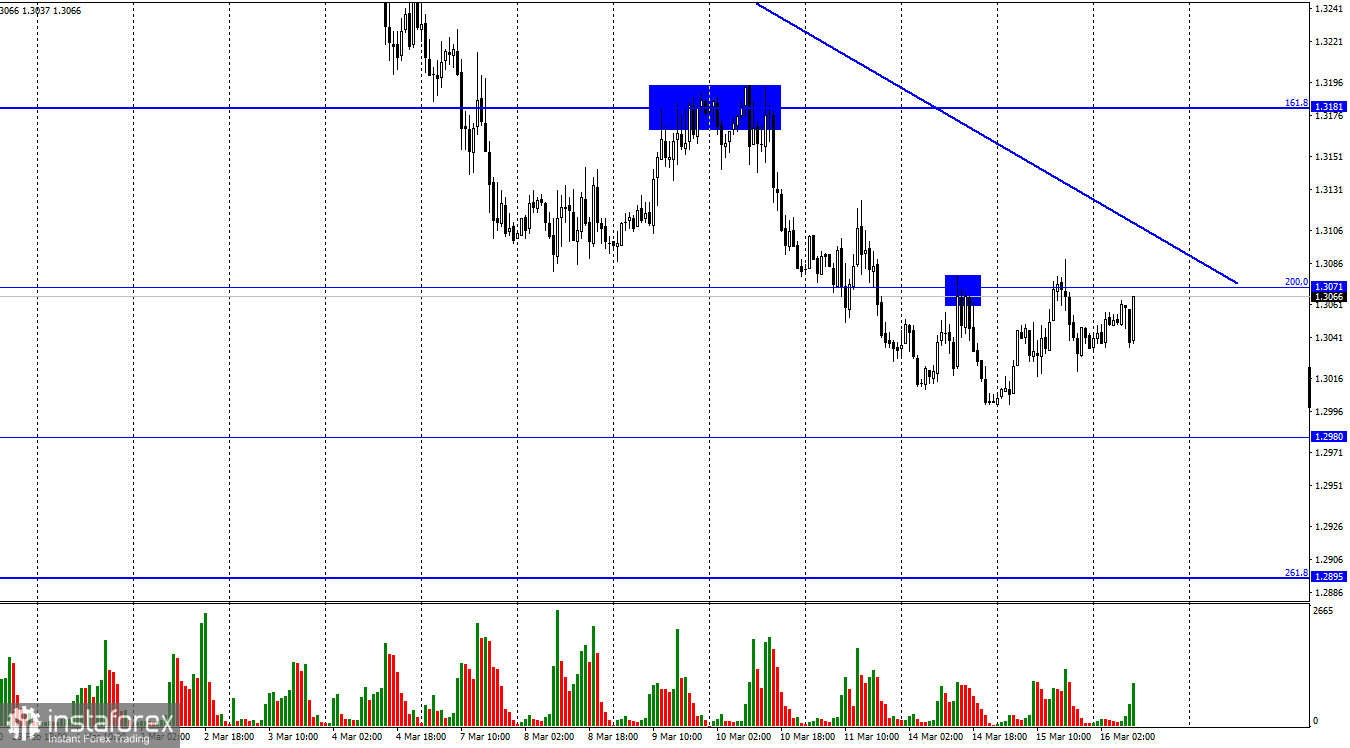

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the British on Tuesday and rose to the corrective level of 200.0% (1.3071). The rebound of quotes from this level yesterday led to a slight drop in quotes, but this morning the pair made a return to it. The descending trend line is very close, and if the Fed makes not quite the decisions that traders are counting on tonight, then the pair can consolidate above the trend line, which will mean a change of mood to bullish. However, it is not necessary to exclude the option of a new fall of the pair. In this case, the "bearish" mood of traders will remain. There has been little geopolitical news over the past day, but I still pay attention to the fact that the euro and the pound continue to be located quite low against the US currency.

I believe that this is evidence of the continuing tension of traders. The euro and the pound have fallen in recent weeks due to the military operation in Ukraine, as the demand for risky assets and currencies has sharply decreased, while the dollar has grown. And now, when the dollar is still trading very high in pairs with the euro and the pound, we can conclude that the mood of traders has not changed with regard to geopolitics. However, today and tomorrow, the current graphic picture may seriously change. Do not forget that very often after a meeting of the central bank (any), unambiguous movement of the pair in a particular direction is not observed. The pair can go 100 points up, and then fall by the same amount in a few hours. In this case, it will not even be possible to say exactly how the traders interpreted the results of the meeting. At best, the movement will be in one direction, but now, I don't even know exactly what decision the Fed will make on Wednesday and the Bank of England on Thursday, it is simply impossible to predict exactly how the pound-dollar pair will move in the coming days. You need to be ready for any scenario.

