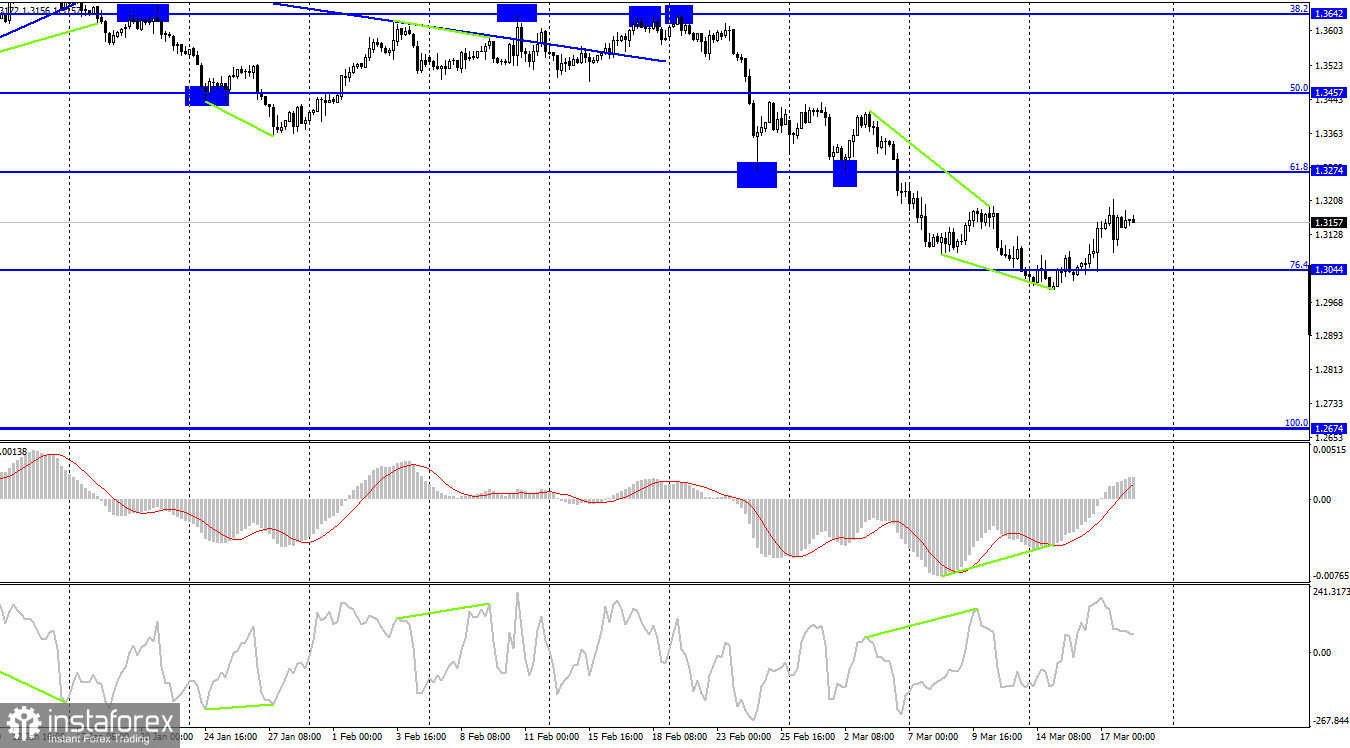

According to the hourly chart, the GBP/USD pair performed an increase to the Fibo level of 161.8% (1.3181) yesterday, rebound from it, a strong drop, and then return to the level of 161.8%. Tonight, the quotes have already completed the third rebound from this level, a new reversal in favor of the US currency, and began to fall towards the corrective level of 200.0% (1.3071). Thus, the British showed growth exactly before the Bank of England's decision to raise the rate by 0.25% and exactly after this event. During this event, it was falling, which looks very strange, since many were counting on a backlash from traders. Therefore, yesterday's movements are very difficult to analyze. At the moment, it can be concluded that traders have "digested" all the information received on Wednesday and Thursday and are now ready to trade more calmly. Since the level of 161.8% has not been overcome, I am inclined to believe that we will see a new drop in the British dollar in the very near future.

The problem of high inflation persists in the UK. In February, it was 5.5%, but the Bank of England expects the figure to rise to 8% in the second quarter. The regulator's press release clearly shows the reason for the rising prices: the military conflict in Ukraine, rising prices for energy and raw materials. In addition, the problems with supply chains around the world that arose two years ago due to the pandemic are getting worse. Thus, I do not yet see how inflation can begin to decline, whether it is the United States, Great Britain, or the European Union. The problems are the same everywhere. The risks to the economy are the same everywhere. The Bank of England and the Fed have started raising interest rates, but many experts believe that these measures will not have any positive effect at the early stages of tightening. Since the problem of rising prices is widespread, the pound or dollar do not have an advantage over each other due to inflation or monetary policy. But the British and the European are in a weaker position due to the military conflict in Ukraine, as the dollar usually grows in times of complex geopolitics.

