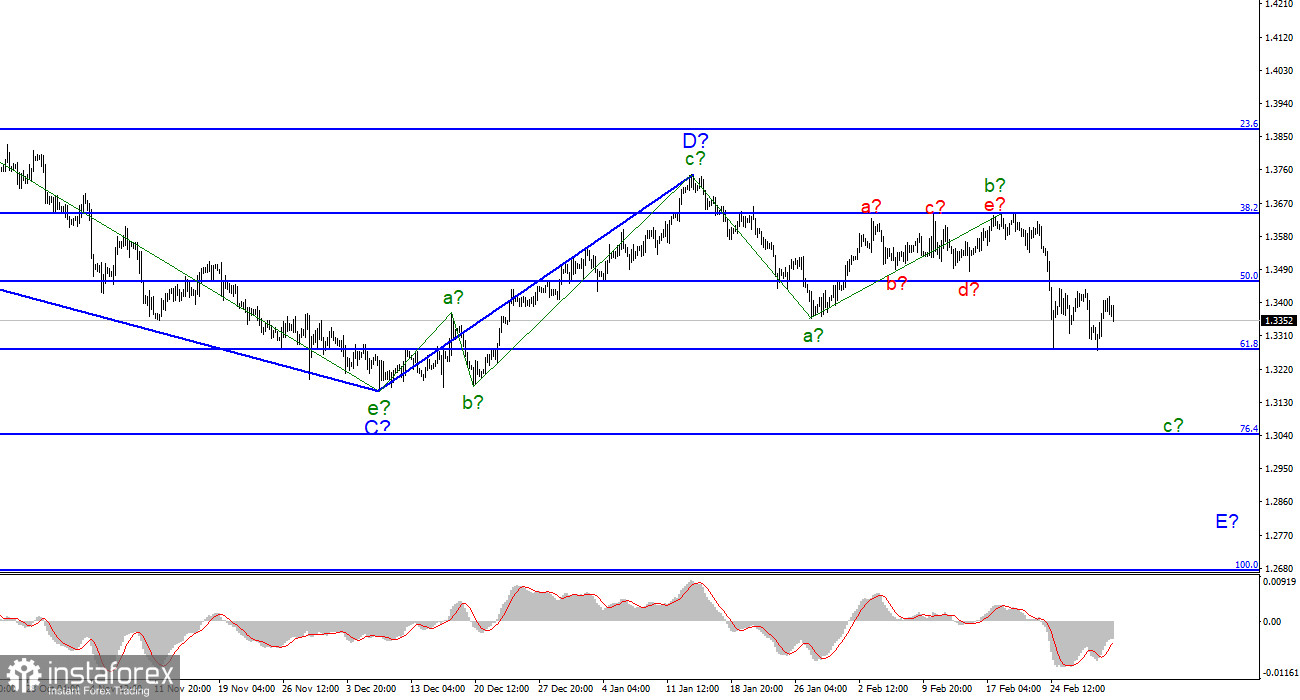

For the pound/dollar instrument, the wave counting continues to look very convincing, although rather complicated. Estimated wave b in E of the downward trend became much more complicated, but after several unsuccessful attempts to break through the level of 1.3642, it still ended. The decline in quotes over the past few days indicates a transition to the formation of wave c, which can also turn out to be quite extended. At the moment, the low of the expected wave a has been broken, so the construction of the downward trend section continues. And definitely within wave E. Thus, the entire downtrend has acquired a five-wave form, and its expected wave E should also acquire a five-wave form. Hence, adopt a rather lengthy structure. Two unsuccessful attempts to break through the 1.3272 mark led to a retreat from the lows reached, but it is unlikely that it will last long. Wave c in E does not look completed yet - it is too short, and the current news background may continue to increase demand for the dollar.

Jerome Powell reported on a possible slowdown in the tightening of monetary policy

The rate of the pound/dollar instrument fell by 60 basis points on March 3. Over the past week, the pound managed to avoid serious losses, and yesterday it even rose by 80 points. But, as we all see, the UK currency is heading down again. Last night, Federal Reserve Chairman Jerome Powell made a speech, saying that because of the situation in Ukraine, geopolitical risks have seriously increased, and with them the risks for the US economy. He said that the Fed is starting a rate hike to fight high inflation, but he also warned markets that the hike could be smooth and unhurried. On the one hand, this is good. The US stock market can avoid a shock and a new collapse if the Fed acts cautiously. On the other hand, inflation is now the main problem of the United States. It is growing and will continue to rise, because at the moment nothing has been done to stop it from accelerating.

