World politics is undergoing irreversible processes to redistribute zones of economic influence. This affects the fluctuations of many financial instruments and forces investors to seek new ways to protect capital. We have seen a timid and impulsive attempt by the market to turn to cryptocurrencies as protection against potential inflationary losses. But investors have opted for more traditional assets.

Nevertheless, investors significantly increased their interest in gold-backed stablecoins or the US dollar. This indicates that big capital is considering digital assets as a possible alternative to classic financial instruments. Lyn Alden, an investment strategist, expressed similar views. According to the expert, geopolitical tensions may accelerate the adoption of BTC as a reserve asset.

The geopolitical crisis greatly increases the demand for large capital and government funds in reserves. Russia has attempted to turn to cryptocurrencies, but this initiative was suppressed by European and US sanctions. However, the Russian case with the blocking of foreign exchange and gold reserves could make governments think about alternatives. Indeed, gold is a stable asset that retains value, but, like any modern financial instrument, it is centralized. That is why the US and Europe have had no problem blocking a large part of Russia's gold and forex reserves.

Bitcoin may become a safe-haven asset in such a situation. The main value of cryptocurrency will not be hedging risks, but its decentralized nature and minimal influence from the authorities. In other words, Bitcoin can be partially restricted, but it is impossible to completely freeze the asset. Thus, the current situation may force central banks and funds, which mostly rely on fiat money or gold, to diversify their reserve portfolios.

Lyn Alden says many hedge funds use company stocks or government funds to supplement the reserve. With Bitcoin's liquidity increasing as it becomes more popular, investing in cryptocurrencies in reserve funds will have the dual benefit of protecting capital and increasing it, as well as the relative independence and decentralization of some reserve assets.

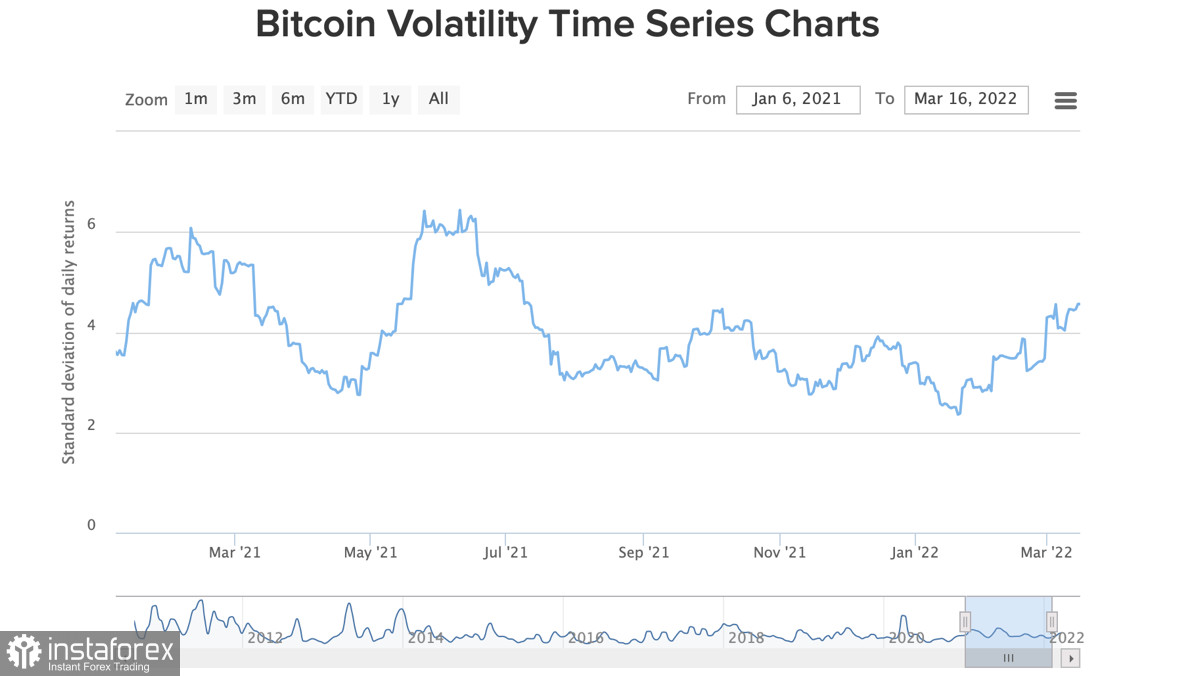

Meanwhile, Bitcoin finally lost its bullish momentum, touching $41,700 and dropping to $40,200. Technical indicators show that the bullish momentum has been choked. The RSI began to move in a flat bullish zone, while the stochastic oscillator maintains upward momentum without any hint to the growth of quotations. This situation is likely triggered by rising volatility ahead of the Fed meeting.

The BTC/USD pair is expected to break out of the current trading range, and taking into account the stable bearish positions around $42,000, as well as the key rate hike, the pair is likely to break through the lower boundary of this range. However, this drop is limited by the local bottom around $34,500, after which the adaptation to the new conditions and accumulation of volumes will begin.