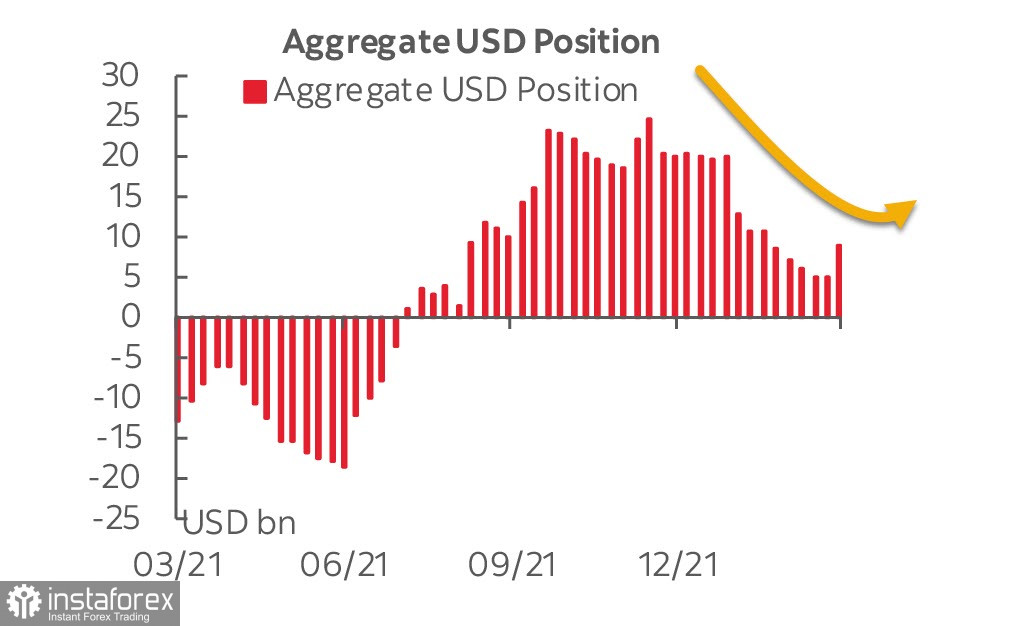

The cumulative long position on the dollar for the reporting week increased for the first time since January to 8.921 billion, the overbalance cannot be considered significant. However, we may be seeing a change in trend. It is too early to draw long-term conclusions, since it was not the growth in demand for the dollar that played the decisive role, but the decline in the euro, which lost 5.4 billion euros over the week.

It should also be noted that all commodity currencies added strongly, such as AUD, NZD, CAD, this may be a delayed reaction to the strong increase in oil in the previous week. Additionally, a factor contributing to the growth in demand for risk is a noticeable decrease in long positions in gold (-6 billion) and yen (-551 million).

The main reason for optimism, according to reviews of several banks, is "successful negotiations between Russia and Ukraine." This optimism seems clearly overstated.

On Friday, there were many speeches by Federal Reserve representatives. Governor Christopher Waller suggested that at one of the next meetings it is possible to raise the rate immediately by 0.5%, St. Luis Fed President James Bullard recommends focusing on 3% or higher by the end of the year, Richmond Fed President Thomas Barkin is ready to raise the rate at the next meeting by half a point, Minneapolis Fed President Neel Kashkari sees a target for a rate of 1.75-2% by the end of the year, but proposes to start reducing the Fed's balance sheet already at the May meeting. The Fed is sending extremely hawkish signals to the markets, apparently trying to attract investment capital to the U.S. markets. We will soon see how successful this plan will be.

The general trends for the coming week look like this. European currencies have suffered the most, which logically follows from the large-scale sanctions pressure on Russia, which cause noticeable damage to the economies of Europe, the dollar is expected to increase due to capital flight, and the demand for commodity currencies reflects primarily geopolitical risks due to rising commodity prices.

