The GBP/USD pair was in a difficult position

Hello, dear traders!

I think it is evident that raising the interest rate is positive for the national currency. Taking this aspect into account, the GBP/USD pair was in a difficult position last week as both the US Federal Reserve System and the Bank of England raised their key interest rates by 25 basis points. Investors did not reveal their preference until the close of the week's trading. However, pound bulls became dominant. At the end of trading on March 14-18, the GBP/USD pair rose and closed the week at 1.3173. A possible reason for this decision of the market participants was that the English central bank had reduced the volume of its assets purchases from 895 to 867 billion pounds apart from the interest rate raising. However, the Fed's stance is more hawkish. Notably, despite the Fed's tightening of its monetary policy and the beginning of raising interest rates, the past week was not favorable for the US dollar. The dollar declined across a wide range of markets.

Meanwhile, the UK energy sector faced a crisis, triggered by ever-increasing gas and oil prices. Energy companies are on the verge of bankruptcy as they do not have sufficient money to pay off their loans and all their costs. The embargo on Russian oil and gas hurts EU consumers and is the reason for soaring prices. The situation on the energy market was very complicated before the start of Russia's military operation in Ukraine. However, the imposition of sanctions on Russian oil and gas imports has worsened it. Therefore, now EU energy companies have no liquidity reserves and they are forced to ask their governments for assistance. Nevertheless, they have to stick to the US plans and block Russian oil and gas supplies. This situation is extremely complicated for all countries, leading to significant losses. Besides, it is advisable to start analyzing price charts of the GBP/USD pair with the results of the previous week.

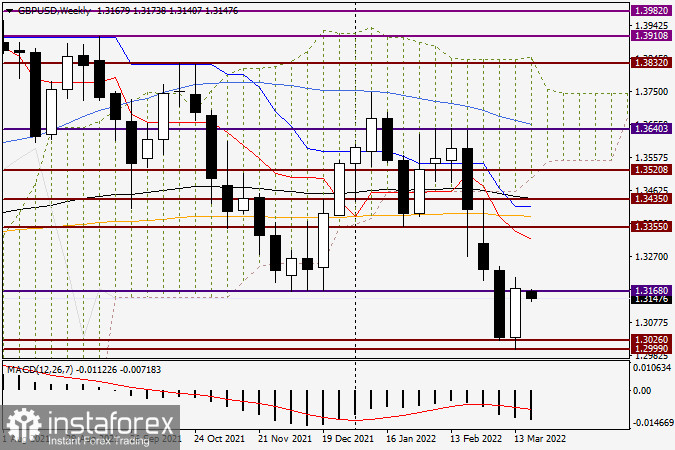

Weekly

As it was mentioned above, the pair was in an uptrend during last trading week. The trading on March 14-18 closed above the previously broken support level of 1.3168 due to the pair's growth. Currently, the breakout of this level can be considered false. As I indicated in some of my previous reviews, false breakouts often cause a reverse effect, i.e. in this case a false breakout of the support at 1.3168 can be a sign of the pair's further rise. Therefore, the price zone of 1.3340-1.3355 will be the target on the weekly chart. This area is technically strong. Moreover, there is also a red Tenkan line of the Ichimoku indicator and broken support at 1.3355. However, to reach the mentioned area, it is necessary to consolidate above the important and strong level of 1.3200. In the previous trading week, the pair hit highs at 1.3209. However, pound bulls failed to close the week above 1.3200.

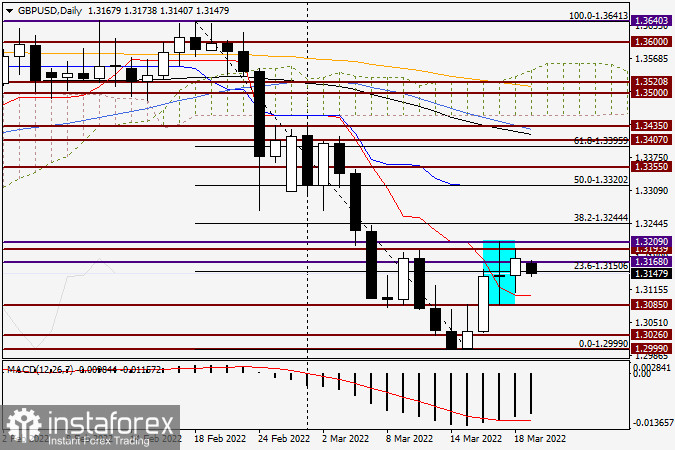

Daily

After reaching the marked candlestick from March 17, pound bears tried to dominate the trading. However, after decline to the daily Tenkan line, the pair found support there and reversed northward. Nevertheless, despite the pair reversed and finally rose on Friday, I believe the outcome of trading will be affected by the breakout of the resistance at 1.3209. In this case, it is necessary to pierce 1.3193 before the breakout of this level. Overall, pound bulls have some targets to hit. Besides, the bears have to change the March 17 candlestick lows and fix the trade under 1.3085 to meet their targets. Notably, this level is strengthened by the red Tenkan line, which is slightly above 1.3085. Therefore, it will be very difficult to pierce this level.

Taking into account the technical picture on both time frames discussed today, the author of this article thinks it is more beneficial to buy the GBP/USD pair. Besides, it is recommended to buy the pair after it consolidates above 1.3209. However, smaller time frames will be analyzed in tomorrow's review on GBP/USD. Then, today's trading recommendations can be updated. Traders always want to buy cheap and at low prices. Therefore, it will be possible to seek this opportunity on smaller time frames tomorrow. Moreover, this argument is valid for selling the pair. Sales also should be considered.

Good luck!