The EUR/USD currency pair on Wednesday not only refrained from a new fall but also managed to grow quite significantly. For several days in a row, traders did not receive any macroeconomic or geopolitical information. And on Wednesday, the bears could not stand it and began to take profits on previously opened short positions. This, from our point of view, led to fairly strong growth of the European currency. Let's look into it in more detail. During the first three days of the week, there was not a single important macroeconomic report. Neither in the USA nor the European Union. That is, traders simply had nothing to pay attention to. There was not a single speech by Jerome Powell, Christine Lagarde, or other representatives of the ECB or the Fed. There was not even important geopolitical news. In Ukraine, the situation remains the same, although military operations have weakened in the last few days.

Moscow has officially recognized the presence of its troops (and conscript soldiers among them) in Ukraine, but this, by and large, does not affect anything. Kyiv stated that at the moment Russian troops cannot advance in their offensive, but at the same time, they note that there is a regrouping and a new offensive is expected on Kyiv, Kharkiv, and other Ukrainian cities. At the same time, the European Union, the United Kingdom, the United States, and other countries of the world continue to work only in one direction. They are introducing more and more sanctions against the Russian Federation. Russia has already been isolated from the whole world without new sanctions, but sanctions are still being imposed, and companies continue to withdraw from the Russian market. Also yesterday, it was reported that the head of the Central Bank of the Russian Federation Elvira Nabiullina wrote a statement on her resignation, which was not accepted by Vladimir Putin. There is no official confirmation of this information. The Moscow Stock Exchange did not open on March 9.

What to expect from the ECB today?

As we have already said, it is extremely difficult to expect any serious actions from the European Regulator now. Christine Lagarde has repeatedly stated that the regulator will not raise the rate this year, and there are no more questions to the ECB now. However, we believe that today's meeting and the subsequent press conference with Lagarde may still be important events. Since the last meeting, so much has changed in the world that it's scary to imagine. The Ukrainian-Russian conflict has led to the fact that a huge number of companies (including European ones) have left the Russian market. The European currency has fallen quite a lot against the dollar. Now the European Union is under pressure from all sides to impose an embargo on Russian oil and gas. And most importantly, oil and gas have risen in price very much. And the European Union imports both of these energy carriers in large volumes. Thus, a new round of price growth can be expected in Europe, and inflation may jump much higher than the current 5.8%.

It is the comments on all of the above topics and issues that will be of great importance for the markets. After all, now it is completely unclear what to do with the price increase? Just wait it out? The ECB (as well as the Fed) was confident that inflation would begin to decline by itself against the background of the weakening of the pandemic, against the background of the recovery of production chains, against the background of the completion of the increase in oil and gas prices. But the military operation in Ukraine has begun, energy prices have soared up and it turns out that all Lagarde's forecasts can simply be thrown into the landfill. In general, we will not guess what the head of the ECB can tell traders. It's better to just wait for her press conference.

