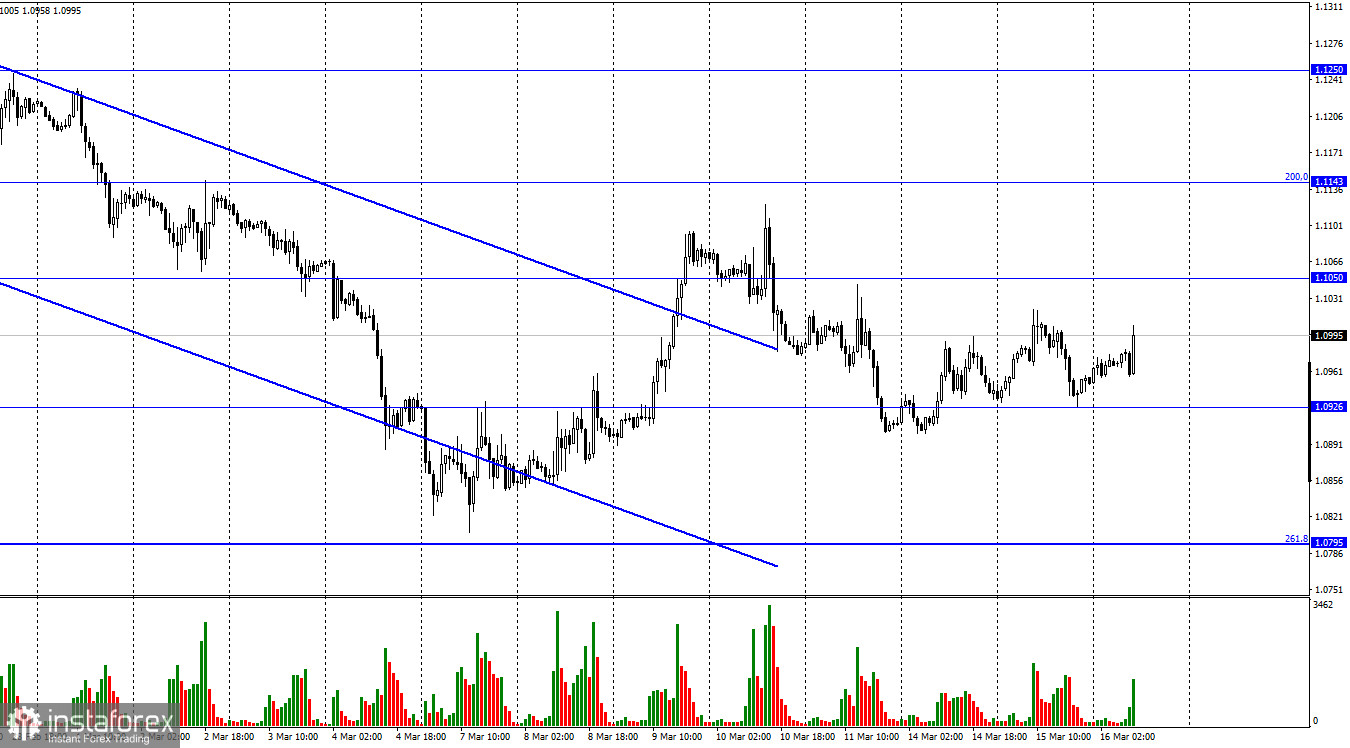

On Tuesday, the EUR/USD pair performed an increase first, and then a fall to the level of 1.0926. The rebound of quotes from this level worked in favor of the European currency and the resumption of growth towards the level of 1.1050, however, in general, I would like to draw readers' attention to the fact that the movement has weakened in recent days. But it remains strong. Here is such a paradox. Yesterday, the pair went first 100 points up, and then 100 points down. That is, according to all the canons of technical analysis, such a movement should be considered strong. However, if you look at the movements of the pair over the past few weeks, the absence of a strong trend is striking. At the moment, bull traders are trying to seize the initiative, but so far they cannot take the pair away from the lows zone. Yesterday's information background had almost no effect on the mood of traders. Reports on the mood in the EU business environment and industrial production did not cause any emotions among traders. Christine Lagarde's evening speech did not give any new information.

