The macroeconomic data released in the UK earlier this week didn't provide GBP with notable support. Consumer lending contracted to 608 million pounds in January from 817 pounds a month ago. Analysts had projected the volume of consumer loans to have grown to 1.05 billion pounds. On the plus side, the UK manufacturing PMI by Markit rose to 58.0 in February from 57.2 in January. Besides, the retail price index by BRC increased to 1.8% in January from 1.5% previously. Nevertheless, GBP/USD dropped to 1.3270, the lowest level in 10 weeks.

The US dollar is still setting the tone for GBP/USD. Investors are poised to buy the greenback as a safe haven asset amid the fierce standoff between Ukraine and Russia. Meanwhile, the Western allies have slapped tough sanctions against Russian companies and individuals.

The US macroeconomic data published yesterday was moderately optimistic. Fresh evidence that the US economy is on a sound footing arises hopes that the Federal Reserve will venture into monetary tightening. The ISM manufacturing PMI rose to 58.6 in February from 57.6 in January, stronger than the expected growth to 58 points. In a separate report, the factory orders index by ISM also climbed considerably to 61.7 from 57.9 in the previous month whereas analysts had expected 59.1.

On Wednesday, ADP payroll processor in tandem with Moody's Analytics reported that the US private sector created 475K jobs in February. The actual score again beats expectations for 400K new jobs. The data for January was strongly upgraded. Fed Chairman Jerome Powell said on Wednesday that he would suggest that the official funds rate should be increased moderately by 0.25% at the nearest policy meeting to be held in two weeks.

It would be a well-rounded decision on the back of soaring inflation, steadily growing domestic demand, and the healthy labor market. With these remarks, Jerome Powell made no impact on trading sentiment. Nowadays, investors anticipate that the key interest rate would be increased by 175 basis points until the year end. If so, the Federal Reserve could outpace other central banks in the pace of monetary tightening. The divergence of curves parting from each other will display the process. Such prospects are bullish for the US dollar.

In the economic calendar for today, market participants will take notice of the ISM non-manufacturing PMI for the US service sector that is on tap at 15:00 (GMT). Though data on the service sector doesn't matter to the US GDP, unlike the manufacturing sector, a reading above 50 is considered a positive factor for USD. The ISM non-manufacturing PMI is expected to stand at 61.1 in February following 59.9 in January and 61.0 in December. If confirmed, it will benefit USD. Fed leader Jerome Powell will speak again in Congress at 15:00 (GMT). Perhaps he will reiterate his yesterday's remarks on further monetary policy. Thus, the market is likely to give a muted response to his speech. However, we cannot rule out any surprises. Any hints about more aggressive monetary tightening will spark off higher volatility in the US stock market and reinforce the firm US dollar.

Technical analysis and trading tips

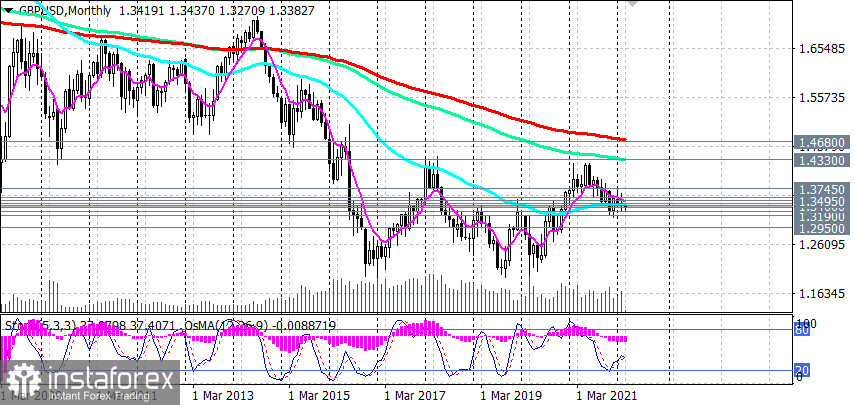

At the moment of writing the article, GNP/USD was trading at nearly 1.3380. The overall trend is bearish and the price is below the key resistance at 1.3560 (EMA200 on the daily chart). The currency pair is trading in the red inside the downward trend channels on the daily and weekly charts. The lower borders are seen at the levels of 1.3190 and 1.2950 respectively.

Support levels: 1.3365, 1.3300, 1.3275, 1.3190, 1.3100, 1.2950

Resistance levels: 1.3400, 1.3430, 1.3495, 1.3560, 1.3640, 1.3700, 1.3745, 1.3900, 1.3970, 1.4000

Trading tips

GBP/USD: Sell Stop 1.3360. Stop-Loss 1.3410. Take-Profit 1.3300, 1.3275, 1.3190, 1.3100, 1.2950, 1.2865, 1.2685

Buy Stop 1.3410. Stop-Loss 1.3360. Take-Profit 1.3430, 1.3495, 1.3560, 1.3640, 1.3700, 1.3745, 1.3900, 1.3970, 1.4000