The cryptocurrency managed to make a marginal gain over the weekend and consolidate above $41k. Given the weekend's decline in institutional activity, Bitcoin's rise should be attributed to retail traders. The slight increase in BTC/USD over the weekend suggests that there is not much interest in the coin at this stage.

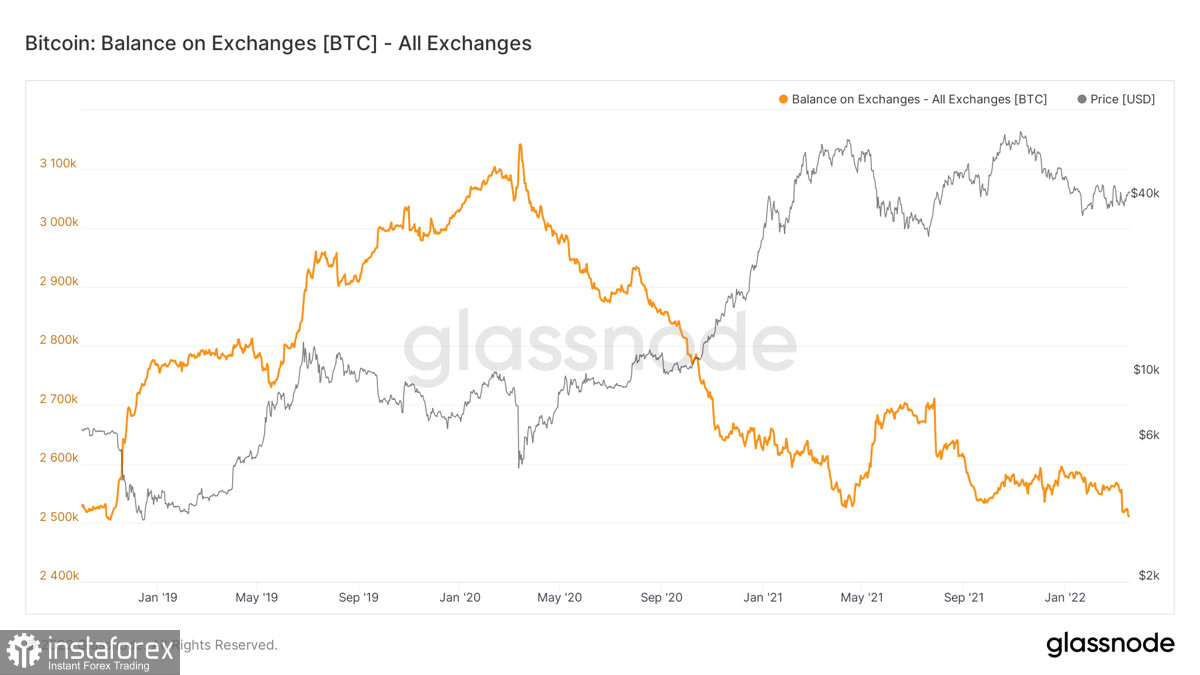

At the same time, the momentum of the main cryptocurrency accumulation has been maintained. BTC volumes on cryptocurrency exchanges have reached a three-year low. One of the reasons for the active hoarding phase could be sanctions against the Russian Federation. Most crypto transfers are to non-custodial wallets, giving users greater security guarantees and direct access to their capital. In any case, this reason should be seen as a precautionary measure rather than preparation for a likely price rally.

Another likely reason for the minimal supply on exchanges could be a change in investment strategy by institutional players. With harsh economic sanctions and a key rate hike, Bitcoin is becoming an important liquidity-preserving and multiplying tool, along with gold. With the gradual emergence of a legal framework, Bitcoin will become increasingly in demand in the new tight macroeconomic environment.

However, it is important to understand that the current accumulation period has nothing to do with preparing for a bullish cryptocurrency price rally, as has happened in the past. At this stage, the market is not yet ready for a full-fledged uptrend, as the overall high volatility conditions do not guarantee profits from a high-risk asset like BTC. Only five days have passed since the Fed meeting and the stock markets are in for another capital redistribution. Bitcoin investment flows are likely to increase slightly due to the Fed's soft policy. However, an uptrend above $50k should not be considered in the current environment.

As of March 21, the cryptocurrency is in a prolonged sideways movement with a full balance of bullish and bearish forces. The price continues to squeeze on both sides and a move out of this range is imminent. It should be noted that regardless of the triangle breakdown direction, the situation will not change dramatically. The stock remain in the $32k-$45k range, so we should not expect a prolonged bullish or bearish trend.

Considering the situation inside the $32k-$45k range, it should be noted that an upward break of the triangle would take the price to $45k. In case of a breakdown and a successful consolidation above this level, we can expect a move into the $46k-$58k range. However, given the high volume of sales in this area, such a breakdown looks unlikely.

On a downside move out of range, BTC/USD is likely to retest the local bottom around $32k. There is also the possibility of a drop below $30k, due to growing panic in the market. At the same time, below the round mark is the level of interest of major Bitcoin investors and hence there will be a fierce battle for $30k.