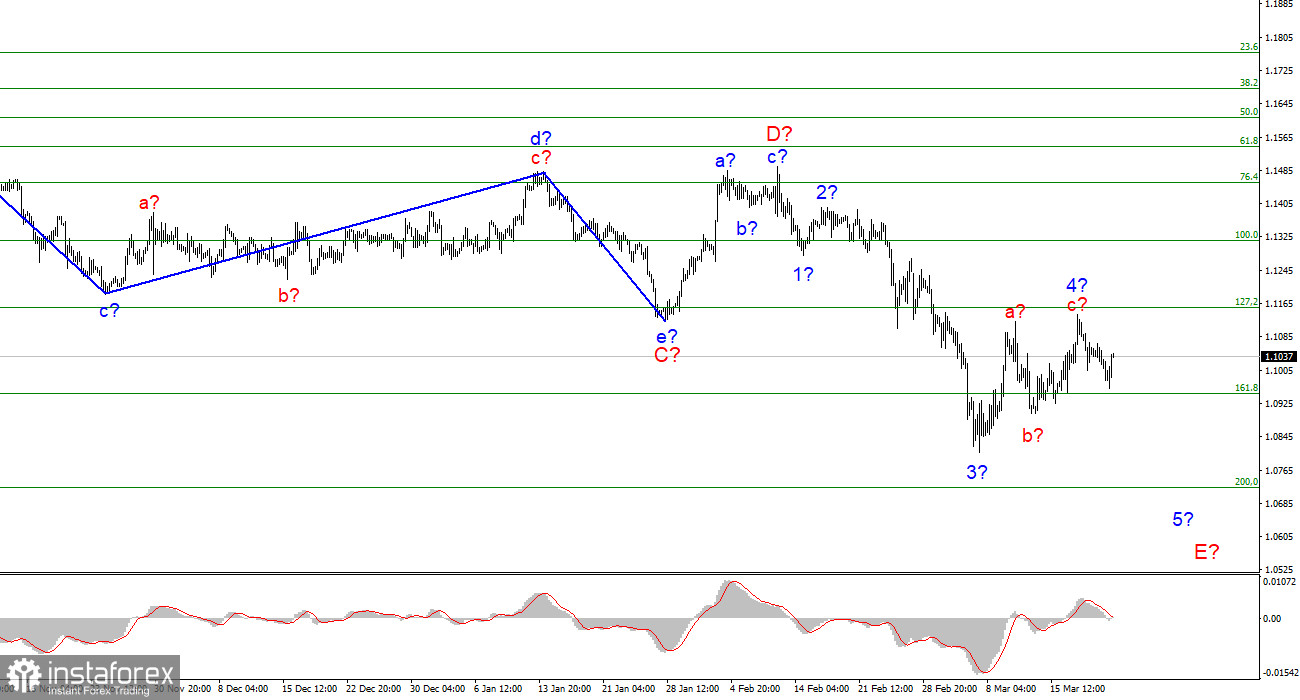

The wave marking of the 4-hour chart for the euro/dollar instrument still does not change and looks quite convincing. At this time, the construction of the proposed wave E is continuing, which should take a five-wave form. The low of the previous wave was broken, so the construction of a downward trend section continues. Since wave E has already taken on a sufficiently extended form, a scene appears in which the construction of this wave will soon be completed. However, so far, the internal wave marking of wave E indicates that only wave 4 has been completed and the construction of wave 5 has begun. Wave 4 has taken a clear three-wave form and is much more massive than the corrective wave 2. However, if it becomes even more complicated, this may cast doubt on a further decline in the quotes of the instrument. This wave can take the five-wave form a-b-c-d-e, but its appearance, in this case, will be very much out of the general wave pattern. Therefore, I expect that the decline in quotes will continue this week with targets located near the 7th figure. I am not considering alternative options yet, since there are no serious violations in the current wave marking.

