The GBP/USD currency pair also started a correction on Wednesday. But if the European currency was at least able to grow to the moving average, then the pound could not even do that. Recently, the British currency has been looking very weak, much weaker than the euro. Maybe this is because earlier it was the European currency that fell much more strongly than the pound. Recall that in global terms, the European currency has adjusted by almost 100% against the trend of 2020. And the pound has adjusted by only 40%. The difference, as they say, is visible to the naked eye. Thus, the pound/dollar pair is currently maintaining a downward trend. Today, the euro and the pound can move completely differently, since for the euro today there will be important results of the ECB meeting and Lagarde's speech, and for the pound today only a report on American inflation, which is likely to continue to accelerate.

How the market will react to the new acceleration of inflation in the US, we no longer undertake to predict. If for many months in 2021, the dollar received support on every message about the acceleration of inflation, then in recent months, firstly, it feels just fine without inflation, and secondly, traders have stopped associating an increase in inflation with an increase in the likelihood of a Fed rate hike. Recall that at his last speech, Jerome Powell openly stated that he would support a rate increase of only 0.25%. He also drew the attention of the markets to the fact that the crisis in Ukraine creates additional risks for the American and global economy, therefore, it is impossible to hurry with tightening monetary policy. Indeed, none of us knows when and how the Ukrainian-Russian crisis will end. It is possible that if it drags on for several months, then other countries will be involved in this conflict. For those who refuse to believe in such a development of events, we remind you that two months ago hardly anyone could have imagined that everything that started would begin between Ukraine and the Russian Federation. And two years ago, no one could have imagined that the whole world would be "covered" by a pandemic.

The UK sees no way to restore normal relations with the Russian Federation.

Meanwhile, British Prime Minister Boris Johnson continues to be one of the key figures of the West in the Ukrainian-Russian conflict. Yesterday, the British Prime Minister said that he does not see any opportunity to restore normal relations with Russia. Johnson said that Russia violated the fundamental principles of international law by invading Ukraine. "Our task is not to change Russia, it's their business, not ours. Our task is to rally around Ukraine and resist aggression," Johnson said.

At the same time, Boris Johnson said that Western countries have already begun to develop a "Marshall Plan" for Ukraine. According to him, "Western countries will help to restore Ukraine after the hostilities." Recall that Western countries have harshly condemned the Kremlin's aggression against Ukraine and are providing huge financial, humanitarian and military assistance to Kyiv, simultaneously imposing sanctions against the Russian Federation and members of its government.

However, all this generosity of the British people is not helping the British pound in any way yet. There is a feeling that only the meetings of the Fed and the Bank of England can affect the mood of the market globally. Or you need to wait for the process of redistribution and redirection of capital from the Russian Federation and Ukraine, or related to them, to be completed. Recall that COT reports on the euro and the pound do not currently indicate that major players are getting rid of these currencies. According to the euro currency, professional traders are increasing purchases altogether. But at the same time, the euro and the pound are still falling. This means that the demand for the dollar exceeds the demand for European currencies. Consequently, until this process is completed, COT reports are useless. And when this process is completed, hardly anyone will be able to say. The meetings of the Bank of England and the Fed may affect the market if the first raise the rate for the third time in a row, and the second raises it by only 0.25%. In this case, the British currency may receive market support.

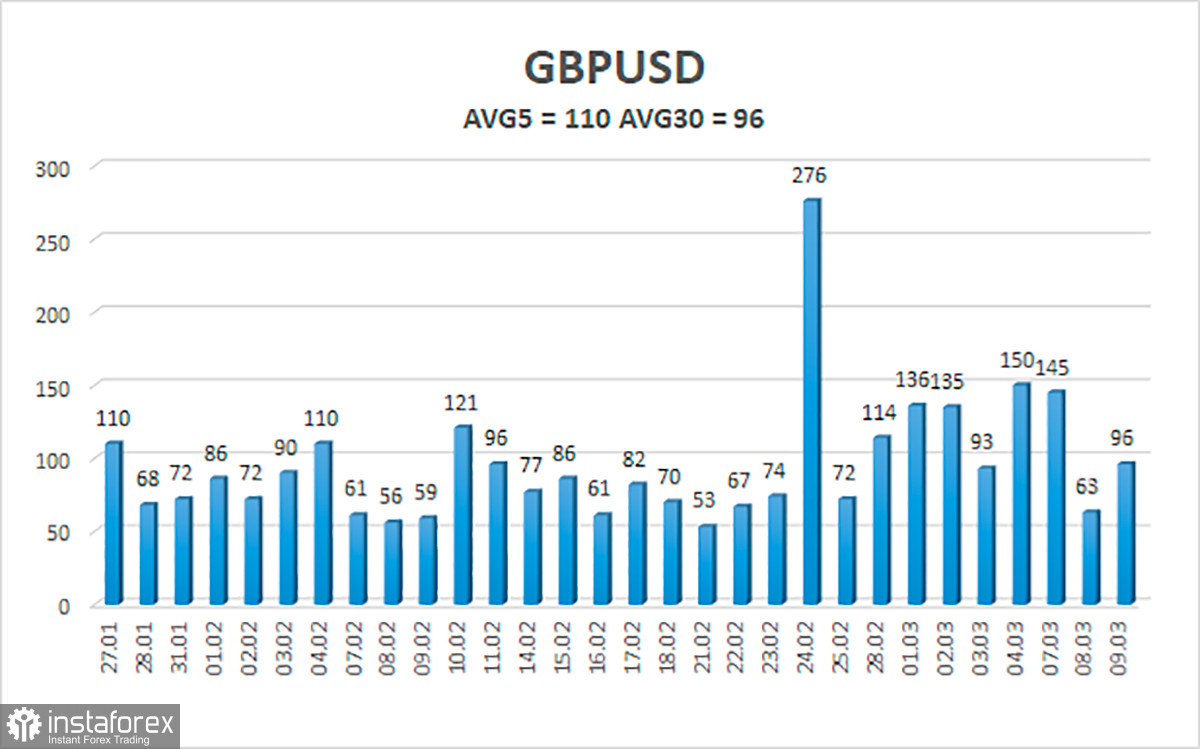

The average volatility of the GBP/USD pair is currently 110 points per day. For the pound/dollar pair, this value is "high". On Thursday, March 10, thus, we expect movement inside the channel, limited by the levels of 1.3052 and 1.3272. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.3123

S1 – 1.3062

Nearest resistance levels:

R1 – 1.3184

R2 – 1.3245

R3 – 1.3306

Trading recommendations:

The GBP/USD pair started an upward correction on the 4-hour timeframe. Thus, at this time, new sell orders with targets of 1.3123 and 1.3062 should be considered in the event of a reversal of the Heiken Ashi indicator down or a rebound from the moving. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3306 and 1.3367.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.