Hi, dear traders!

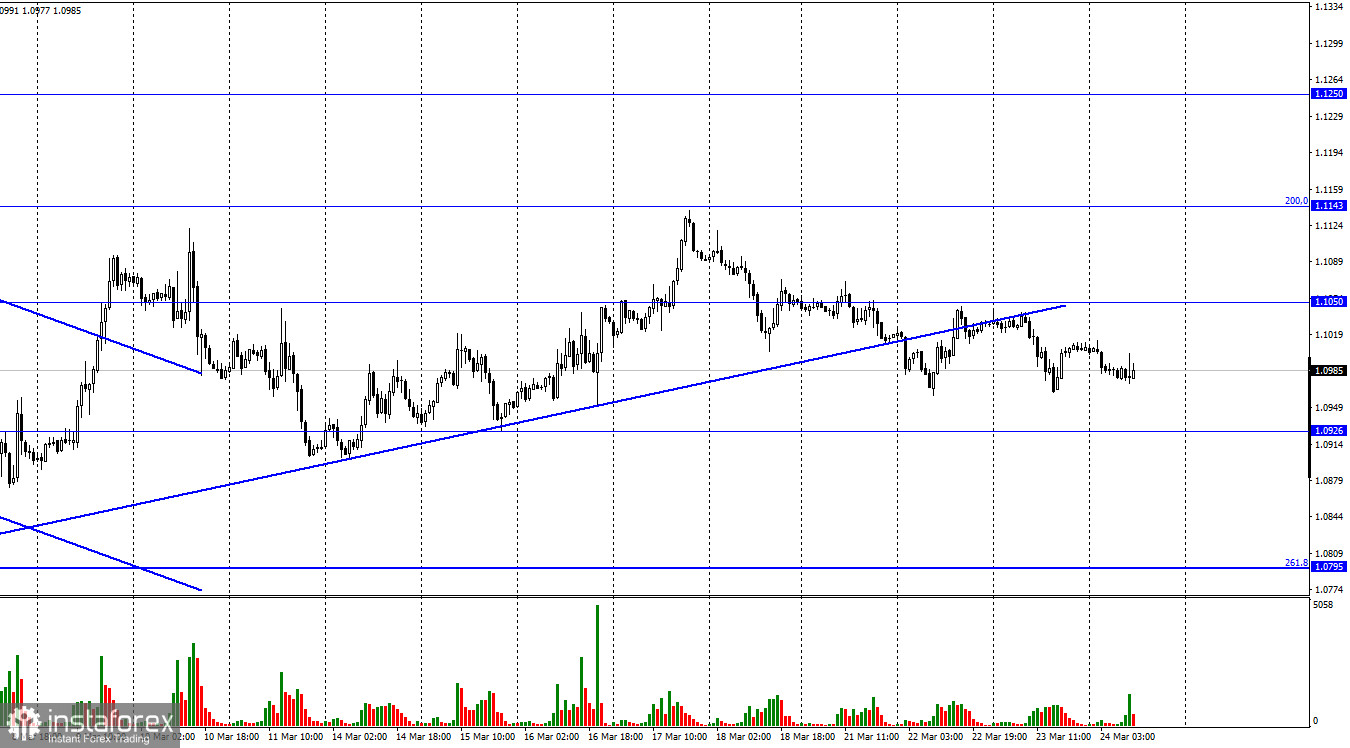

On Wednesday, EUR/USD stopped its downward movement towards 1.0926 and reversed upwards. The pair has been moving without a clear trend for the past 2 days. However, EUR/USD could dive again - earlier, it closed below the ascending trend line. Traders have digested all new information and are now uncertain about what to do next. The meetings of US and EU central banks have concluded, the war in Ukraine has become a stalemate, and statements by Jerome Powell and Christine Lagarde had no new information. No event in the economic calendar influenced traders yesterday. Traders already know Jerome Powell's position very well from his speech earlier this week. The Fed is set to increase the interest rate as fast as possible, which would give support to USD in the long run. However, all future rate hikes cannot be priced in by the market in just a couple of days. With the war between Russia and Ukraine becoming a stalemate, trading volume is falling as well, compared to the previous month. Today's data releases did not change the situation. EU manufacturing and services PMI decreased slightly, but still exceeded expectations. US jobless claims and durable goods data are also unlikely to stir traders. Market players could be interested in talks between Joe Biden and his European partners. However, no-fly zones and deployment of peacekeepers have been ruled out, and an immediate ban on oil and gas imports is also extremely unlikely. The EU has also imposed all possible sanction measures against Russia that wouldn't backfire on the European economy. It is uncertain what the US and EU would discuss in this situation.