On the 4-hour chart, the pair performed a reversal in favor of the British currency after the formation of a bullish divergence at the MACD indicator and continued the process of growth in the direction of the Fibo level of 61.8% (1.3274). The rebound of quotes from this level will allow us to expect a reversal in favor of the US currency and a slight drop in the direction of 1.3044. There are no new brewing divergences now.

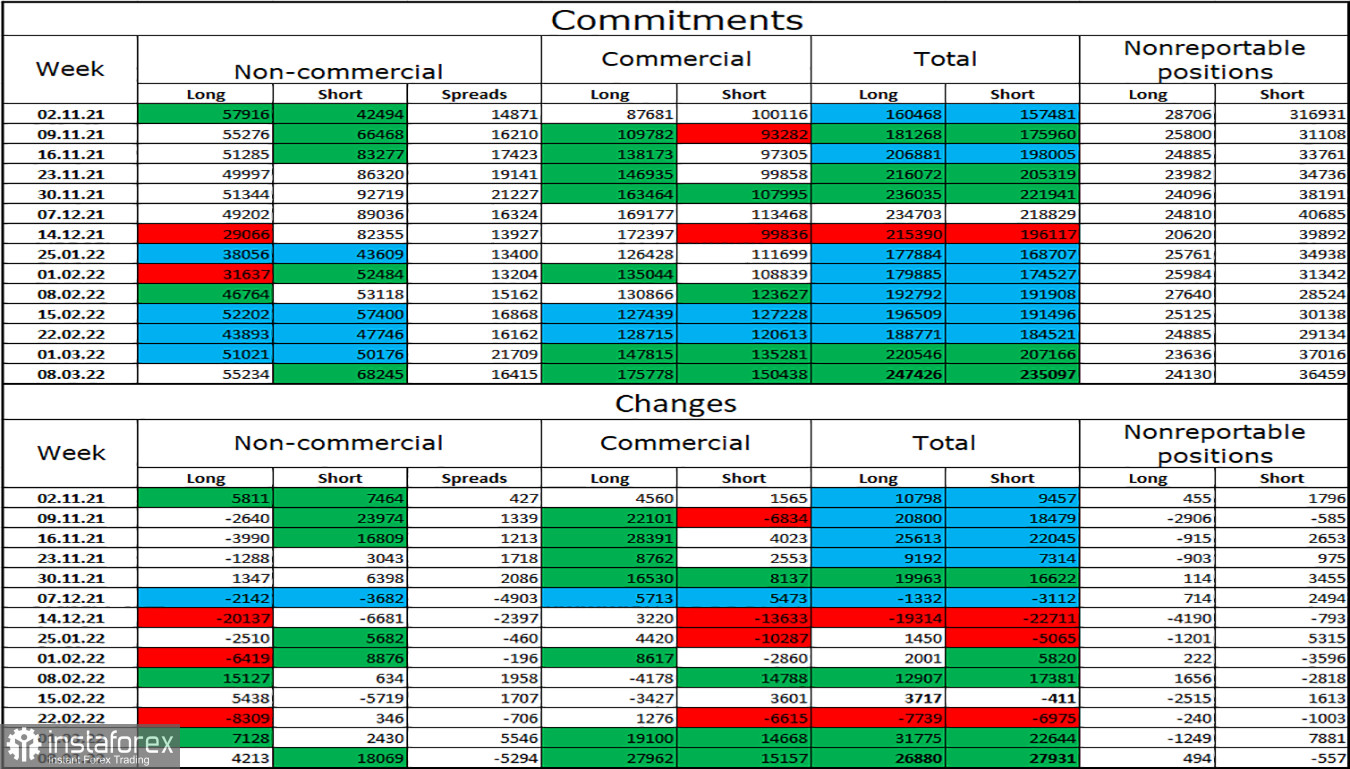

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts increased in the hands of speculators by 4213, and the number of short contracts increased by 18069. Thus, the general mood of the major players has become more "bearish", and the number of short-contracts has increased significantly. Thus, everything is in order now, and the ratio between long and short contracts for speculators corresponds to the real state of things. The British dollar is falling, and the big players are selling the pound more than buying it. Nevertheless, I draw the attention of traders to the fact that the mood of major players changes too often and too sharply, and the British dollar has been falling for quite a long time.

News calendar for the USA and the UK:

On Friday, the calendars of economic events in the US and the UK do not contain a single interesting entry. Thus, today the influence of the information background on the mood of traders will be completely absent.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the British when rebounding from the level of 1.3181 on the hourly chart with a target of 1.3071. I advised buying the British when closing above the trend line on the hourly chart with a target of 1.3181. Now this goal has been fulfilled. New purchases are above the level of 1.3181 with a target of 1.3279.