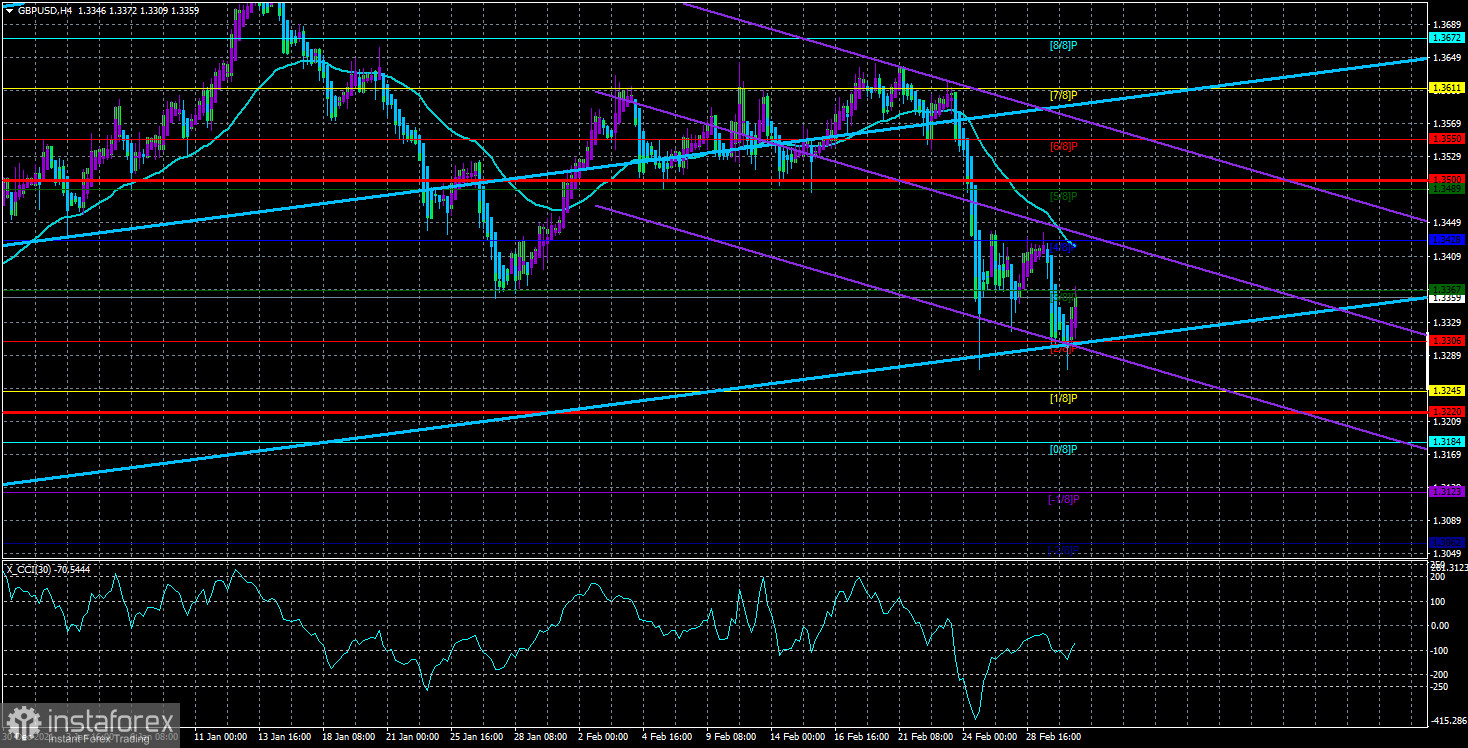

The GBP/USD currency pair failed to overcome the Murray level of "2/8" - 1.3306 and bounced off it for the second time. Thus, we can say that the pound is now teetering on the edge of the abyss and barely avoided a new fall. Of course, if you try to look at the whole technical picture as a whole, then nothing supernatural has happened at all in the last week. Yes, the pound fell, but the technical picture allowed it to fall again. It just felt a little more quickly and a little more unexpectedly than expected. That's all. However, as we have already said, the danger now lies not in how much the euro and the pound have fallen, but in the fact that we are waiting for peace in the coming weeks or even months. Absolutely everyone has already realized that Ukraine is now a kind of battlefield. Moreover, we are not even talking about military actions as such. The West and the EU countries decided to support Ukraine, and not just speak out in support of it. It is unlikely that such a development of events was expected in Moscow. Thus, instead of the standard package of sanctions, as it was in 2014, Russia faced an "unprecedented" package of sanctions.

We are not even talking about the freezing of assets of Russian banks and oligarchs abroad, not about the fall of the ruble, and not about the fall in the value of shares of Russian companies and banks. We are talking about a total blockade of the Russian Federation. Various manufacturers are leaving Russia, European and American countries are closing their airspace, and Russian ships may soon be denied access to European seaports. But all this is business, all this is money. Accordingly, now the Russian Federation is not only losing money because of sanctions, not only losing money because of the war itself, but also because of restrictions for Russian business. However, as we said earlier, sanctions are a two-sided thing. If any company has done business with the UK, and now cannot do it, then British companies will also receive losses. If Europe used to sit on Russian gas, then after refusing supplies it will have to buy gas at higher prices. As a result, everyone will suffer.

