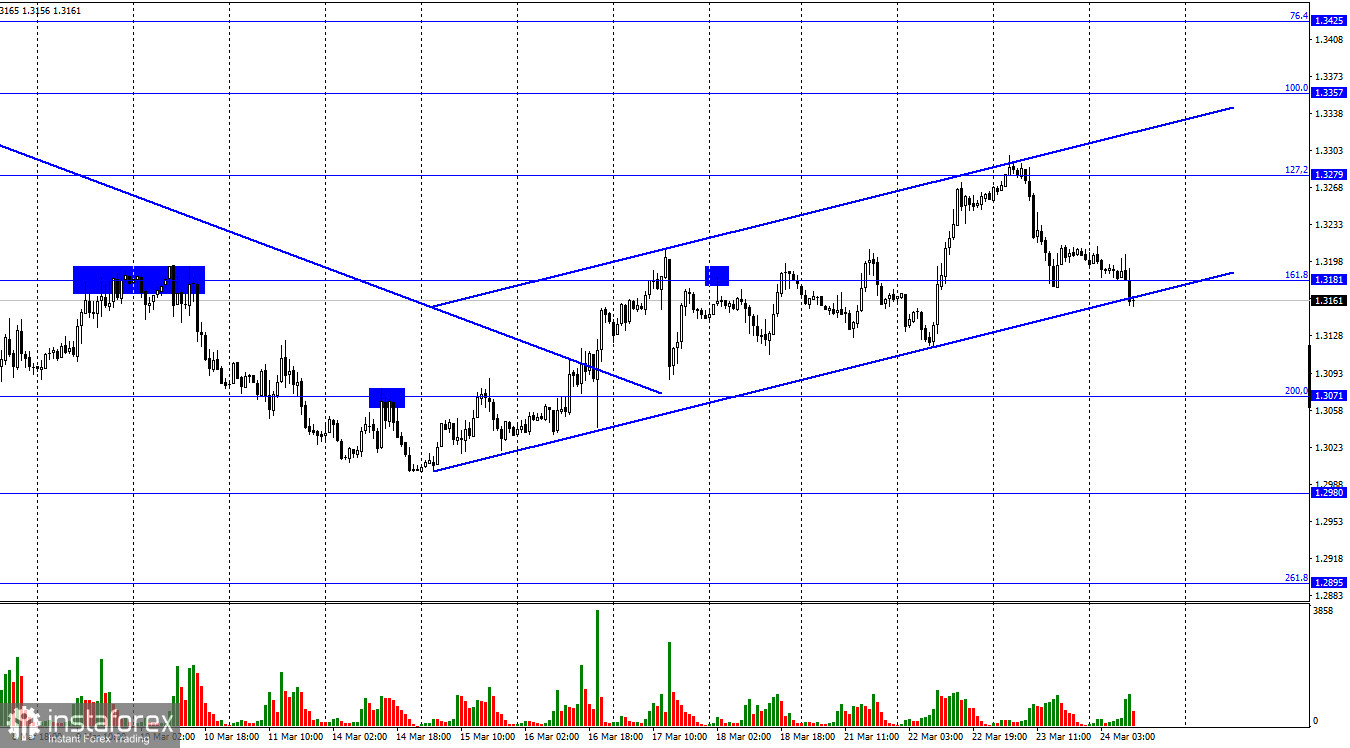

According to the hourly chart, the GBP/USD pair on Wednesday performed a rebound from the corrective level of 127.2% (1.3279), a reversal in favor of the US currency, and a fall to the Fibo level of 161.8% (1.3181). Already today, the pair has also fallen to the lower border of the ascending trend corridor. Closing the pair's rate under the corridor will work in favor of a further fall of the British dollar in the direction of the next corrective level of 200.0% (1.3071). A rebound from the lower limit will allow traders to count on new growth in the direction of the 1.3279 level. The key event of yesterday was the report on British inflation, which rose more than traders expected. The British pound has suffered a lot against the background of this report, but so far it is not in danger of a new fall, since it is still inside the ascending corridor. Today, reports on business activity in manufacturing and the service sector were released in the UK, but they turned out to be ambiguous, as business activity in manufacturing fell, and in the service sector, it increased.