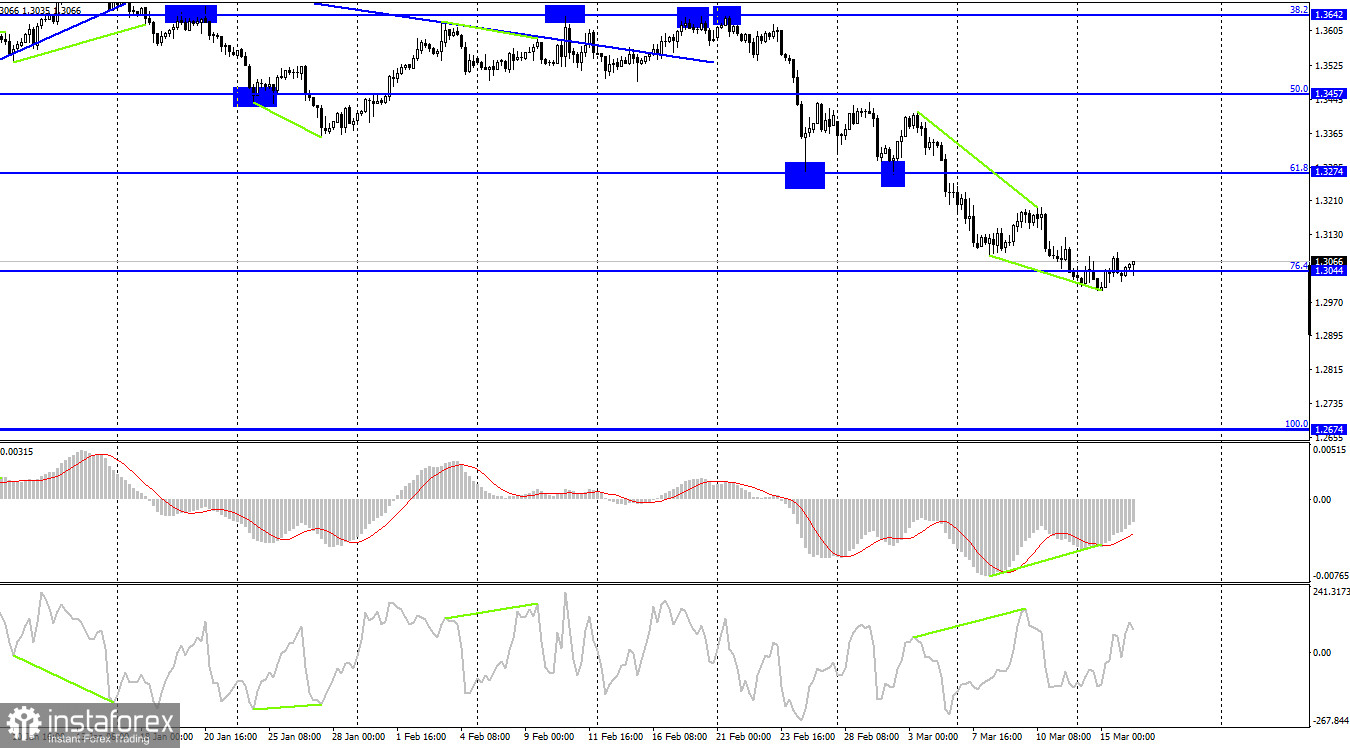

On the 4-hour chart, the pair performed a reversal in favor of the British currency after the formation of a bullish divergence at the MACD indicator. It was also closed above the corrective level of 76.4% (1.3044), which allows us to count on continued growth in the direction of the Fibo level of 61.8% (1.3274). However, as I have already said, today and tomorrow the graphic picture fades into the background. The pair can easily resume falling, despite either bullish divergence or closing above 1.3044.

