Gold prices remain under pressure from sellers and barely react to weak consumer sentiment and rising inflationary expectations.

On its meeting on Wednesday this week, the Fed plans to increase the interest rate on USD by a quarter of a basis point.

On Friday, the University of Michigan released its preliminary consumer sentiment survey, which showed consumer optimism fell to 59.7 from 62.8 in February. The data fell short of expectations as the consensus forecast was around 61.4.

Consumer sentiment is at its lowest level since 2011.

At the same time, the report showed that inflation expectations rose sharply. Consumers expect inflation to rise to 5.4% for the year. This figure is significantly higher than the previous figure of 4.9%. At this time, inflation is at its highest level in 40 years.

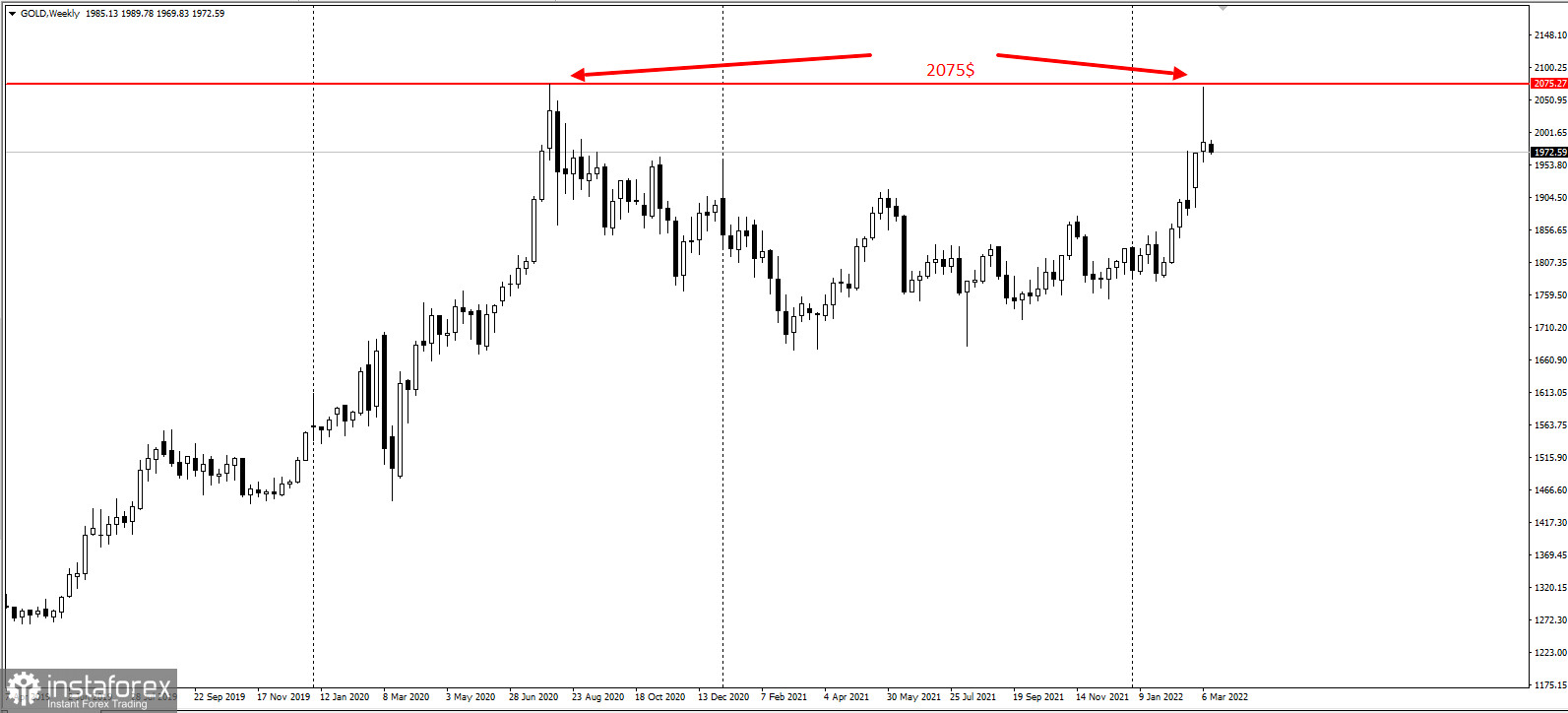

However, the gold market is not seeing much of a reaction to the latest data for the month as prices remain under strong selling pressure, dropping below $2,000 an ounce. April gold futures traded at $1,983.70 an ounce on Friday, down 0.83% on the day. The previous week failed to rewrite the 21-year high of $2,075.

While short-term inflation expectations continue to rise, the report notes that long-term forecasts remain unchanged. Also, according to the report, consumers expect inflation to fall to 3% in five years.

Andrew Hunter, senior U.S. economist at Capital Economics, said that given the ongoing geopolitical tensions in Ukraine that are pushing commodity prices, especially oil and gasoline, higher, it is not surprising that the latest consumer sentiment data is disappointing.