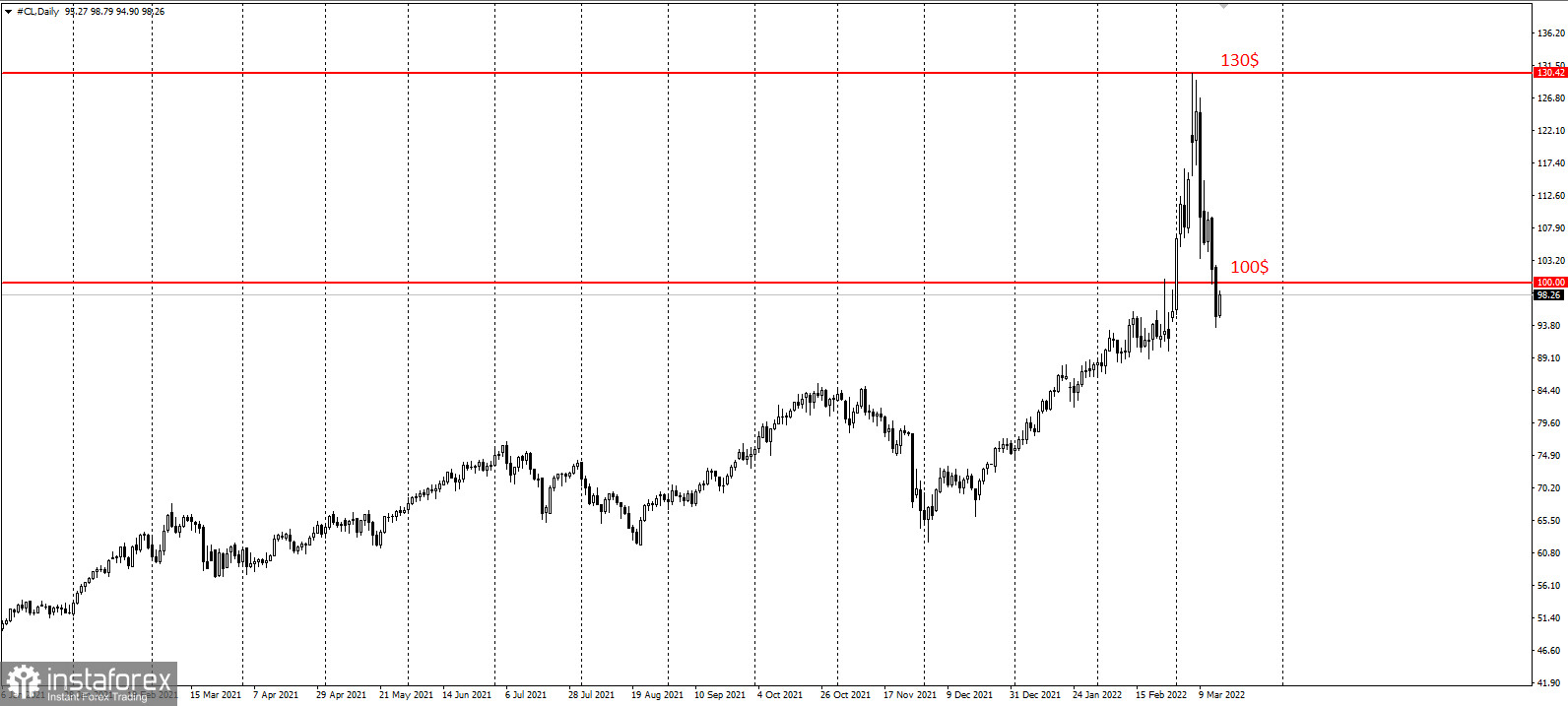

The meeting of leading financial leaders in China showed that the nation will ensure an active monetary policy and will seek to manage the risks associated with the real estate sector. But stocks in both China and Hong Kong came under pressure, losing $1.5 trillion in the first two days of this week. WTI also lost most of its gains and is trading below $100 a barrel, weighed down by Covid lockdowns in the country, which poses a threat to hydrocarbon demand.

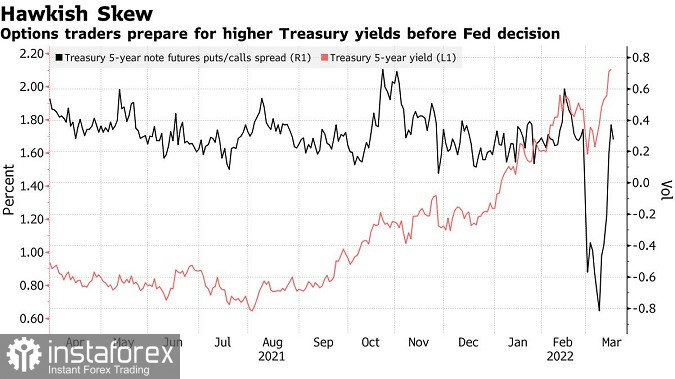

The yield on 10-year US Treasuries hit 2.15% ahead of the Fed's decision on Wednesday.