The European regulator does not know what to do with inflation

The euro/dollar instrument first fell by 60 basis points on Tuesday, and then rose by 80. These movements do not violate the current wave marking, but they cannot be called expected. Jerome Powell and Christine Lagarde made speeches yesterday, but there was no reaction to them, although both presidents made several important statements. Another speech by Lagarde was supposed to take place today, but so far there is no information in the media about this. I would venture to assume that Lagarde did not tell the market anything new. At the moment, the ECB's hands are tied at the seams, and there is practically nothing it can do. Rates have been negative for many years, and lowering them even more to stimulate the economy is like suicide - inflation will fly into the sky. Raising rates to start curbing inflation is also like death, since GDP in this case may go into negative territory.

Europe is on the verge of a new large-scale crisis, and not even one. Since the sowing campaign in Ukraine is under threat of disruption, the whole of Europe may face a food crisis. Since Brussels does not want to support Russia's aggressive actions on the territory of Ukraine and also fears an invasion on the territory of Poland, Latvia, and Lithuania, it is going to refuse to buy oil and gas from the Russian Federation. However, it is not able to do this, since it is impossible to replace these energy resources with energy resources from other countries. At least in the short term. A stalemate. Lagarde herself admits that inflation may continue to rise in the coming months, but hopes that it will slow down further. Given that oil is rising in price again, and gas has already risen to historical highs, it is hardly worth hoping for this option. But what else can the ECB do now if it cannot manipulate rates?

General conclusions

Based on the analysis, I conclude that at this time the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave layout still assumes the construction of wave 5 in E.

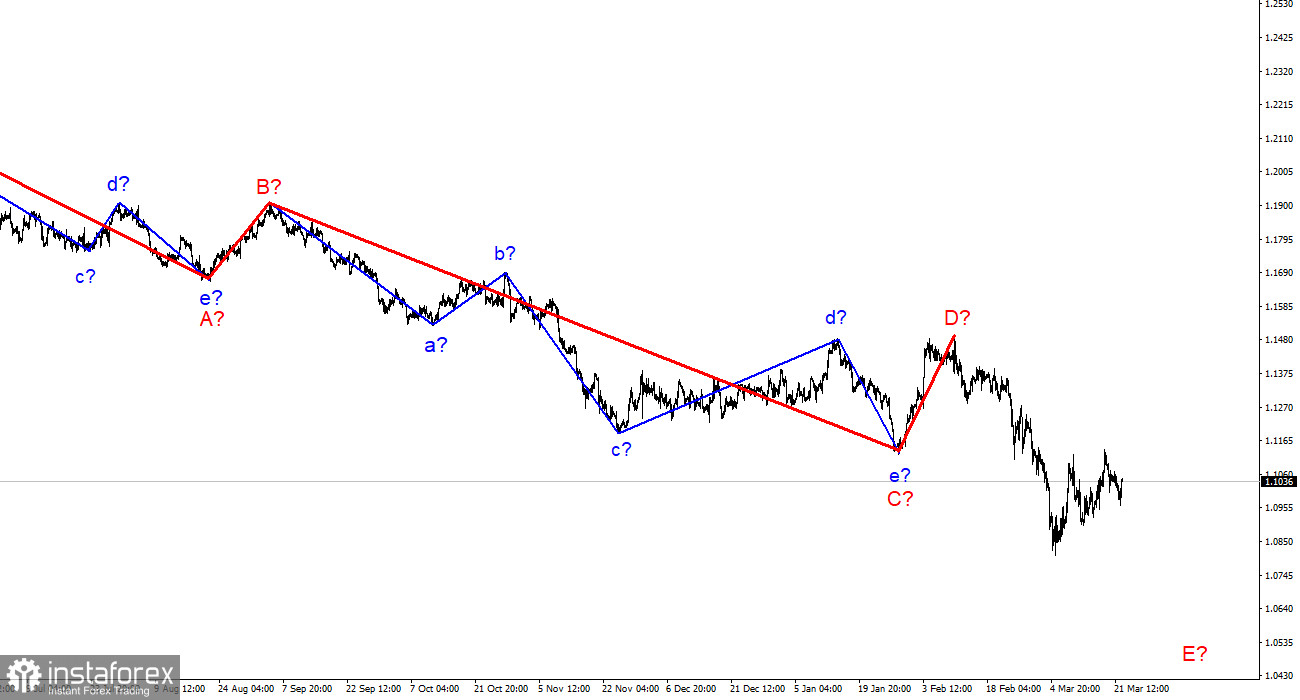

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has already updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.