In today's article on the pound/dollar currency pair, we will focus on technical analysis. However, before that, we will remember what had the greatest impact on the results of the last five-day trading week, and we will also designate the main events of this week for GBP/USD.

So, as expected in the last article on the GBP/USD pair, after the passing meeting of the European Central Bank (ECB), which provoked a decline in the single European currency, the British pound sterling followed the euro in a southerly direction. In addition, do not forget about two other very important factors. First, Russia's military special operations in Ukraine are forcing investors to run away from risks and look for safe-havens. But it is precisely such a haven in the current conditions that the US dollar is. Second, following the results of its two-day meeting to be held this week, the US Federal Reserve System (FRS) is likely to hold the first increase in the main interest rate since the beginning of the COVID-19 pandemic, followed by "hawkish" signals from Jerome Powell, who will hold a press conference.

According to expectations, the Fed will raise the rate by 25 basis points. In this case, the growth of the US dollar will be somewhat restrained, since this is already embedded in the pricing of the US currency. However, it cannot be ruled out that the Fed will raise the rate by 50 bps at once. If this happens, we should expect rapid and strong growth of the US dollar against all its main competitors. Naturally, a lot will depend on the degree of Jerome Powell's "hawkish" statements. Without any doubt, Wednesday, when the above events will occur, will be the most important day at the auction of the current five-day period. And it's time for us to look at and analyze the price charts. Since weekly trading closed on Friday, we will start with this time interval.

Weekly

As you can see, unlike the euro/dollar pair, GBP/USD showed a much stronger downward movement. The pound/dollar pair confidently and powerfully broke through the important and strong support at 1.3168, after which it continued to move along the southern route towards the important psychological level of 1.3000. The quote did not reach this landmark a little, showing the minimum values at 1.3026. Nevertheless, given the technical picture and the upcoming events related to the Fed, one could assume a subsequent depreciation, if not for one "but". The fact is that following the Fed this Thursday, the Bank of England will make its decision on rates. As expected, the English regulator may once again raise the main interest rate, and also by 25 bps. This is already getting quite interesting. I assume that the actual steps of both Central Banks, their rhetoric, and, most importantly, the reaction of market participants to all this will have a huge impact on the price dynamics of GBP/USD. In this regard, I would refrain from unambiguous conclusions regarding positioning for the time being.

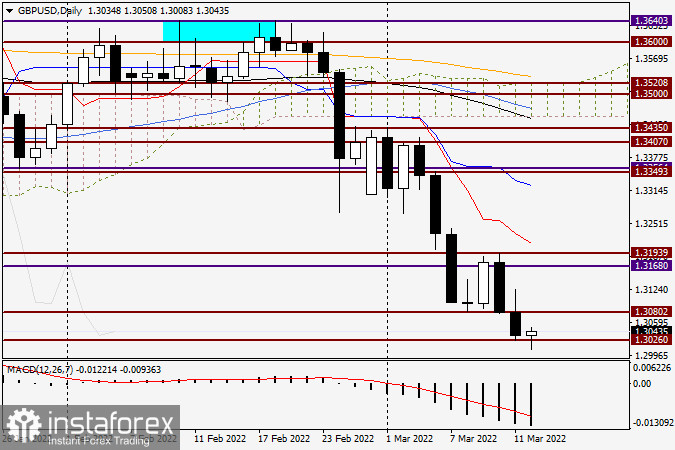

Daily

But in terms of technology, of course, the continuation of the decline in GBP/USD looks more relevant. As you can see, the market did not fully work out the highlighted reversal model of candle analysis from March 8. After the first day of growth, the sentiment for the pair regained a bright bearish hue, the reversal model was broken, and the support at 1.3080 was confidently broken. Returning to the trading recommendations for GBP/USD, I would like to emphasize once again that the decisions and rhetoric of the Fed and the Bank of England will have a huge impact on the price dynamics of the pair. In this regard, for the time being, I suggest not to rush to open new positions. If we focus purely on the technical component, in tomorrow's article we will analyze smaller timeframes and try to find acceptable options for opening positions on them.