And today, during the day, there will be no interesting events in Europe at all. In the evening, the results of the Fed meeting will be summed up, but during the day traders will be deprived of information support. However, in any case, they are not eager to work out statistical information right now. Thus, today it all comes down to the evening results of the Fed meeting. No one doubts that the rate will be increased by 0.25% and any other decision of the regulator may cause a violent reaction of traders. It will also be very interesting to hear what Fed President Jerome Powell has to say at the press conference. Let me remind you that traders are now very interested in the question of how many times the rate will be raised in 2022 and how the military conflict in Ukraine will affect the American economy and monetary policy. Jerome Powell will be called upon to answer these questions, but, most likely, he will again take the most cautious position and refrain from harsh comments.

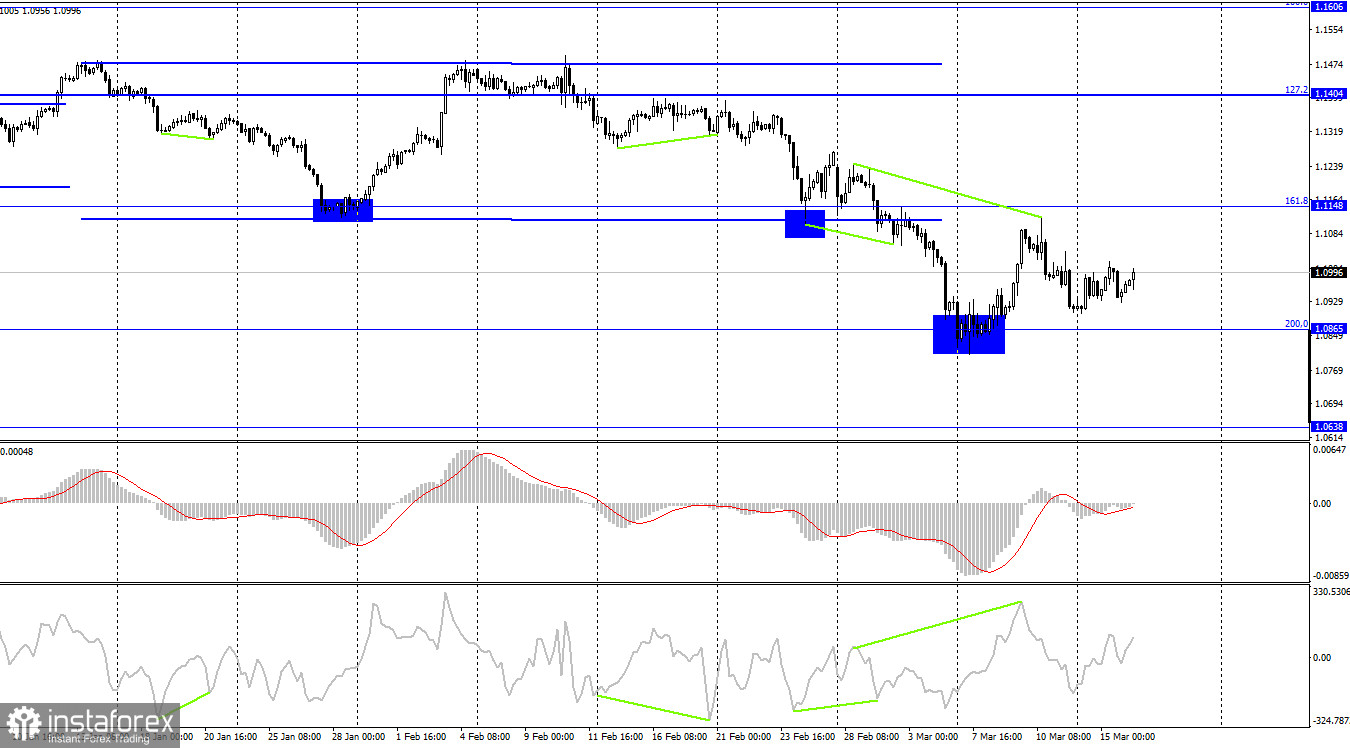

On the 4-hour chart, the pair performed a reversal in favor of the US dollar after the formation of a bearish divergence at the CCI indicator and may continue the process of falling towards the corrective level of 200.0% (1.0865). A rebound from this level will work in favor of the EU currency, but it is more likely to close below this level and a further drop in quotes in the direction of the 1.0638 level.