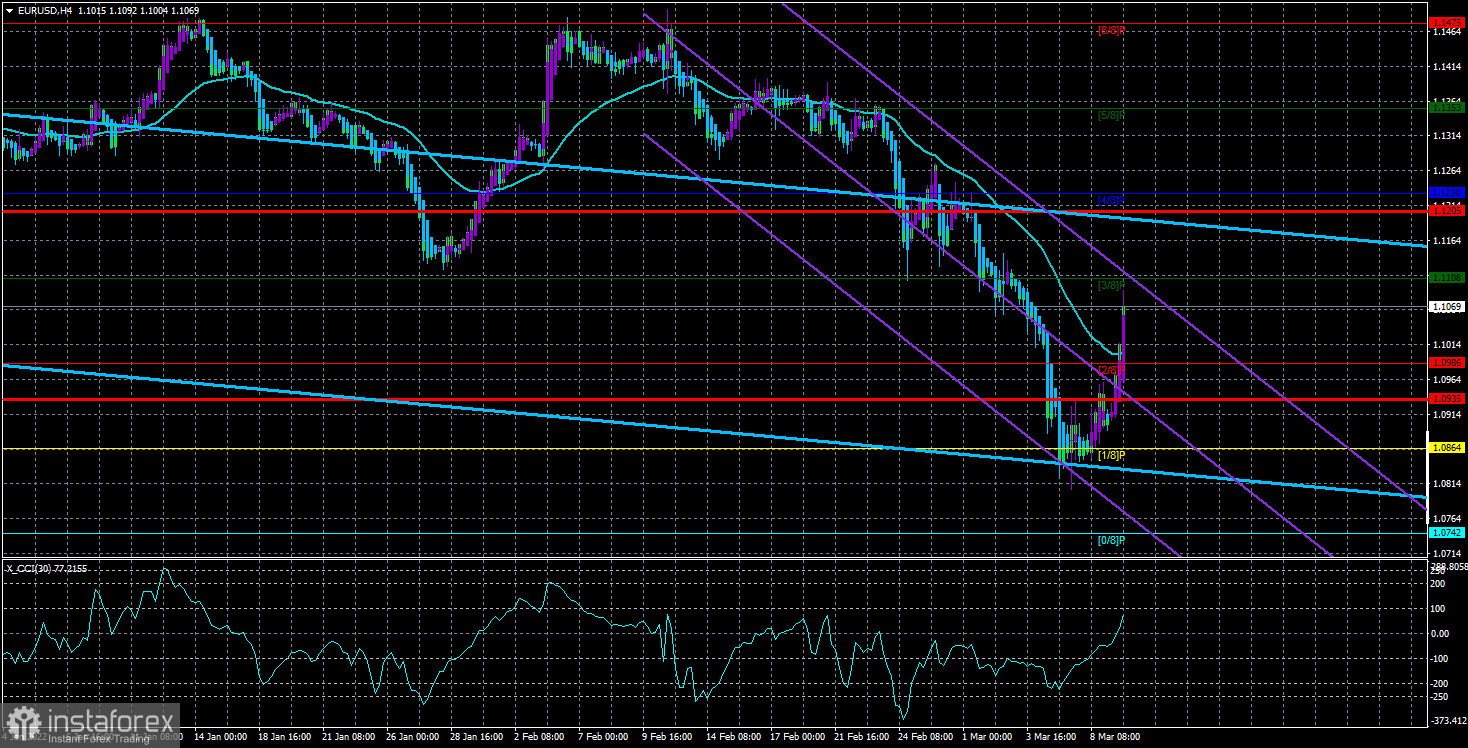

From a technical point of view, the pair is currently above the moving average line. On the one hand, this suggests that the trend may change or has already changed to an upward one. On the other hand, the Ukrainian-Russian crisis is not over and may persist for many months. If so, then all world markets may still fall far more than once. And this also applies to the euro and the pound sterling. Thus, it is too early to open champagne on the completion of the euro's fall.

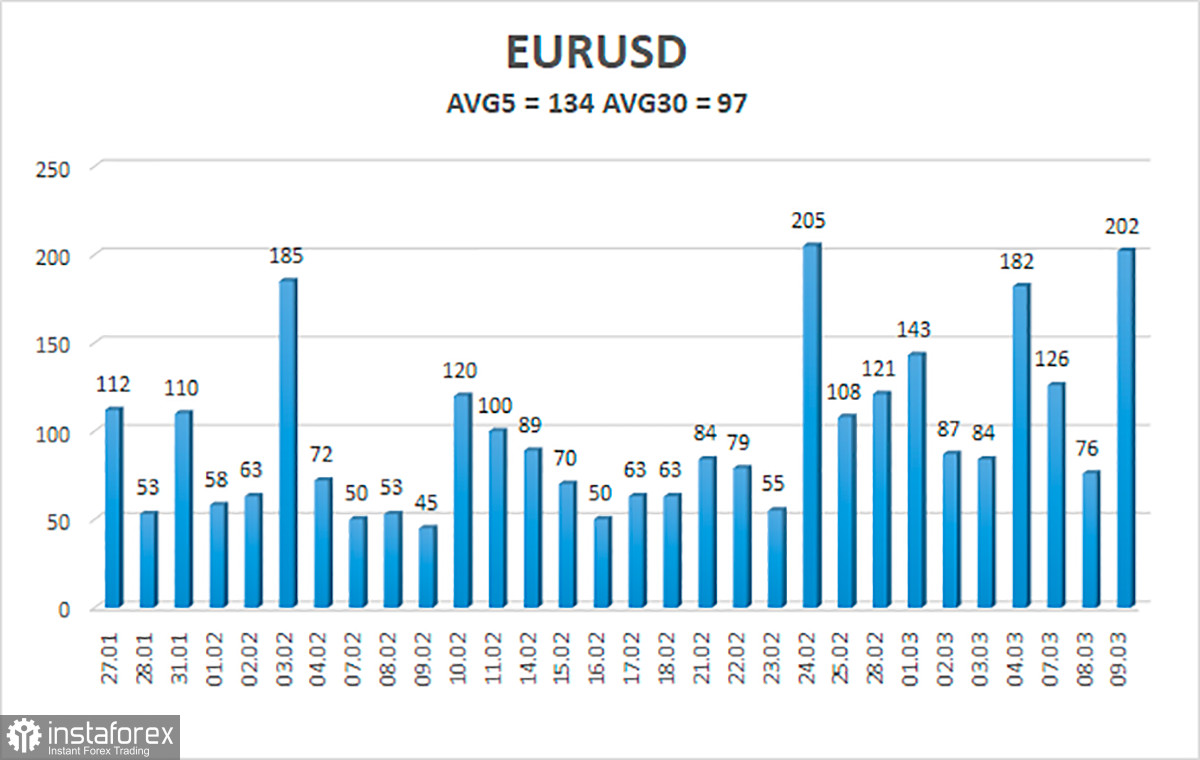

The volatility of the euro/dollar currency pair as of March 10 is 134 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0935 and 1.1205. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues to adjust and has consolidated above the moving average. Thus, now it is necessary to stay in long positions (who managed to enter them) with the goals of 1,1108 and 1,1205 until the Heiken Ashi indicator turns down. Short positions should be opened no earlier than the price-fixing below the moving average line with targets of 1.0935 and 1.0864.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.