A multi-directional price movement is highly possible

Hello, dear colleagues!

The EUR/USD pair failed to decline again in yesterday's trading. As usual, the technical picture will be discussed later. It is better to focus on the current events, yesterday's macroeconomic reports, and today's prospects. Notably, the external background is relatively calm. I suppose that the market participants are awaiting the outcome of the NATO and EU summits, as well as the G7 summit. Notably, US President Joe Biden will fly to the EU to take part in these meetings. It is evident that the main agenda of these summits is increasing pressure on Russia, which continues its invasion in Ukraine. Biden will likely exert considerable pressure on his European partners to tighten sanctions and ban Russian oil and gas imports. According to credible sources, Germany plans to halve imports of Russian oil by summer 2022. As for gas, Germany intends to cut gas consumption by 30% by the end of 2022. As mentioned above, the embargo on Russian oil and gas is not beneficial to any countries. However, these are political grounds.

As for the economic calendar, yesterday's reports on the eurozone manufacturing and services PMI turned out better than economists expected. However, they were not favorable for the single European currency. Besides, US statistics were mixed yesterday. The durable goods orders were not in line with economists' expectations and came out in the red zone. Meanwhile, the initial jobless claims as well as manufacturing and services Markit PMI surpassed analyst' expectations. Today, I recommend focusing on Germany's IFO purchasing manager and business climate indexes. As for US statistics, pending home sales as well as the University of Michigan's consumer sentiment index may be significant for investors.

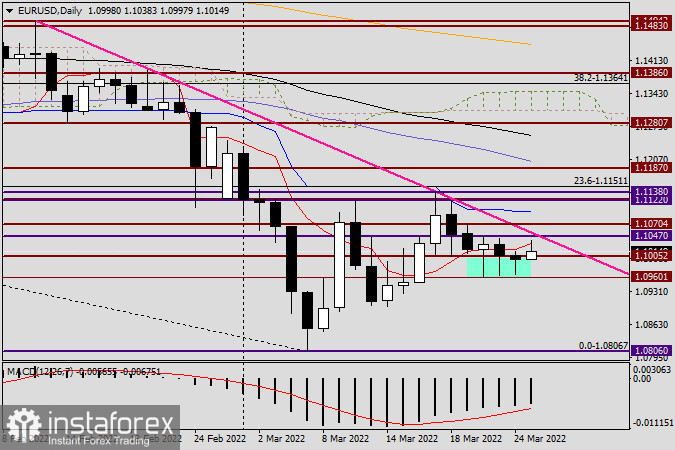

Daily

Despite the fact that the EUR/USD pair declined slightly at the end of yesterday's trading, the technical picture changed little. Strong support still remains near 1.0960. I marked the bottom shadows of the last few candlesticks, indicating demand for the single European currency in this area. However, the sellers' resistance at 1.1045 remains strong, preventing the pair from rising. I changed the pink resistance line pierced earlier, using a new entry point. Currently, its levels are 1.1495-1.1138. Notably, the red Tenkan line of the Ichimoku indicator still hampers the pair's growth and is also considered an obstacle to euro bulls.

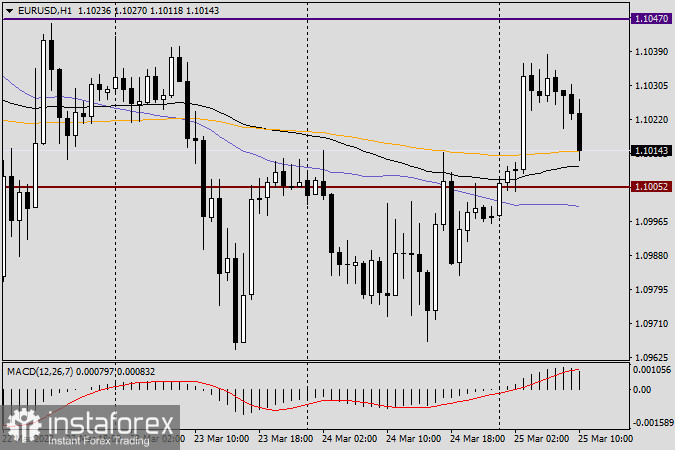

H1

Despite the fact that the pair has consolidated above the moving averages, it pulled back to them at the moment of completing the article. Technically, the moving averages can provide significant support to the pair. Therefore, I currently recommend market players, willing to open new positions on the last day of the weekly trading, buy the EUR/USD pair at 1.1015-1.1000. I believe the important psychological level of 1.1000 will be extremely significant for determining the closing price of the week. Therefore, a multi-directional price movement is highly possible. Under the current conditions, trading is very risky. On Monday, taking into account the outcome of the weekly trading, I will most likely specify the future prospects for the EUR/USD pair.

Have a nice day!