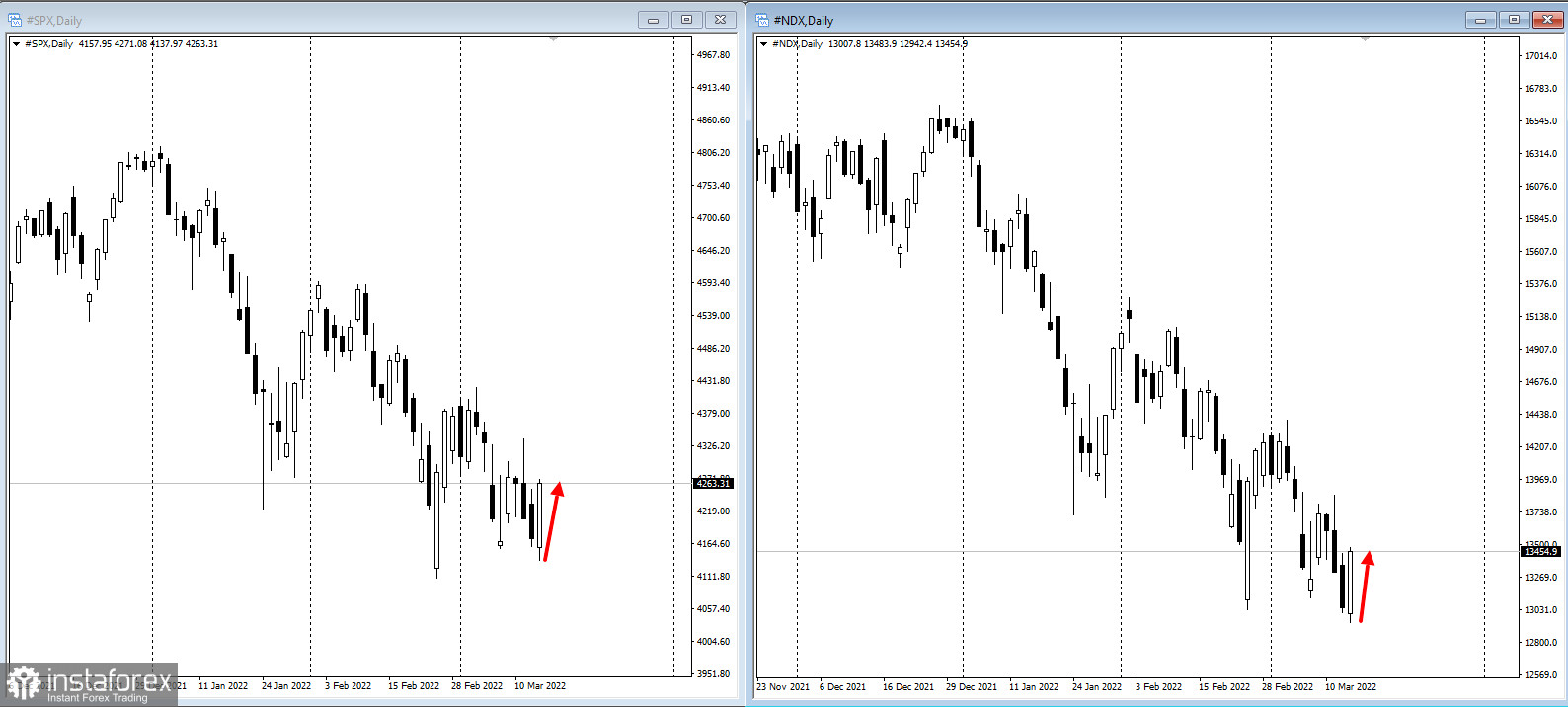

Many expect the US central bank to raise a quarter-point rate tonight, the first since 2018, to combat high inflation. They also anticipate a total of seven such moves this year, all while considering a potential persistent increase in inflation.

At the moment, PPI in the US is at 10%, underscoring inflationary pressures. Manufacturing activity in New York also weakened significantly in early March, pointing to the Fed's dilemma.

Other key events for this week are:

- EIA crude oil inventory report (Wednesday);

- FOMC rate decision and press conference by Fed Chairman Jerome Powell (Wednesday)

- Bank of England rate decision (Thursday);

- speech of ECB members Christine Lagarde, Isabelle Schnabel, Ignazio Visco and Philip Lane (Thursday)

- Bank of Japan rate decision (Friday).