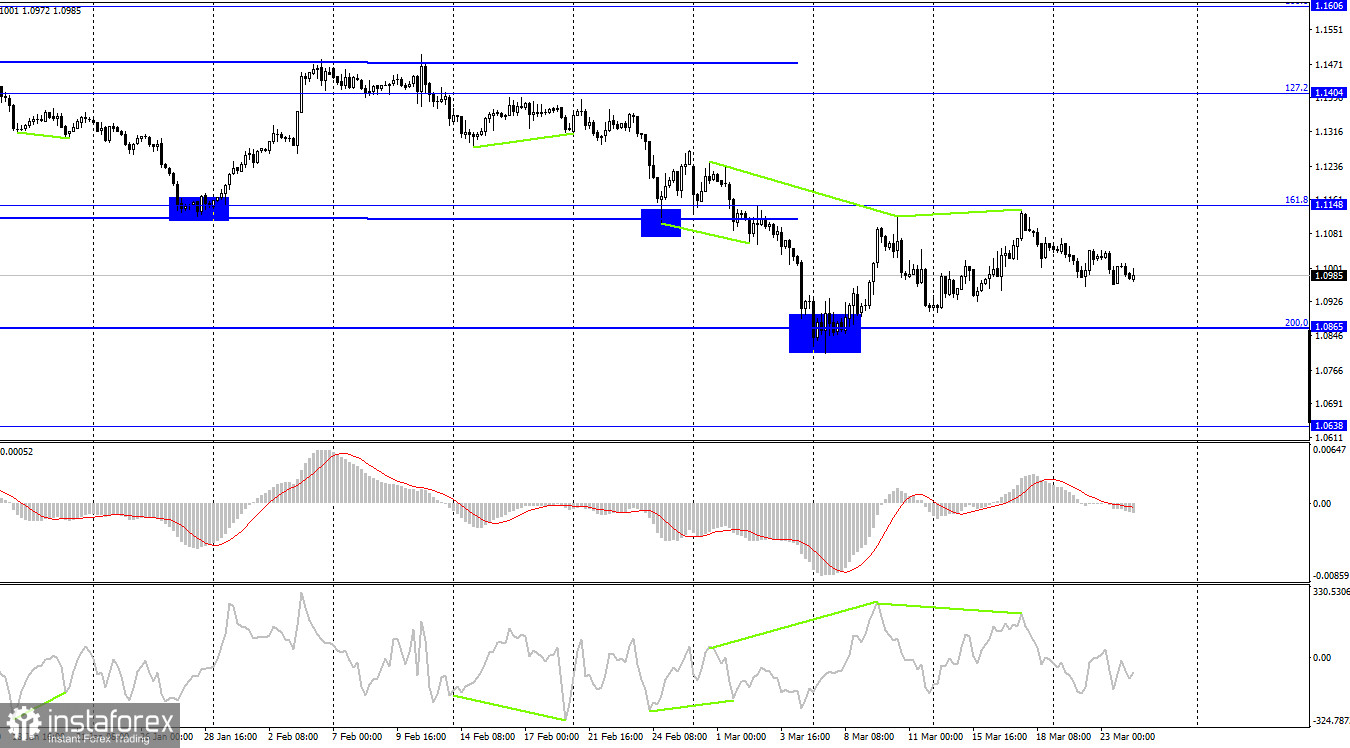

According to the H4 chart, the pair has reversed downwards. It is currently moving downwards towards the retracement level of 200.0% (1.0865). Earlier, the Commodity Channel Index formed a bearish divergence. If EUR/USD bounces upwards off 1.0865, it could grow slightly. If the pair settles below this level, it could lead to a further downward movement towards 1.0638.

