So, at the end of yesterday's meeting, the Bank of England met market expectations and increased its key interest rate by 25 basis points, from 0.5% to 0.75%. As this decision was already reflected in the price of the British pound sterling, the market reaction to this event was very peculiar. So why did sterling ignore the Bank of England's decision and not show growth? Let's try to get to the bottom of that. Well, firstly, the BoE minutes show that not all members of the committee voted for the decision to raise the rate, but only eight out of nine. Secondly, the English central bank showed a very cautious tone regarding further tightening of its monetary policy.

The main focus was on elevated inflation. If it continues, the Bank of England will consider a further tightening of monetary policy. Thus, the English central bank is taking a wait-and-see attitude and will closely monitor inflation risks. At the same time the BoE believes that inflationary pressures globally will be on the rise in the near future. It would seem to be a mismatch and with such expectations the Bank of England should have taken a more hawkish stance and given the markets a clear signal for a further interest rate hike. However, this did not happen and, in my personal opinion, this factor prevented the pound from showing a strengthening against the US dollar in yesterday's trading. Let's have a look at the daily chart.

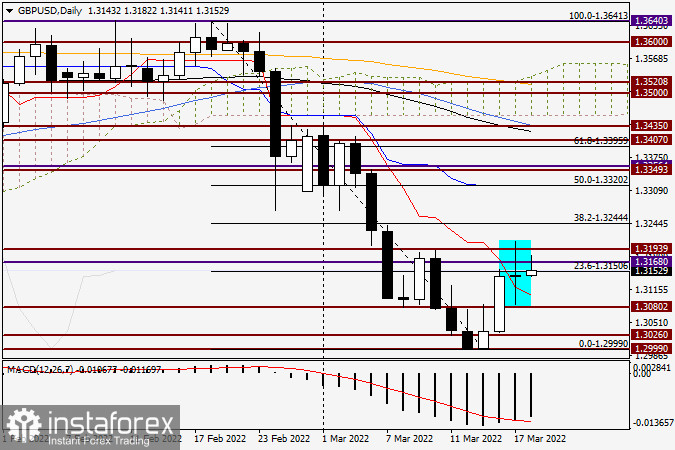

Daily

As a result of ambiguous comments from the Bank of England in yesterday's trading, the GBP/USD pair showed decent volatility. As a result, the daily chart showed a candlestick without body with rather long shadows. Attempts to break through the strong resistance zone 1.3168-1.3193 were unsuccessful, as well as the testing of the strong technical level 1.3200, mentioned in the previous articles about this instrument. The pair tried again to pass the price area of 1.3168-1.3193, but after reaching 1.3182, the bullish candlestick started to fade. This suggests that the bulls on the pound are not in the best shape and they do not have enough strength to fulfill their functions.

However, their opponents are not at their best either, so the further price direction of GBP/USD is getting hazy in my opinion. The nearest landmark for the upside players is 1.3200. If the pair manages to consolidate above this level, we should expect a continuation of the upward trend towards 1.3300-1.3320. In case of a decline under 1.3080, a bearish scenario is likely to take place. In any case, yesterday's highs at 1.3209 and lows at 1.3086 are the nearest landmarks for further rate direction. With this uncertainty and the fact that weekly trading ends today, I would not recommend to take any new positions in GBP/JPY just yet and wait for Monday, when the actual week's trading will be more accurate.