The abandonment of the QE program is good, but it only means that billions of printed dollars will no longer flow into the American economy. But oil prices, on which a lot of things in our world still depend, continue to grow. Gas prices continue to rise. The isolation of Russia can lead to an even greater increase in energy prices, since it was from there that the lion's share of oil and gas was supplied to at least the EU countries. Thus, a smooth rate hike by the Fed is not exactly something that can quickly help to cope with high inflation. And "quickly" now means not even within a year, but at least for several years. Especially considering the "Ukrainian factor". After all, a month ago, no one even thought that a war would begin. And any war leaves an imprint on the economy and supply chains. Consequently, inflationary risks have increased even more.

General conclusions

The wave pattern of the pound/dollar instrument suggests the formation of wave E. The instrument made two unsuccessful attempts to break through the 1.3645 mark, which first led to the beginning of a new decline. Failed attempts to break through 1.3274 pushed the instrument back slightly up twice, but in general I advise selling with targets located near 1.3046, which corresponds to 76.4% Fibonacci, on MACD signals "down", as wave c in E doesn't look complete yet.

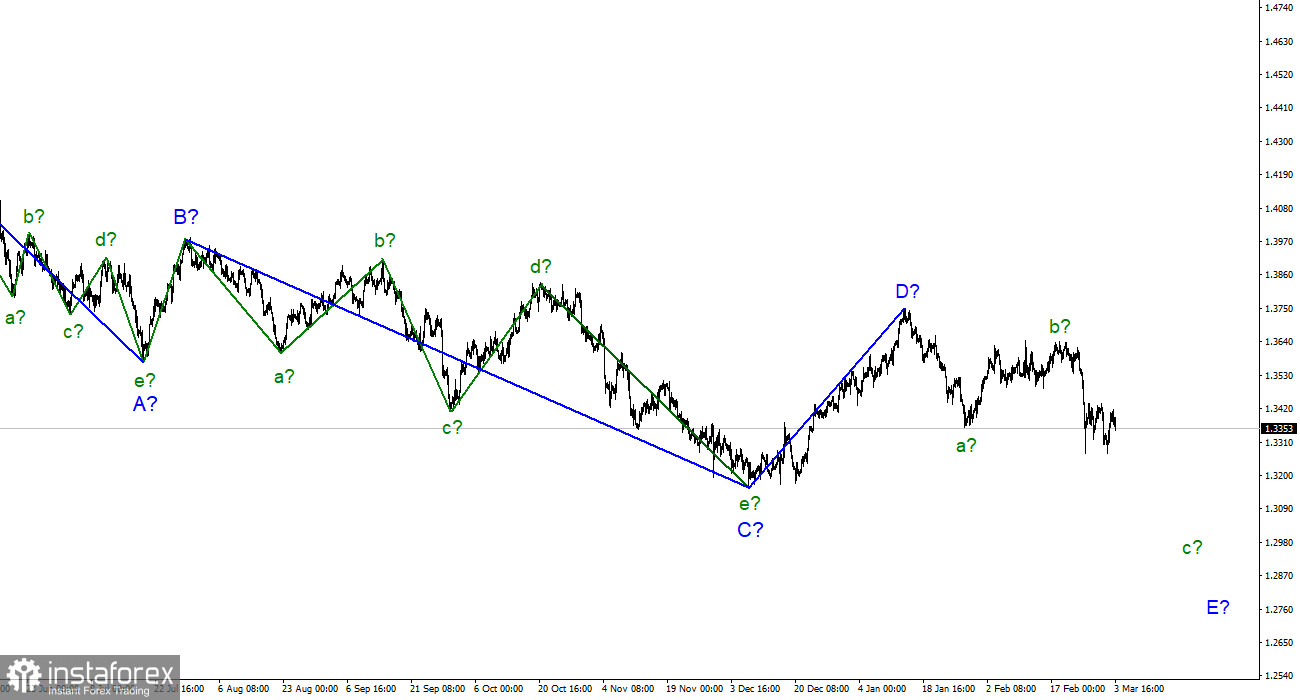

On the higher scale, wave D also looks complete, but the entire downward trend section does not. Therefore, in the coming weeks, I expect the instrument to continue to decline with targets below the low of wave C. Wave D turned out to be three waves, so I cannot interpret it as wave 1 of a new upward trend section.