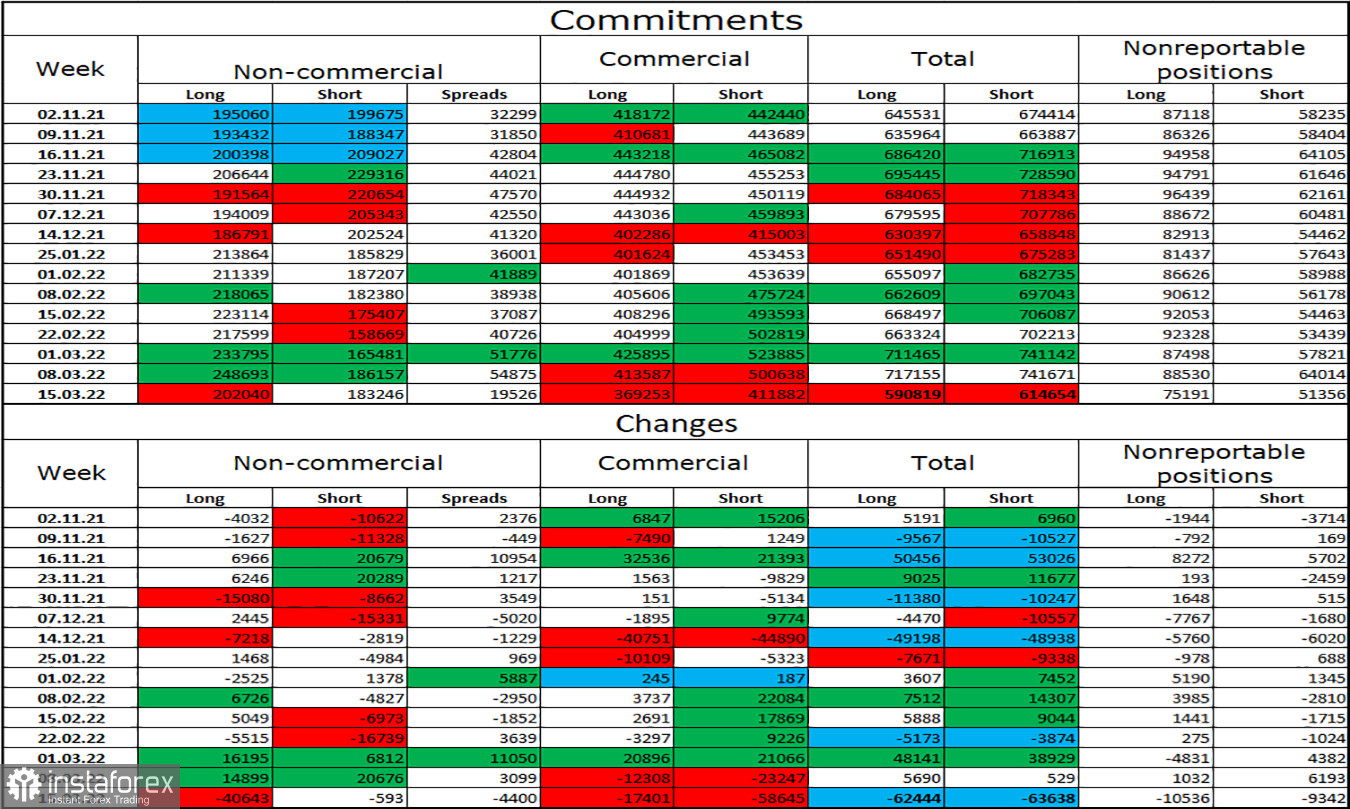

Commitments of Traders (COT) report:

In the previous week covered by the report, traders closed 40,643 Long positions and 593 Short positions, indicating the bullish sentiment among major players decreased. However, the total number of open Long positions is now 202,000 against 183,000 Short positions, meaning that the overall sentiment of Non-commercial traders remains bullish. This could have boosted the euro, but recent events are favoring the US dollar. The price dynamics of the pair are primarily driven by geopolitical factors. EUR/USD is in the downtrend despite major market players being bullish since January 25.

US and EU economic calendar:

EU - Manufacturing PMI (09-00 UTC).

EU - Services PMI (09-00 UTC).

US - Durable goods orders data (12-30 UTC).

US - Initial jobless claims data (12-30 UTC).

Today's events in the economic calendar are unlikely to influence traders.

Outlook for EUR/USD:

Earlier, traders were recommended to open new short positions with 1.0926 on the H1 chart being the target, if the pair closed below the trend line. These positions can be kept open until EUR/USD settles above 1.1050. Short positions can be opened if the pair bounces off 1.0865 on the H4 chart, with targets at 1.0926 and 1.1050.