I believe that the strong movements of the last two days were caused precisely by the inflation data in Britain. Now, when they are worked out by traders, the activity of the British will have to decrease. The end of this week promises to be quite boring, as the remaining entries in the calendar are unlikely to interest traders. All attention will now be turned to Joe Biden's talks with European leaders on the topic of the military conflict in Ukraine. It is not yet known what decisions can be made. Most likely, Biden's visit to Europe is in the nature of negotiations and discussion of new sanctions and the imposition of an embargo on Russian oil and gas. The UK has already stated that it will refuse to purchase hydrocarbons in Russia by the end of the year, so these negotiations do not apply to it. Nevertheless, Boris Johnson will also take part in meetings of NATO and G-7 countries. In any case, we will find out tonight or tomorrow what decisions have been made and whether they have been made at all.

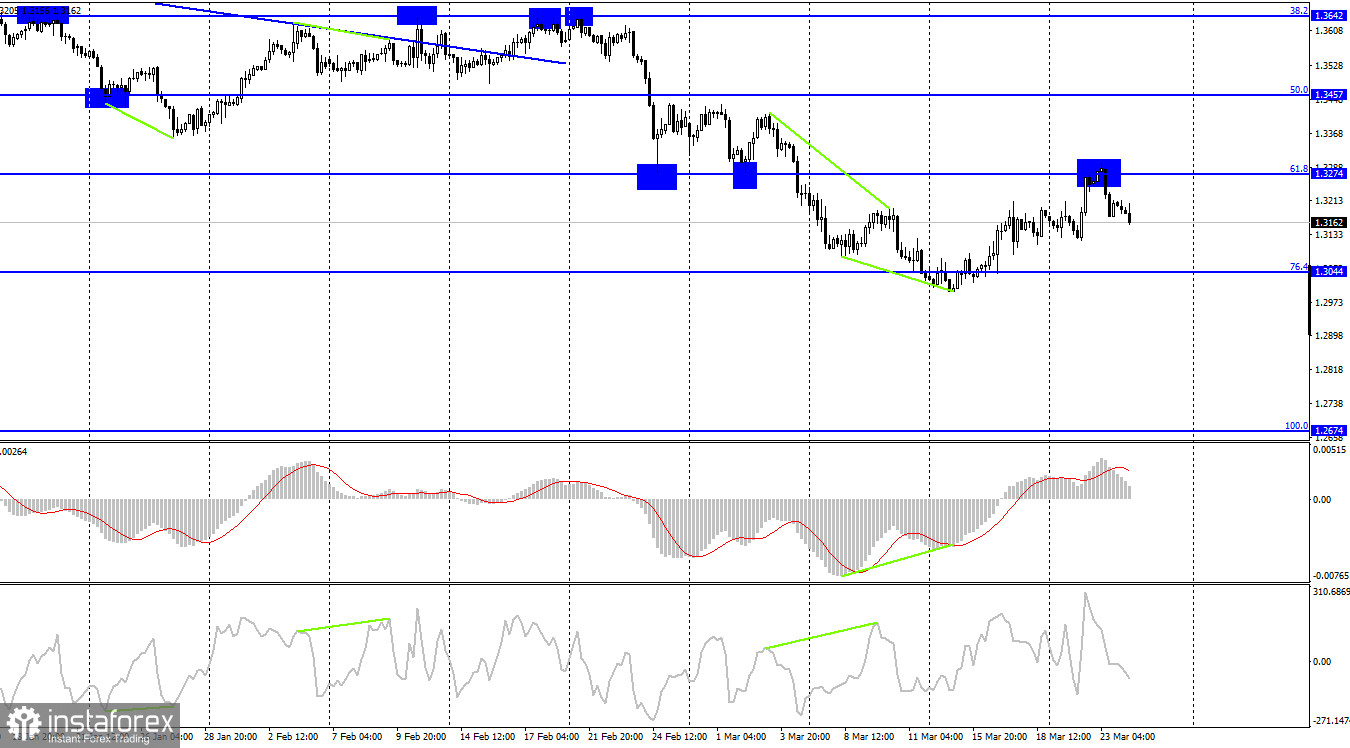

On the 4-hour chart, the pair performed a rebound from the corrective level of 61.8% (1.3274), a reversal in favor of the US currency, and began to fall in the direction of the Fibo level of 76.4% (1.3044). Brewing divergences are not observed in any indicator today. Fixing the pair's rate above 61.8% will allow us to count on further growth of the British dollar in the direction of the corrective level of 50.0% (1.3457).

