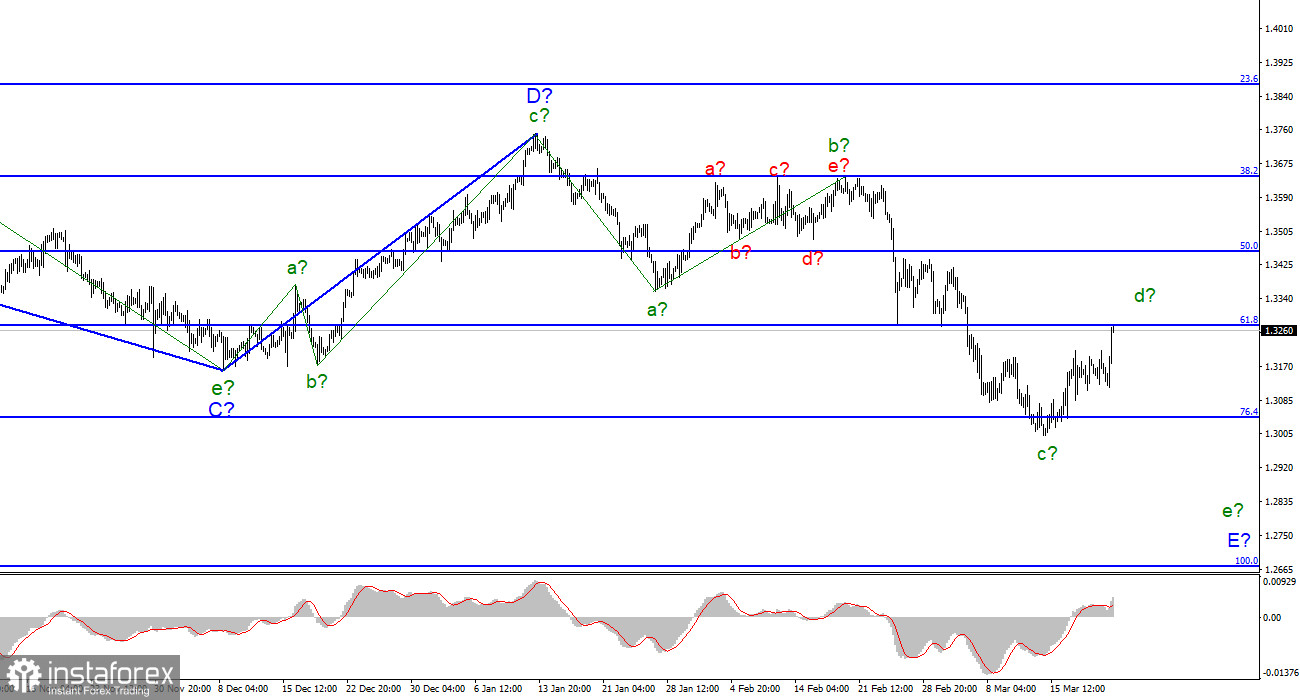

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The increase in the quotes of the British dollar in recent days may be a corrective wave d in E and it may be nearing its completion. In total, there should be five waves inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction. At the moment, the British quotes have made an unsuccessful attempt to break through the 61.8% Fibonacci level, which may mark the end of wave d. The overall decline of the instrument has not yet been completed, and the last descending wave E may turn out to be more extended. Already today or tomorrow, the construction of the wave e in E. may begin. However, a successful attempt to break through the 61.8% level can lead not only to the complication of the ascending wave d, but also the entire wave marking of the instrument. At the moment, as I said, everything looks very organic, so I'm not considering alternative options for wave marking right now.

Boris Johnson urges world leaders not to restore ties with Russia.

The exchange rate of the pound/dollar instrument increased by 90 basis points during March 22. Tuesday's news background was very weak. Not a single important report, not a single important speech in the UK or the USA. Thus, it was very strange for me to observe an increase in demand for the British today. But at the same time, this increase looks very organic in the current wave markup. Now the correction waves b and d are proportional to each other and we can expect the completion of the latter.

