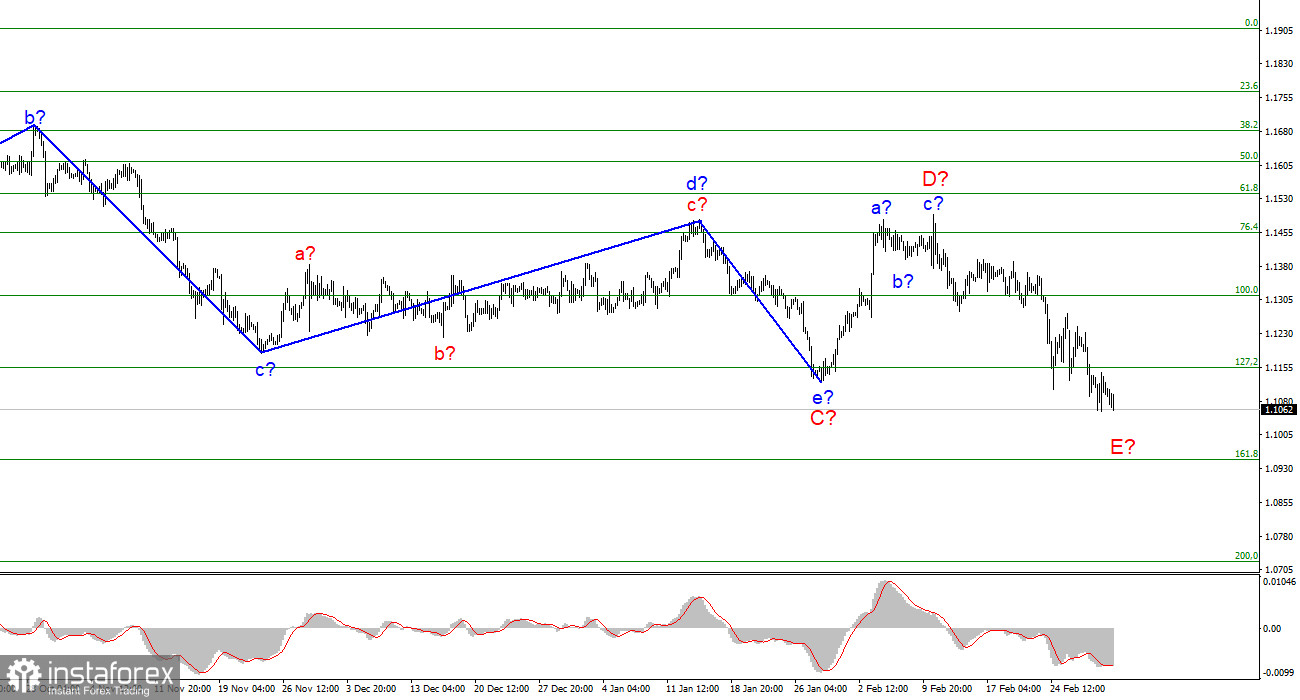

The wave marking of the 4-hour chart for the euro/dollar instrument has not changed lately and looks quite convincing. The European currency has been declining over the past few days, which is fully consistent with the current wave count. On Monday, it tried to stay afloat, but began to decline again on Tuesday. The current decline in quotes is interpreted as wave E, and this wave can turn out to be very long and strong. At the moment, I believe that wave D is over, and the news background frankly supports an increase in demand for the US currency. Based on this, I think that the probability that the instrument will continue building a downward wave is 80 percent. I give 20% of the probability that the entire wave counting will require additions and adjustments. However, now the mood of the market is affected only by the news background, which, unfortunately, is very sad. Therefore, I believe that the decline in the instrument will continue. Considering what is happening in Ukraine now, the whole wave counting can become very complicated.

The markets did not pay attention to the statistics

The euro/dollar instrument fell by 60 basis points on Thursday. Last night there was a slight recovery of the instrument, but it did not last very long. The market is still in a state of panic, no matter what anyone says. Now there is an opinion that European markets and US markets have already digested all geopolitics and are now ready to move in their usual mode. From my point of view, this is absolutely not true. Let me remind you that since the end of November 2021, the European currency has been diligently trying to complete the construction of the downward trend section, making it three waves. However, it was after the start of the military operation in Ukraine that the decline in quotes resumed, and at the moment the entire section of the trend should take on a five-wave form. Thus, the market simply lost faith in the fact that now it is possible to start building a new upward section of the trend and is fully tuned in to new short positions.

