EUR/USD is still challenging the level of 1.10, taking advantage of the soft US dollar. Nevertheless, the price retreats to 1.09 whenever traders try to test 1.1000. They have lots of attempts to break that level.

The key resistance level is still hard nut to crack for the buyers of EUR/USD despite price bounces. It is important not only to pass that level but also to settle above. It is a tough challenge because traders don't dare to climb higher. They prefer to take profit at around 1.10, putting pressure on the currency pair. It is currently facing two opposite forces. On the one hand, the US dollar is weighed down by some optimism about a peaceful solution to the Russia – Ukraine talks. On the other hand, the euro is facing risks of stagflation. For the time being, traders are poised to buy EUR/USD amid the soft greenback. The Federal Reserve's verdict on monetary policy that is on tap later today are sure to clear up market sentiment. It is risky to trade currency pairs with the US dollar against such a controversial fundamental background that obscures a trajectory of currency pairs in the short term.

At the moment, we can only say with confidence that traders will not downplay the policy meeting of the Fed, although market participants take no notice of all other fundamental factors (macroeconomic reports, comments by ECB representatives, COVID-reports). The focus is on geopolitics. The relevant news background sets the tone for trading, outweighing out all other fundamental signals. And yet, the Fed stands apart here. The results of the March meeting will definitely spark off high volatility. In favor of the dollar or against it is an open question.

A 25-point interest rate hike will not come as a bombshell. This fact was priced in by market participants long ago, so the focus will be on the rhetoric of the accompanying statement and the rhetoric of the Fed Chairman, Jerome Powell, who will hold a traditional press conference. The main intrigue is how fast the Fed will tighten monetary policy this year. In a broader aspect, this question sounds somewhat different: will the regulator focus on fighting inflation, or will it be concerned about the risks of economic growth in the light of recent events?

Most experts are inclined to the first option: economists expect the Fed to not only raise the rate by 25 basis points today, but also signal an additional tightening by 90 points within the current year (updating the dot plot). Jerome Powell may also drop a hint that the regulator is ready to raise the rate at one of the meetings by 50 points at a time (such a move is not excluded at the March meeting, but it is unlikely.) Also, the Fed leader can make it clear that the regulator is ready to start the so-called "quantitative tightening" as early as May of this year.

Other analysts say that Powell will be very cautious today in his forecasts against the backdrop of events unfolding in Ukraine and the risks associated with them for the global economy. According to some experts, the Fed will not "wave the sword" of aggressive monetary tightening due to mounting geopolitical risks and lower economic growth forecasts. The Fed Chair may point to a potential decline in consumer demand due to soaring energy prices and the downtrend in the stock market and capital markets. In addition, according to the results of the March meeting, the forecasts for economic growth and unemployment may be revised downwards, but the forecast of the core consumer price index will suggest further growth.

In my opinion, the Fed is unlikely to be too aggressive today. The regulator will no doubt raise the rate by 25 basis points and declare further increases, but without any hawkish distortions (such as announcing a 50-point increase). It is likely that the implementation of such a cautious scenario will put pressure on the US dollar, which is kept afloat not only due to risk-off sentiment, but also due to hawkish expectations.

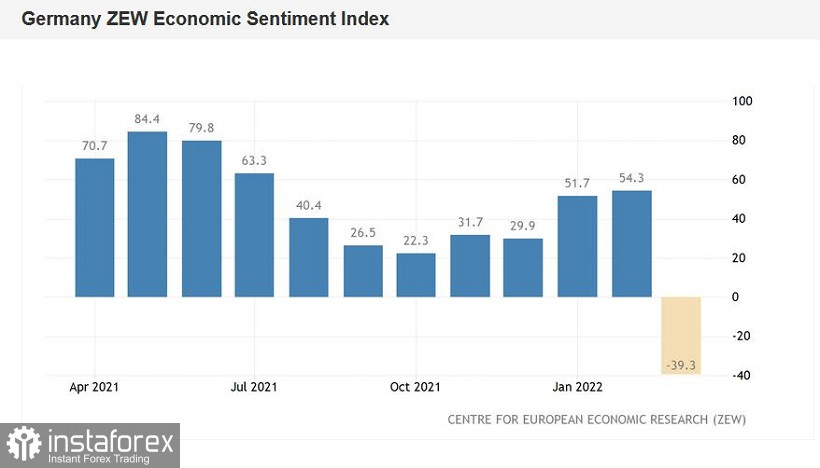

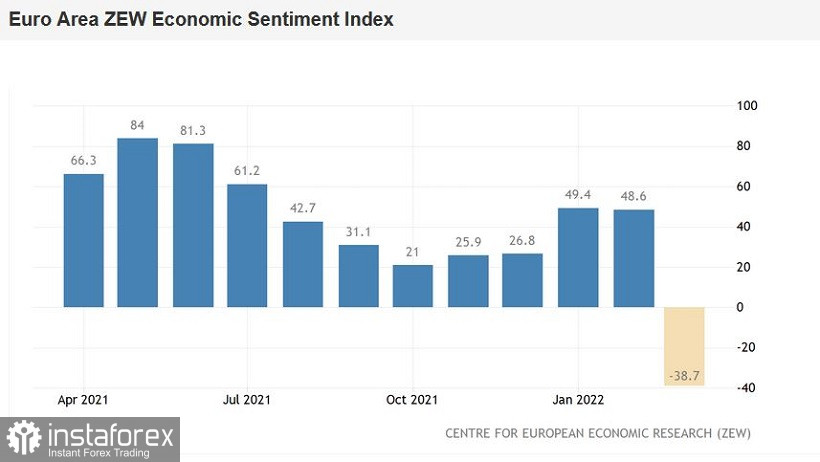

However, even if the greenback weakens, it is doesn't make sense to count on a trend reversal for EUR/USD, given the vulnerability of the single currency. Yesterday's reports from the ZEW Institute reflected the extremely pessimistic mood of the European business environment. Thus, the German business sentiment index fell from 54 points to -39 points (against the forecast of a decline to 5 points). The pan-European ZEW index showed similar dynamics (decrease from 48 to -38 points). A vivid illustration of the latest trends was today's news that BMW and Volkswagen are shutting down several of their factories in Europe due to a shortage of spare parts.

In general, the European currency is under strong fundamental pressure, due to the poor key macroeconomic indicators, the risk of stagflation and the dovish stance of the ECB.

Therefore, it would better to refrain from trading EUR/USD in the short term. However, short positions would be reasonable in the medium term amid the growing divergence between the Fed and the ECB rhetoric. The first downward target is seen at 1.0900. The main target is defined at 0.0800 that matches the lower border of the Bollinger banks on the daily chart.