At the same time, British Prime Minister Boris Johnson continues to advocate the complete severance of any economic ties with Russia and calls for the same actions by European countries. According to Johnson, the whole world made a big mistake in 2014, when only very light sanctions were imposed for the annexation of Crimea, and in the next 8 years, the whole world continued to pretend as if nothing had happened. According to Johnson, if Moscow succeeds in its military operation in Ukraine, it will not stop and will continue its aggression in the Baltic states, Georgia, Moldova, and throughout Eastern Europe.

All these statements now show only one thing. It is not necessary to count on the lifting of sanctions. Most likely, they will be in effect for many years, and the process of imposing sanctions against the Russian Federation has not yet been completed. This week, the European Union and the United Kingdom may introduce new packages of sanctions, but, as analysts say, they are unlikely to contain any embargo on oil or gas. Nevertheless, it is no secret that European and British politicians are looking for ways to refuse to buy energy resources in Russia. Even if it will be at a loss. Of course, Russia will also not sit idly by and will impose retaliatory sanctions. All this means that the conflict between the European Union and Russia will only become more complicated and escalate. So far, this is only a sanctions conflict, but who knows what may happen in the future?

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. I continue to advise selling the instrument with targets located around the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since wave E does not look completed yet. I propose to consider the expected wave d in E completed until the instrument makes a successful attempt to break through the 1.3273 mark, which equates to 61.8% Fibonacci.

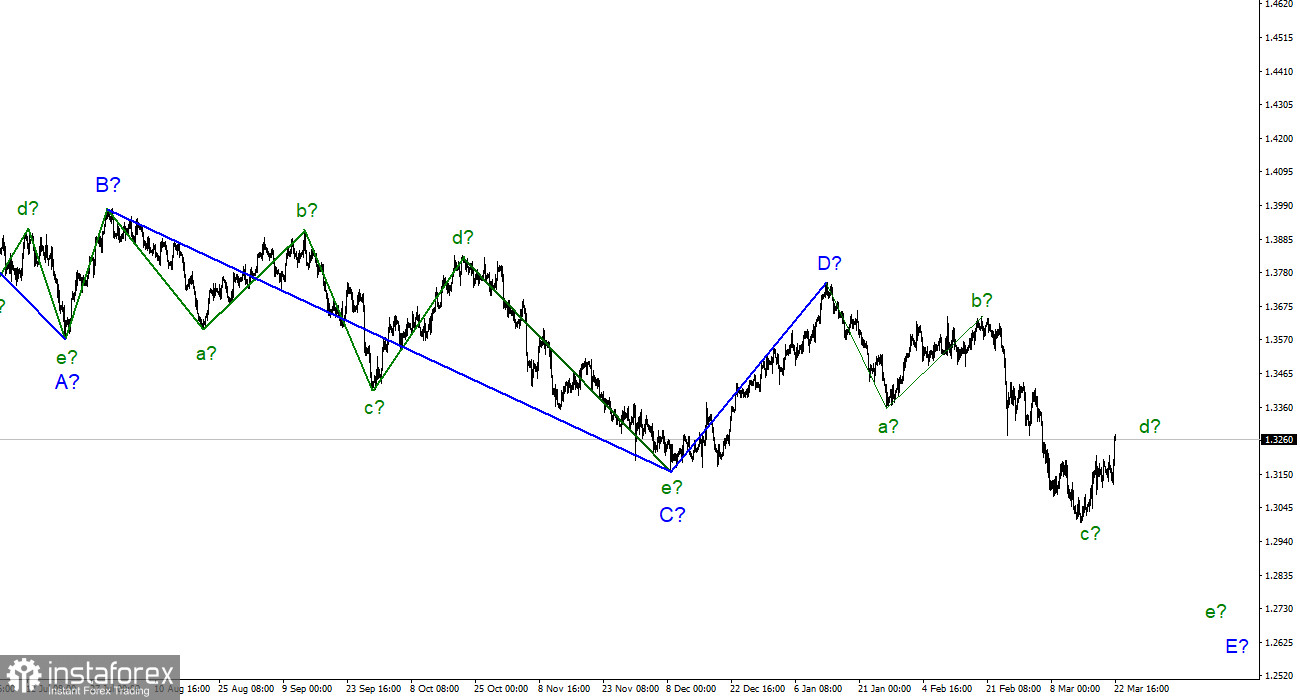

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.