The GBP/USD currency pair stood in one place almost all day on Thursday. This is very strange. At least because on Thursday, unlike Monday, Tuesday and Wednesday, there was important news, there were important statistics. Take, for example, the US inflation report. Take, for example, the negotiations between Dmitry Kuleba and Sergey Lavrov. However, the pound/dollar pair and its traders did not consider it necessary to work out this information. Thus, at the moment, the pair continues to try to adjust, but it is not the price that is now moving towards the moving, but the moving towards the price. The upward correction is very weak, and the pound sterling continues to remain in the "risk zone". The British currency has been looking bad in recent weeks. Previously, we have repeatedly said that the pound is much better against the dollar than the euro currency. However, it has fallen in price more recently, and its corrections have been weaker.

It is impossible to make an unambiguous conclusion why this is happening now. Too many factors have an impact on the foreign exchange market, which has not yet fully recovered from the shock of February 24. We can only assume that the pound now looks like the least stable currency among the euro-dollar-pound trio. Perhaps this is due to the actions of the British government, which openly opposes Moscow, imposes new sanctions, freezes the assets of Russian oligarchs in the UK, refuses to supply Russian oil and gas, and also calls on other European countries to do the same. But in Europe itself, they are much more restrained in their comments on Russian aggression against Ukraine. In particular, several countries (including Germany) have stated that they cannot abandon Russian oil and gas, because there is simply nothing to replace them with. Thus, the pound sterling may be falling since an open confrontation between London and Moscow, a sanctions war can have a very negative impact on the British economy.

American inflation continues to rise.

At the same time, American inflation continues to rise. Moreover, this applies not only to the United States but also to the United Kingdom and the European Union. Prices are rising everywhere and doing it much faster than before. Now we can remember with a smile the times when the Fed and the ECB vainly struggled to accelerate inflation to 2%. Now they are struggling with all their might to lower inflation to 2%. And so far without success. Yesterday, it became known that the consumer price index in the United States rose to 7.9% y/y. No one was surprised by this value. Many predicted even greater growth. Thus, so far we can conclude that the Fed's rejection of the quantitative stimulus program, which previously sent $ 120 billion to the economy every month, did not affect inflation. Well, maybe it is not growing as fast as it would be with the QE program.

Already next week, the Fed is very likely to raise the rate by 0.25%. Maybe even by 0.5%. But, according to many experts, this will not help bring inflation back to 2%. One has only to look at the gap between the target and the current values. Therefore, the rate will have to be raised for a long time and a lot to hope for a reduction in inflation to 2%. Therefore, this task is for the next few years. It will not be possible to solve this problem quickly and easily. Moreover, the conflict in Ukraine and rising oil and gas prices will provoke new price increases all over the world. Consequently, on the one hand, the Fed will raise the rate, and on the other hand, prices will continue to rise based on more expensive hydrocarbons. And no one knows to what levels oil and gas will grow since now half the world has taken a course to abandon Russian energy carriers. Accordingly, there will be an artificially created shortage of hydrocarbons and prices will rise. And the longer the conflict in Ukraine persists, the more oil sanctions are imposed against the Russian Federation, the more oil can grow.

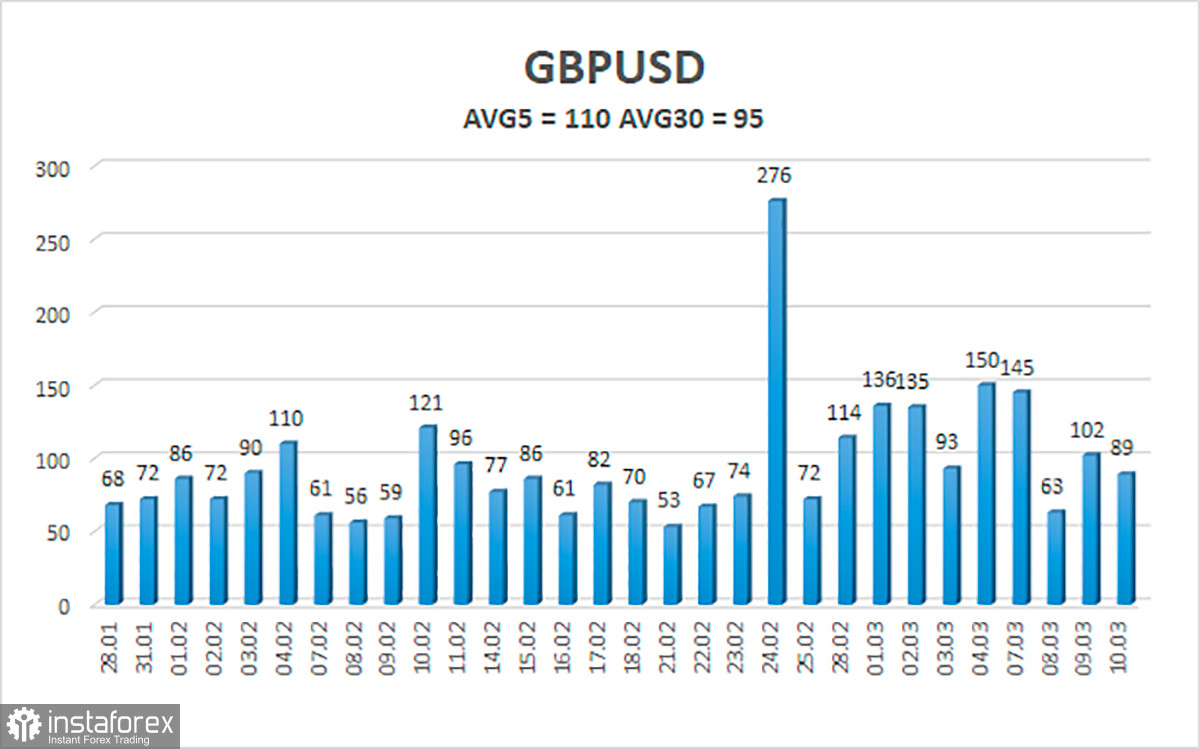

The average volatility of the GBP/USD pair is currently 110 points per day. For the pound/dollar pair, this value is "high". On Friday, March 11, thus, we expect movement inside the channel, limited by the levels of 1.2996 and 1.3215. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.3123

S1 – 1.3062

Nearest resistance levels:

R1 – 1.3184

R2 – 1.3245

R3 – 1.3306

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe completed a round of upward correction near the level of 1.3184. Thus, at this time, new sell orders with targets of 1.3062 and 1.2996 should be considered in the event of a downward reversal of the Heiken Ashi indicator. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3306 and 1.3367.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.