Boris Johnson continues to exert pressure.

These days, British Prime Minister Boris Johnson remains one of the main world speakers. Now, in principle, there is a feeling that all European deputies go to work only to impose new sanctions against the Russian Federation. However, Johnson continues to speak every day, answer journalists' questions and make statements on the Ukrainian-Russian conflict. His latest statements related to the fact that the Kremlin underestimated the "readiness of the Ukrainian people to fight," as well as the "determination of Western countries." In addition, Johnson announced that British ports are now closed to Russian ships, all Russian assets in the UK will be seized, and calls for disconnecting as many Russian banks as possible from the SWIFT system. Thus, relations between the Russian Federation and the UK can already be called completely spoiled.

It is worth noting that the SWIFT system and the freezing of assets of Russian banks abroad are the most formidable weapons of the West. It is also worth noting that disconnecting from SWIFT is not a matter of one day. That is, MEPs cannot get together, decide to disconnect from SWIFT and immediately click on the "red button". In any case, it will take time to bring the decision to execution. But what will happen to the ruble, Russian banks, companies, loans, mortgages when this decision comes into force? Many experts already agree that Russians will calmly survive the absence of new iPhones on store shelves, and will be able to buy other car brands instead of BMW or Audi. Roughly speaking, the situation of 2014 with import substitution will repeat, that's all. However, will the Central Bank of the Russian Federation be able to keep its economy afloat with a rapidly falling ruble and limited access to gold and foreign exchange reserves? And what will be the retaliatory sanctions of the Russian Federation, about which we have not heard much yet?

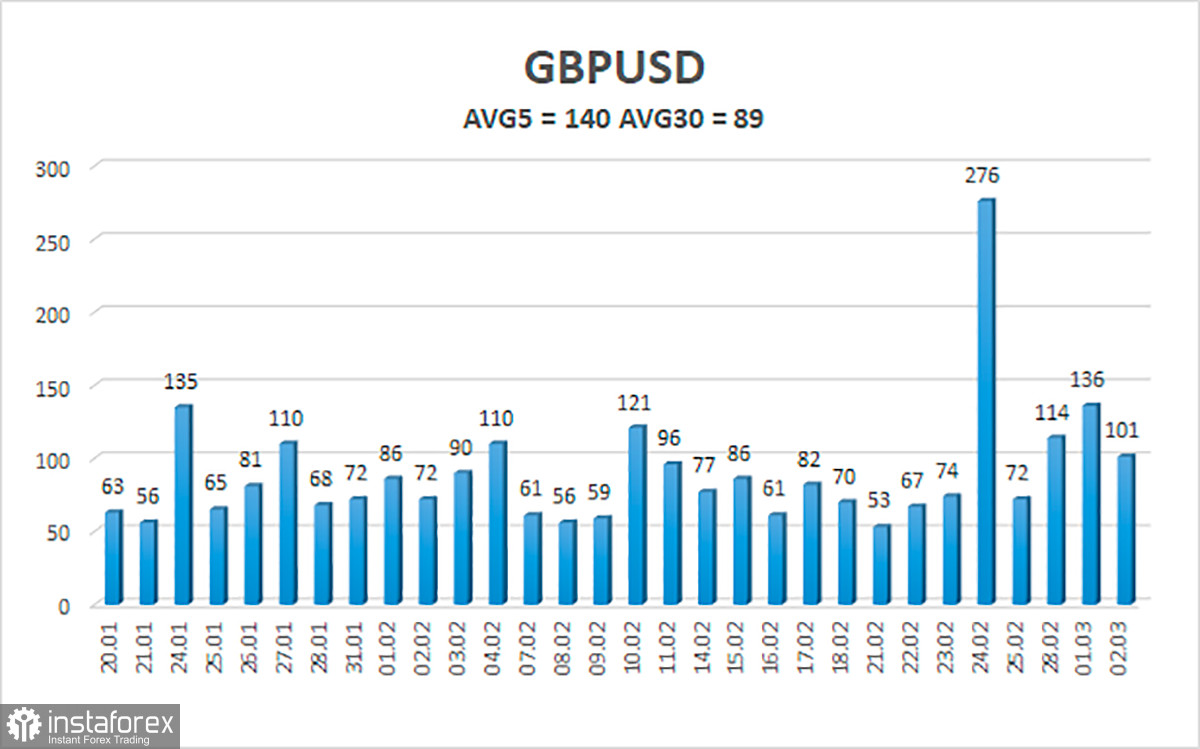

The average volatility of the GBP/USD pair is currently 140 points per day. For the pound/dollar pair, this value is "high". On Thursday, March 3, thus, we expect movement inside the channel, limited by the levels of 1.3220 and 1.3500. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.3306

S2 – 1.3245

S3 – 1.3184

Nearest resistance levels:

R1 – 1.3367

R2 – 1.3428

R3 – 1.3489

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe has started a new attempt to correct. Thus, at this time, new sell orders with targets of 1.3245 and 1.3220 should be considered in the event of a downward reversal of the Heiken Ashi indicator. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3489 and 1.3500.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.