GBP/USD is under pressure, despite the pound sterling firming up, as well as tax cuts in the UK. The US dollar is dominant against GBP and other currencies due to geopolitical tensions. However, geopolitical factors are unreliable from the start - the level of risk-off sentiments in the market is changing very rapidly depending on the news. In these conditions, an outlook for the current downtrend cannot be given. Geopolitics remains the main driver for the pair, overriding other fundamental factors.

Initially, the market's response to UK inflation data was quite adequate. GBP/USD approached 1.3300, hitting the 2.5-week high. Most components in the report increased, strongly surpassing previous estimates and making further monetary tightening by the Bank of England more likely. The UK regulator did not rule out such a scenario at its previous meeting, but noted it would depend on macroeconomic data, particularly inflation.

Yesterday's data release is highly important for GBP/USD, as well as other GBP cross pairs. Usually, the pound sterling would have greatly advanced, but at this point it is following USD due to geopolitical factors. The US dollar, on the other hand, strongly reacts to external fundamental factors.

The inflation report for February will likely to influence the pair in the long term, when the geopolitical situation stabilizes. Traders will then switch to "classic" fundamental factors, assessing the prospects of further monetary tightening by the BoE. The effect of yesterday's data release is likely to be a delayed one.

The consumer price index rose by 0.8% month-over-month, reaching the highest level in 4 months. This component has been steadily falling over the past 3 months, dipping into negative territory (-0.1%) in January. On a yearly basis, CPI inflation has jumped to 6.5%, up from 5.5% in January - its highest level since March 1992. Core inflation increased as well, with core CPI rising to 5.2% and hitting a multi-year high as well. Both output and input PPI surged upwards as well, month-over-month and year-over-year. Such an upsurge was quite impressive, despite it being fueled by temporary factors.

However, GBP/USD quickly reversed downwards after briefly rising on the report. The pair ignored the data release, as well as the UK government reducing the fuel duty. Furthermore, Rishi Sunak, Chancellor of the Exchequer, announced tax cuts to support households and businesses.

GBP/USD has fallen by 150 pips in 2 days, ignoring all these fundamental factors. The downward momentum has faded today, but its uptrend prospects are now in serious doubt.

The pound sterling is obviously following the US dollar, which strongly reacts to geopolitical changes. Reports about Poland proposing NATO to deploy its peacekeepers in Ukraine have led to increased risk-off sentiments in the market, as Russia immediately reacted. Now, this deployment has been ruled out, with US and Germany being against it. This led to today's upward rebound of GBP/USD, as the US dollar retreated amid falling demand.

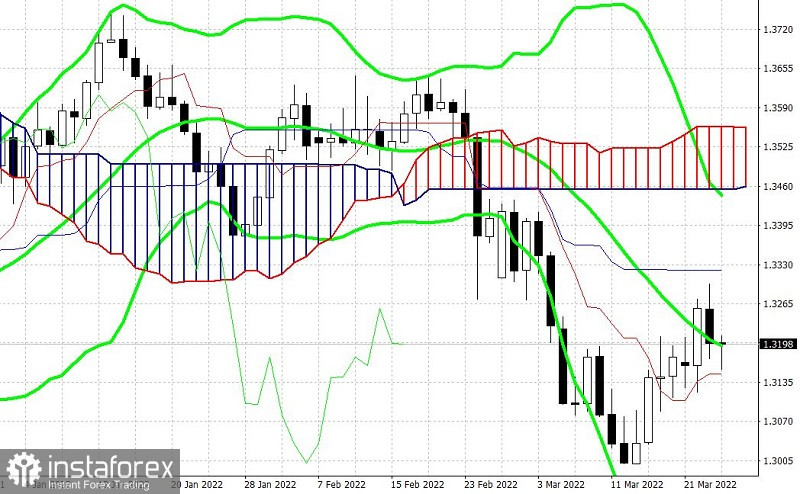

This indicates that GBP/USD traders cannot decide on their direction. Regular fundamental vectors are not influencing the pair as they should, while the geopolitical situation is changing rapidly. The pair fluctuates amid general uncertainty, and its upward or downward movements cannot be forecast. Currently, the quote is moving within a certain range, with the Tenkan-Sen line (1,3150) at the D1 timeframe serving as support and the Kijun-Sen line (1.3320) at the same timeframe being its resistance. Bulls and bears cannot break through either of these levels. All trading decisions can be considered only within this range - the pair is fluctuating within its borders.