Today, we return to the consideration of the pound/dollar currency pair, but before proceeding to the consideration of price charts, we will once again indicate the positions of both central banks. If everything is extremely clear with the position of the Federal Reserve System, and this fact has been repeatedly noted in other materials of the author, then the further steps of the Bank of England in its monetary policy are slightly vague, so to speak. In addition, it coincides with the climatic features of the United Kingdom. In this regard, everything fits together. But whether the expectations of market participants regarding the continuation of monetary policy tightening by the Bank of England will converge is a big question. On the one hand, excessively high inflation in the UK should force the British Central Bank to take drastic measures, the most effective of which is considered to be an increase in the main interest rate. And, on the other hand, what to do with weak economic growth, while maintaining higher rates can create even bigger problems. Thus, the Bank of England, in my personal opinion, is in the process of choosing and making a decision. Many experts and analytical departments of large commercial banks expect the BoE to raise the rate by the same 25 basis points at the May meeting, which will be held on the 5th. Meanwhile, today's data on the UK PMI manufacturing activity index came out worse than the forecast at 56.7 and amounted to 55.5. But the PMI index in the services sector turned out to be better than expected at 54.2 and came out at 54.8. However, you will agree that the difference is very insignificant.

If we return to the quite understandable and "hawkish" position of the Fed, then high-ranking officials of this influential department, one after another, speak out in a rather harsh tone. But a member of the Fed's Open Market Committee, Mary Daly, suggests not to rush too much in the process of tightening monetary policy and to study and analyze incoming macroeconomic reports more closely. Well, it is quite natural that there are "dovish" in the ranks of the Fed's leaders, but they are much smaller than the hawkish majority. So the chairman of the Federal Reserve, Jerome Powell, in his last speech, did not rule out the possibility of an interest rate increase at the May FOMC meeting by 50 basis points at once.

If we sum up such a long entry, then the Fed's position is more understandable and clear, it is due to this that the US dollar can have superiority over its opponents, among which, of course, the British pound sterling. But the Bank of England may not meet expectations and pause further tightening of policy and the fight against high inflation. This probability will become especially relevant in the case of frankly weak macroeconomic indicators coming from the UK.

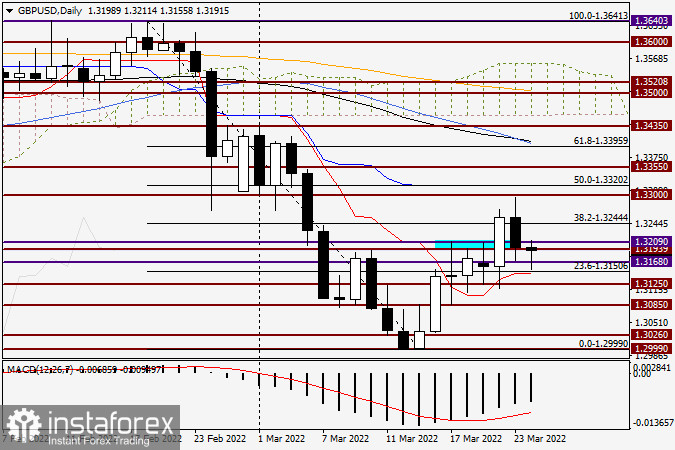

Daily

We turn to the technical picture, which confirms the difficulties of the "Briton" to continue strengthening against the US dollar. It would seem that after such an impressive bullish candle that appeared on the daily chart on March 22, the subsequent growth seemed to be the most likely course of trading. Yesterday, the pair showed a downward trend and returned to the key level of 1.3200, which was mentioned more than once in previous materials. At today's auction, at the time of writing the article, the pair was already falling to 1.3155, where it found strong support and returned to the opening price, leaving a fairly long tail at the bottom. Given this picture, we can conclude that the market does not want to decline, which means it intends to grow. If so, then at the moment, careful purchases of sterling seem to be the most relevant, but with small goals in the area of 1.3250. If bearish candlestick analysis patterns begin to appear near this mark or slightly lower at smaller time intervals, it is worth opening short positions on GBP/USD with the nearest targets in the area of 1.3170-1.3160.