Gold lost as much as $71 over the past two days. It hit its lowest price in three weeks, after soaring to a record high last week. All in all, it fell more than $150.

There were many reasons why gold went through a sell-off. The main one is the March Fed meeting, where a rate hike could be decided. Many expect the central bank to raise rates because inflation is still at its highest level in 40 years. Also, the Fed already began to tighten its monetary policy, reducing monthly bond purchases. Prior to the tapering process, it was buying $120 billion every month. $80 billion of which is US bonds, while $40 billion is mortgage-backed securities. The reduction process is due to be completed this month and was a necessary step before the start of the normalization of the interest rate.

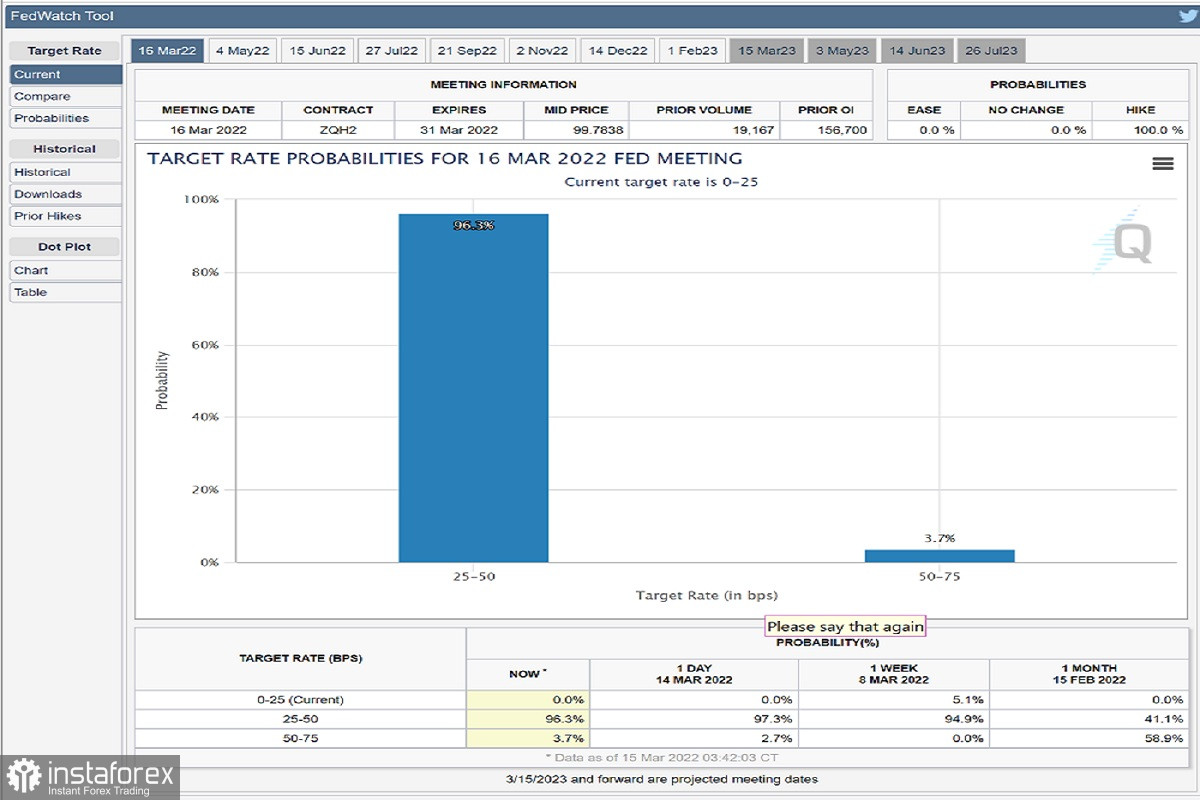

According to the CME FedWatch tool, there is a 96.3% chance that the Fed will raise rates by 25 basis points. This is a slight decrease from yesterday's 98.3% probability as market sentiment has made it more likely that the Fed will be more aggressive and raise rates by 50 basis points.

The FedWatch tool currently forecasts a 3.7% chance that the Federal Reserve will announce a more aggressive interest rate hike.

Geopolitical tensions continue in Ukraine, but there is hope that the current talks will lead to a ceasefire.

Going back to inflation, the latest wholesale price report showed an increase of 0.8% in February, which is below the expectations of economists. Oil prices also fell, closing below $100.