After a small local rebound, which happened just a couple of days ago, the pound promptly returned to the values it was at before. Which, in general, is not surprising. A rebound suggested itself, but in the current realities, neither fundamental nor technical analysis, in principle, work.

The markets are in a permanent state of panic. So even for a local correction, serious reasons were needed. Such was the refusal of the European Union to impose a ban on the import of Russian energy resources. However, the situation has not fundamentally changed. In fact, everything remained as it was.

The main driving force in the market is the events in Ukraine and the subsequent exchange of sanctions. The risks for the European economy are growing every day, which provokes a significant outflow of capital. And until the clashes stop in Ukraine, this trend will not change. So the prospects for the pound are clearly gloomy, and it will continue to gradually lose its positions.

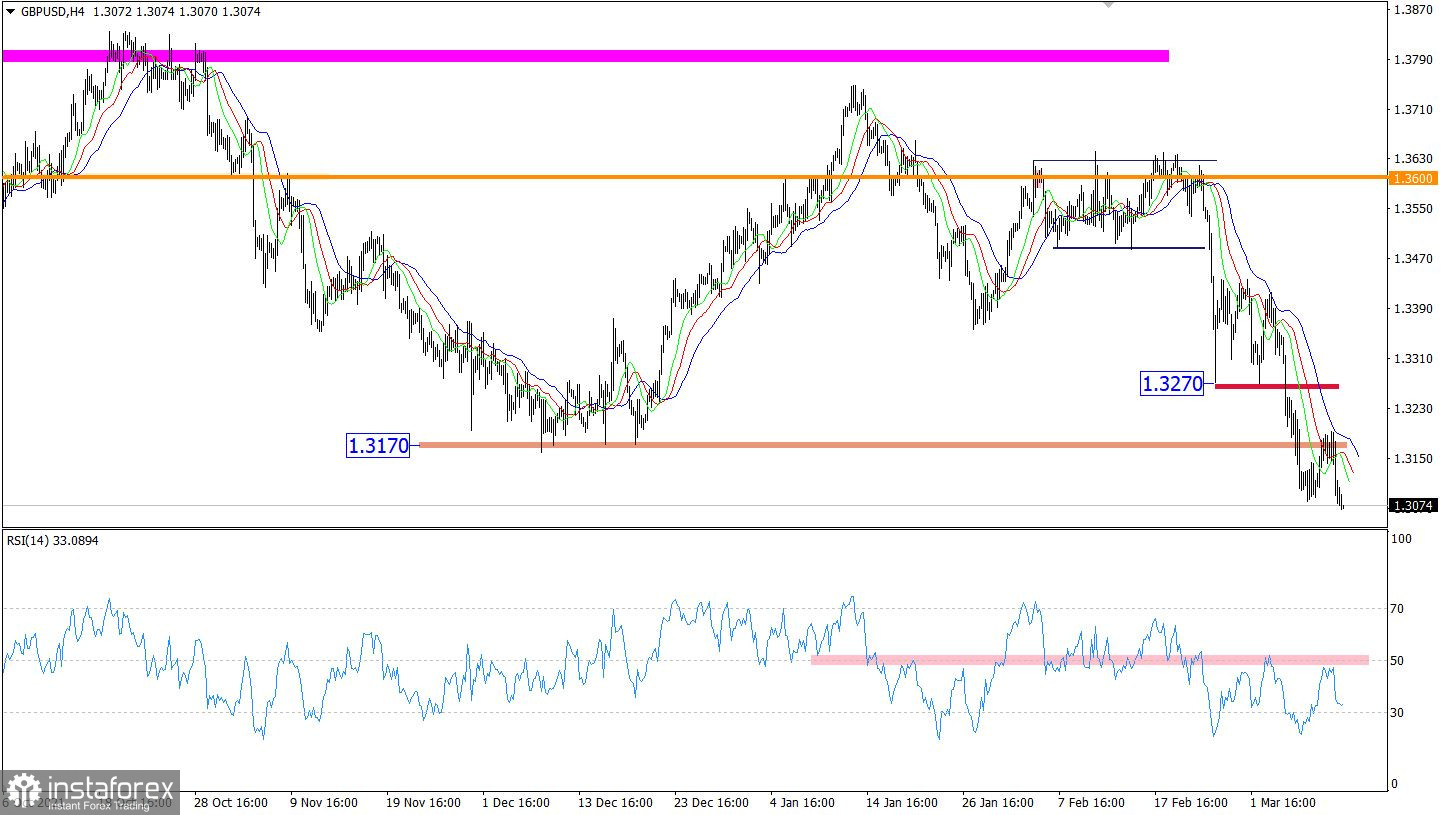

The GBPUSD currency pair, after a slight pullback, rushed down again. This led to a renewal of the local low of the downward trend and the price approaching the psychological level 1.2950/1.3000/1.3050.

The RSI technical instrument in the four-hour and daily periods is moving in the lower area of the 30/50 indicator, which indicates a high interest of traders in short positions.

The Alligator H4 and D1 indicators indicate a downward trend. There are no intersections between MA lines.

On the daily chart, there is a continuation of the downward trend from June 2021.

Expectations and prospects:

At the moment, special attention is paid to the psychological level, as the quote moves within its deviation. The first priority is to touch the 1.3000 mark, but in order to keep the pace set in the market, the quote needs to consolidate below the value of 1.2950 at least in a four-hour period. Otherwise, a reduction in the volume of short positions and stagnation are not ruled out.

Comprehensive indicator analysis gives a sell signal in the short, intraday, and medium-term periods due to the price reversal.