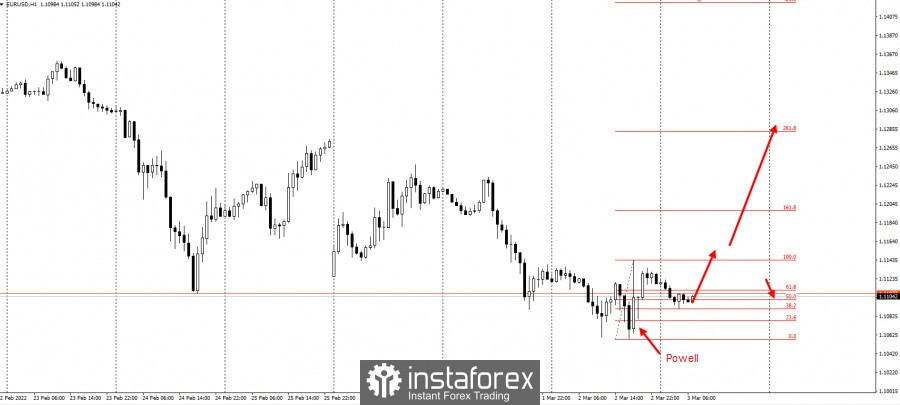

Euro and pound bounced back on Wednesday, after Fed Chairman Jerome Powell said the central bank will increase rates by only 25 basis points. He also said further increases will depend on inflation, the latest data for which will be released on March 10. This is why many expect to see a 0.25% increase in rates at the Fed meeting on March 15.

To find longs in EUR/USD, there is now a fundamental and technical initiative that traders will probably rely on today.

As for GBP/USD, the picture is more optimistic as after a powerful initiative at the end of December, the pair did not roll back so deeply and showed several good buying impulses with good targets over the past few days.

It is currently not ideal to open short positions as those could lead to losses.

The two trading ideas are based on the "Price Action" and "Stop Hunting" strategies.

Good luck and have a nice day!