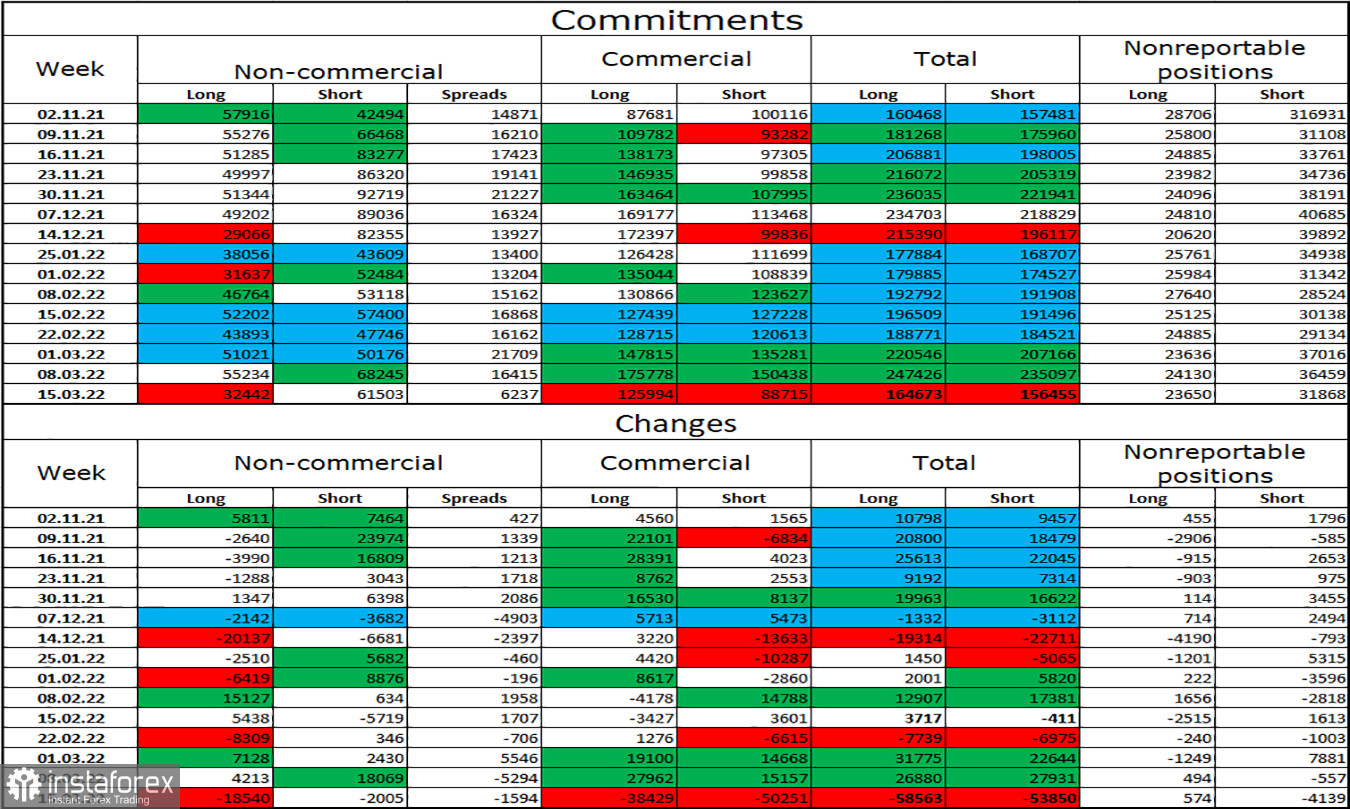

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts decreased in the hands of speculators by 18,540, and the number of short - by 2005. Thus, the general mood of the major players has become even more "bearish". Thus, everything is in order now, and the ratio between long and short contracts for speculators corresponds to the real state of things. The British dollar is falling, and the big players are selling the pound more than buying it. At this time, the difference between the number of long and short contracts for speculators is twofold. Thus, I expect the pound to continue its decline.

News calendar for the US and the UK:

UK - PMI index for the manufacturing sector (09:30 UTC).

UK - PMI index for the service sector (09:30 UTC).

US - change in the volume of orders for long-term goods (12:30 UTC).

US - number of initial applications for unemployment benefits (12:30 UTC).

On Thursday, the calendars of economic events in the US and the UK contain several interesting entries. All the British statistics have already been released and practically did not affect the mood of traders in any way. American statistics can repeat the fate of the British.

GBP/USD forecast and recommendations to traders:

I recommended selling the British when rebounding from the 1.3279 level on the hourly chart with a target of 1.3181. This goal has been fulfilled. New sales at the close under the corridor on the hourly chart with a target of 1.3071. I recommend buying a pound when rebounding from the lower border of the corridor with a target of 1.3279.