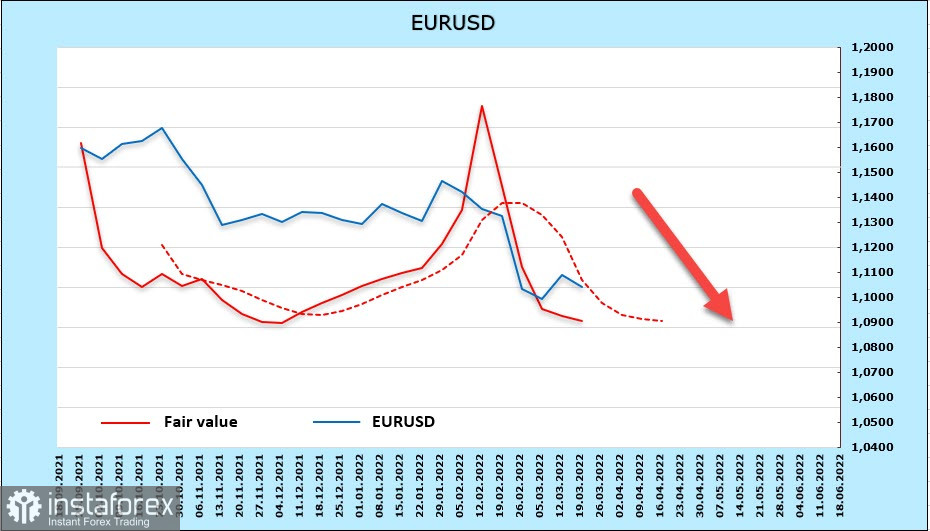

EURUSD

The eurozone still looks weaker than most other currency areas. With PMIs due Thursday, the euro area is expected to reflect a strong downturn, especially in manufacturing, due to fresh supply chain disruptions.

The ECB will obviously act much more slowly than the Fed, and the dynamics of the yield spread will be determined mainly by rising inflation. So far, there are no grounds to assume that the euro can find support for the resumption of growth.

The decrease in the long position on the euro for the week from +8 billion to +2.57 billion suggests that the bearish pressure on the EURUSD is still far from being exhausted. The estimated price is lower than the long-term average and is directed downwards.

We assume that after a short correction towards the middle of the bearish channel, the downward movement will resume. The target 1.0636, set a week earlier, remains relevant, there is a risk of growth to the upper border of the channel 1.1280/1320, followed by a turn downwards, but the chances of such a scenario are small.

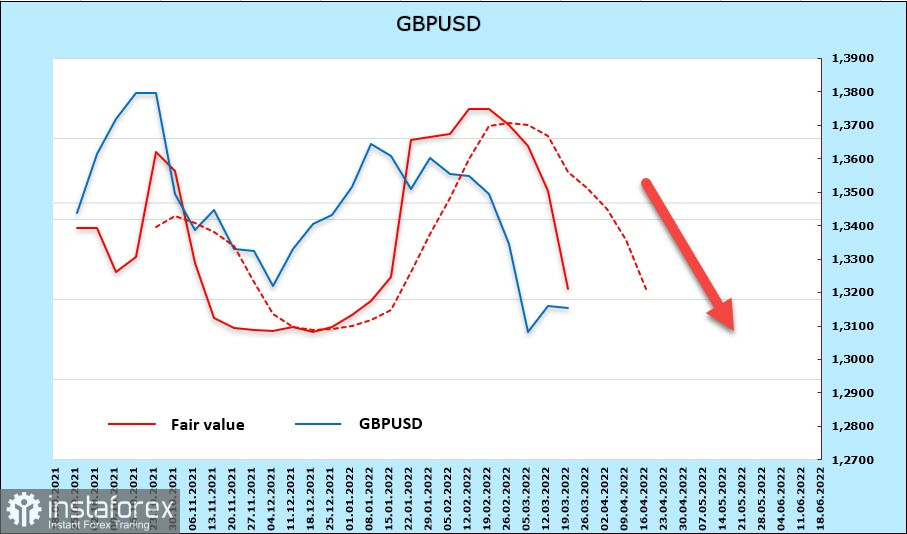

GBPUSD

The Bank of England expectedly raised the rate by 0.25% at the meeting on March 17, but gave the markets much more dovish signals than expected. None of the members of the Committee voted for a 0.5% increase in the rate, and there were such forecasts, moreover, one of the participants suggested leaving the rate unchanged. The accompanying statement is also made in cautious tones, one can single out such a signal as the possibility of a pause at the next meeting, which ultimately does not allow one to count on an outstripping growth of yields against the dollar.

While market expectations for BoE actions suggest 2 more increases this year, a maximum of 3, this means a rate increase to 1.25-1.50%. Inflationary expectations remain high and are roughly in line with those in the U.S., which ultimately gives reason to expect that the yield spread will widen in favor of the dollar. The key day to re-evaluate this conclusion could be Wednesday, on the publication of consumer and producer price indices.

The net short position on the pound increased during the week by 1.343 billion and reached -2.369 billion, the settlement price is confidently directed downwards, the chances of the GBPUSD reversal upwards are minimal.

The pound went up as part of a short correction to the middle of the channel, sales are justified from the current levels with the first target at 1.30 and then 1.2810/20, the stop is just above the local maximum of 1.3206.