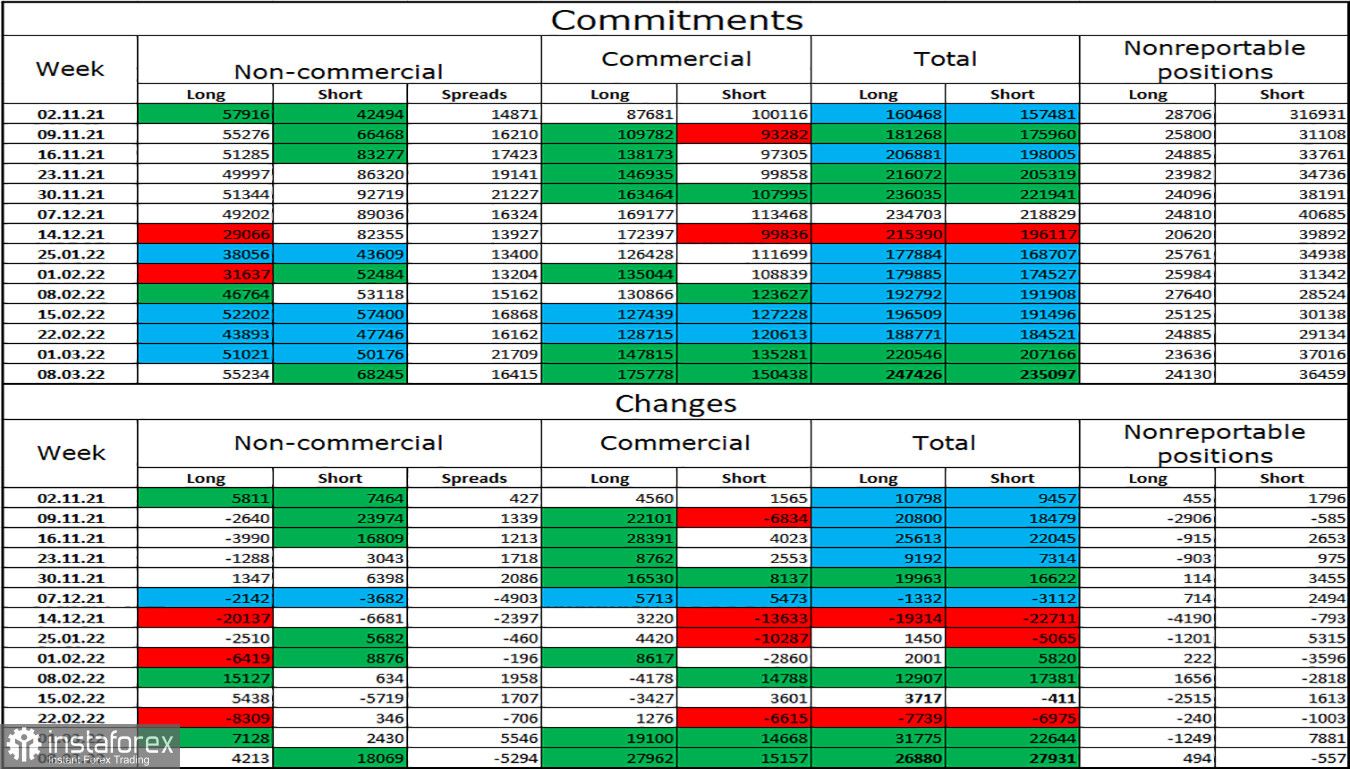

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts increased in the hands of speculators by 4,213, and the number of short contracts increased by 18,069. Thus, the general mood of the major players has become more "bearish", and the number of short contracts has increased significantly. Thus, everything is in order now, and the ratio between long and short contracts for speculators corresponds to the real state of things. The British dollar is falling, and the big players are selling the pound more than buying it. Nevertheless, I draw the attention of traders to the fact that the mood of major players changes too often and too sharply, and the British dollar has been falling for quite a long time.

News calendar for the USA and the UK:

US - change in retail trade volume (12:30 UTC).

US - FOMC decision on the main interest rate (18:00 UTC).

US - accompanying FOMC Statement (18:00 UTC).

US - FOMC press conference (18:30 UTC).

On Wednesday, the calendar of economic events in the UK is empty. In the USA, a retail trade report will be released during the day, and in the evening - the results of the FOMC meeting. I believe that until the evening traders will lie low and will not make sudden movements in the market.

GBP/USD forecast and recommendations to traders:

I recommended new sales of the British at the close under the level of 1.3044 with targets of 1.2980 and 1.2895, but now we also need to wait for the cancellation of the bullish divergence of the MACD indicator. You can also sell at the rebound from the 1.3071 level on the hourly chart or at the rebound from the trend line. I advise buying the British when closing above the trend line on the hourly chart with a target of 1.3181.