The EUR/USD currency pair on Thursday, exactly at the time of the publication of key rates after the meeting of the regulator, shot up by 80 points in 10 minutes. We thought that the ECB had raised the key rate, but in fact, nothing like that happened. Immediately you need to remember that even a day earlier, the European currency rose by 200 points out of the blue, although there were no prerequisites and reasons for this. Thus, the euro showed unreasonable growth for two days in a row. And we believe that now is the time for traders to work it back. Why did the growth happen? The very first and banal thing that comes to mind is a technical correction. Yes, it turned out to be quite strong, since almost 300 points in less than 2 days, you don't see this often. Nevertheless, at the same time, the pound/dollar pair was trading much weaker, so it is hardly possible to conclude a global correction for all instruments in all markets. In the afternoon, the euro currency has already started to decline, and we believe that the downward trend may recover.

From a technical point of view, the pair is now near the moving average and may gain a foothold below it. If this happens, the fall of the euro currency may resume. Moreover, we have clearly understood the position of the ECB, which blames the rising price of oil and gas, as well as the geopolitical conflict between Ukraine and Russia, for the increase in inflation. Thus, it turns out that the ECB cannot influence these factors in any way, and the state of its economy does not allow raising the rate. Recall that in the fourth quarter, it grew by only 0.3% q/q. Moreover, more than 1 million people have emigrated from Ukraine to EU countries in the last 2 weeks alone. These people are in the status of refugees. That is, they all need to be settled somewhere, fed, watered, and paid some kind of allowance. Of course, some Ukrainians forced to leave their country will work, but this still does not negate the fact of an additional burden on the budget of the European Union, which also actively provides financial and military assistance to Kyiv. In general, the economic situation in the EU is not the best right now, and the ECB has virtually no room for maneuvering to tighten monetary policy. It is on this basis that the euro can continue to decline against the dollar in the long term since the Fed has no such problems.

Negotiations between Ukraine and Russia: there is no progress.

Talks between Sergey Lavrov and Dmitry Kuleba took place yesterday in Antalya, Turkey. The negotiations lasted 1.5 hours and their results were brief: progress could not be achieved. According to the head of the Ukrainian Foreign Ministry Dmitry Kuleba, Moscow's position in the negotiations remains unchanged: Kyiv should surrender ("demilitarization" means exactly that), and abandon any attempts to join NATO forever. Ukraine does not agree with these demands and stated that negotiations are when both sides concede, and do not put forward ultimatums to each other. It was not possible to organize humanitarian corridors from Mariupol. Also, it was not possible to agree on a 24-hour silence regime to withdraw civilians from the most hot spots of Ukraine. Thus, the result is the same as for the main "branch": negotiations are underway, but there is no progress.

Thus, there are no reasons for optimism in the markets now and there cannot be. Recall that Russian troops seized two Ukrainian nuclear power plants at once and at the moment the Chernobyl NPP is de-energized. A generator was connected to it, which will be able to supply electricity for 2 days. Next, the electricity will turn off, and nuclear reactors without a working cooling system will start to heat up. According to the representatives of the IAEA, they can reach a critical temperature in 6-7 days. No one can predict what will happen next. However, from our point of view, the world is now not just on the threshold of the Third World War, but also on the threshold of another man-made catastrophe. If someone accidentally hits the Chernobyl nuclear power plant or the NPP with a shell, the explosion can be 10 times stronger than in 1986.

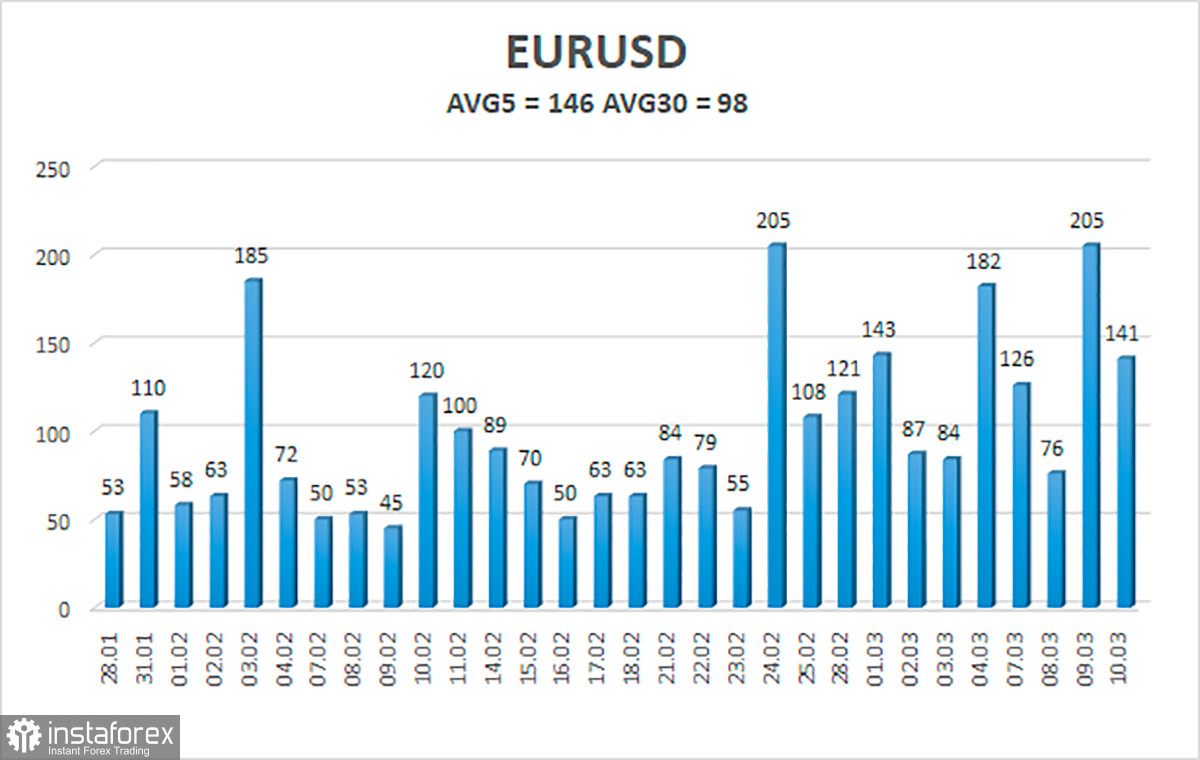

The volatility of the euro/dollar currency pair as of March 11 is 146 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0862 and 1.1154. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues to adjust and has consolidated above the moving average. Thus, now it is necessary to stay in long positions with targets of 1.1108 and 1.1154 if the price remains above the moving average. Short positions should be opened no earlier than the price-fixing below the moving average line with a target of 1.0864.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.