The saddest thing is that the market practically does not react in any way to economic statistics, which nevertheless appear from time to time. Today in the European Union, the index of business activity in the service sector fell to 55.5 points, and the unemployment rate fell to 6.8%. In the near future, unemployment in the EU may continue to fall due to the influx of a huge number of refugees from Ukraine. However, this information did not help the euro. The markets didn't even pay attention to it. The same goes for the ISM Service PMI in the US. This index fell to 56.5 points in February, but the demand for the US currency still continues to grow. It does this at a leisurely pace, because the market has already gone through the "shock days". Now, at a slow pace, the demand for the dollar may continue to rise, and the entire wave E may take on a very long form. Federal Reserve Chairman Jerome Powell's speech, which pushed the euro to slightly rise yesterday, should also take place today. But it is unlikely that Powell will make dovish statements today, which will be enough to stop the new growth of the US currency.

General conclusions

Based on the analysis, I conclude that the construction of wave D is completed. If so, now is a good time to sell the European currency with targets near 1.0949, which corresponds to 161.8% Fibonacci, on every MACD down signal. A successful attempt to break through 1.1154 indicates that the market is ready for new sales of the instrument.

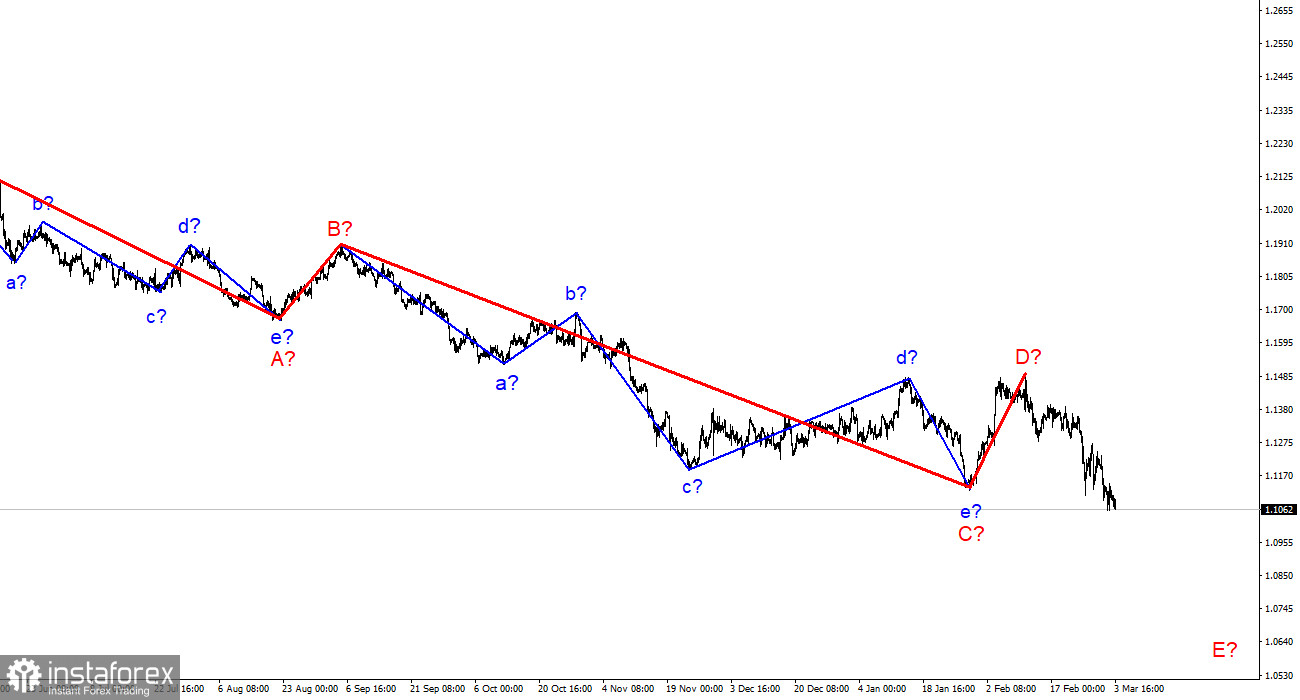

On a larger scale, it can be seen that the construction of the alleged wave D has now begun. This wave may turn out to be a shortened or three-wave. Considering that all previous waves were not too large and approximately the same in size, the same can be expected from the current wave. There is every reason to believe that wave D has already been completed. Then the construction of wave E continues now.