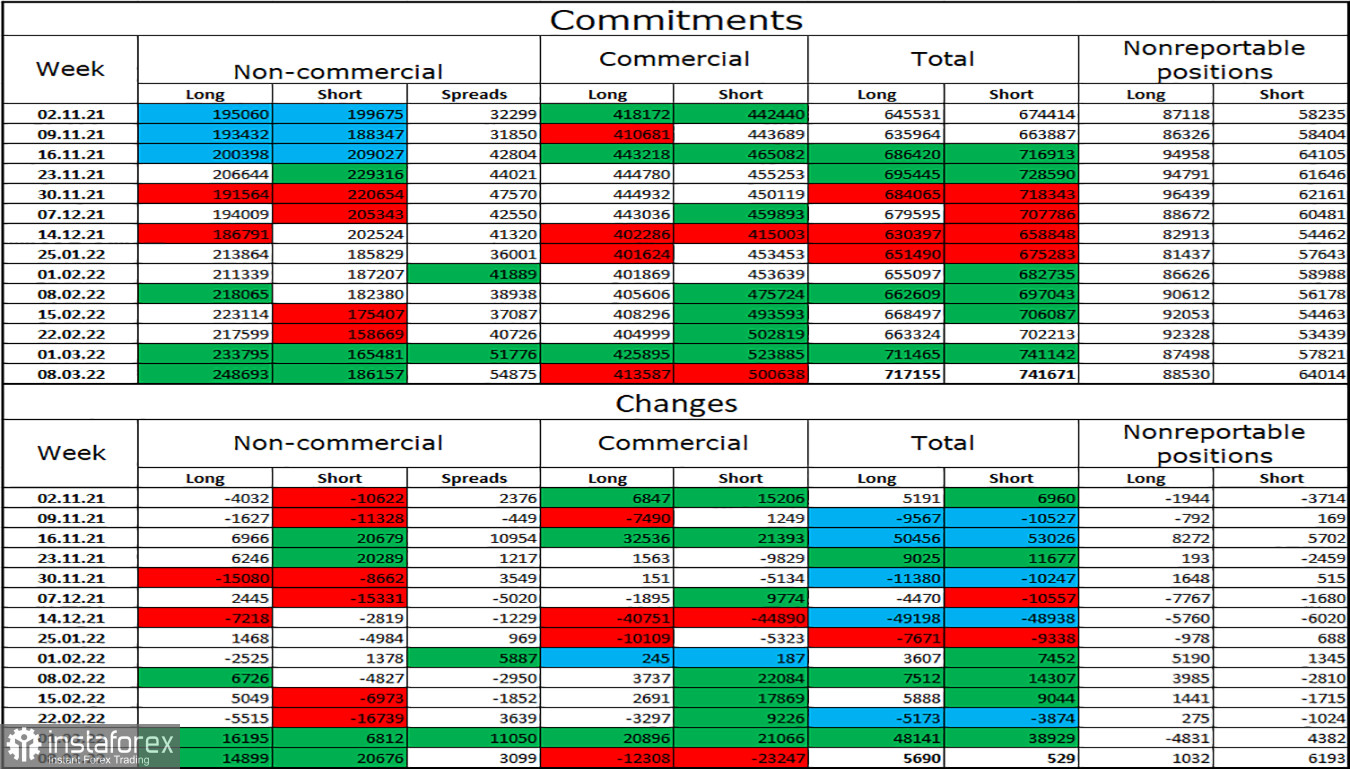

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 14,899 long contracts and 20,676 short contracts. This means that the bullish mood of the major players has become weaker. The total number of long contracts concentrated on their hands now amounts to 248 thousand, and short contracts - 186 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish" and is strong. This would give an excellent opportunity for the European currency to count on growth, if not for the information background, which now supports only the American currency. We are now witnessing a paradoxical situation: the bullish mood of major players is increasing (if you look at it for several months), while the currency itself is falling. And it falls quite heavily. Thus, geopolitics is now a priority.

News calendar for the USA and the European Union:

US - change in retail trade volume (12:30 UTC).

US - FOMC decision on the main interest rate (18:00 UTC).

US - accompanying FOMC statement (18:00 UTC).

US - FOMC press conference (18:30 UTC).

On March 16, the calendar of economic events of the European Union is empty, and in the USA all attention will be paid to the results of the FOMC meeting. There will be another report on retail trade, but it is unlikely that traders will donate enough attention to it so that it will affect the movement of the euro-dollar pair.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair if the pair performs a rebound from the 1.1050 level on the hourly chart, with targets of 1.0926 and 1.0865. I do not recommend buying a pair, as the probability of a new fall in the euro currency is too high. Tonight and tomorrow during the day, much will depend on the results that the Fed will announce today.