Last week, the Japanese yen was the only major that showed a decline against the US dollar. Apparently, this is how the pair reacted to the rate hike introduced by the US Federal Reserve and the strong hawkish stance of its head, Jerome Powell. Moreover, Russia's special military operation in Ukraine still worries investors and they prefer to find a safe haven in the US currency. As for the monetary policy in Japan, the country's regulator left everything unchanged during its March meeting. Given such a big difference in the monetary policies of the Fed and the Bank of Japan, the US dollar is sure to continue its rise against the Japanese yen. The USD/JPY pair has not only continued its uptrend but also noticeably intensified it.

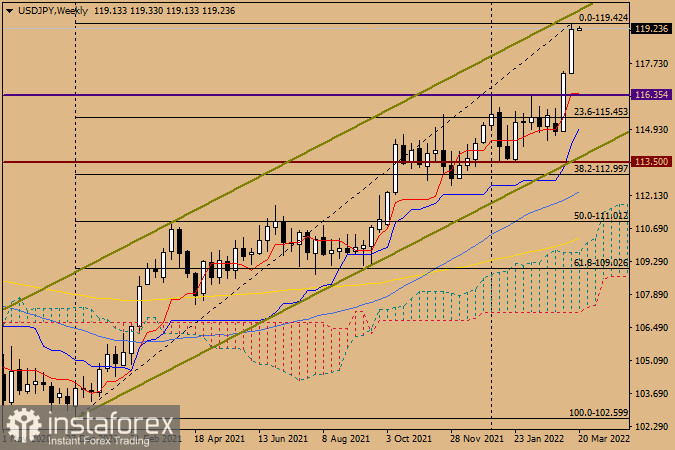

Weekly chart

So, the dollar/yen pair closed last week with impressive growth. As we can clearly see on the chart, the pair has been rising for the second week in a row. As a result, the quote has easily overcome a number of strong technical levels such as 118.00, 118.30, and 118.60, as well as an important level of 119.00, above which the price ended the previous weekly session. At the moment, the way is open for the pair towards the most important historical and psychological level of 120 yen per dollar. However, bulls may face a serious obstacle when approaching this mark. Yet, given such a strong bullish trend, it is quite natural to stay long on the USD/JPY pair.

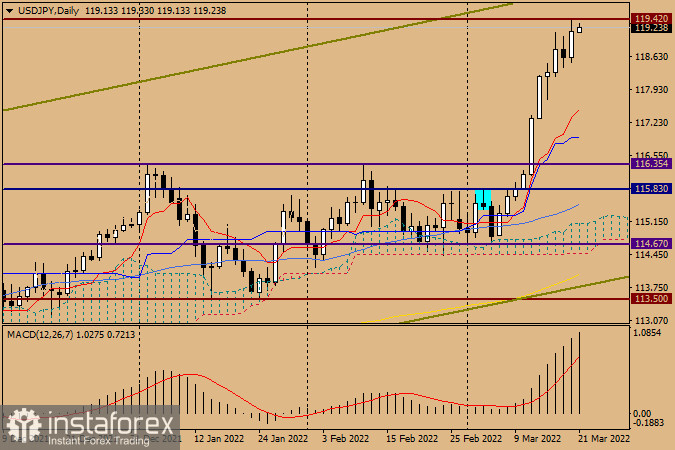

Daily chart

As can be seen on the daily chart, last Friday, the pair faced strong resistance from bears at the level of 119.42. If the price breaks through this level and settles higher after a pullback to 119.42, I recommend buying the instrument. At the same time, it is also possible that a bearish reversal candlestick pattern will appear below 119.42. In this case, the pair may start a downside correction towards 119.00, 118.60, and even lower to the area of 118.30-118.00. A formation of bullish candlestick patterns near the above mentioned levels will serve as a signal to buy the pair at a lower price. On Monday, markets will mainly focus on the speech by the Fed Chair, Jerome Powell, which will take place later in the day. His statement may significantly influence the dynamic of the US dollar and the direction of the USD/JPY pair in particular. This week, we will get back to the technical analysis of the pair and revise it if necessary.

Good luck and big profits!