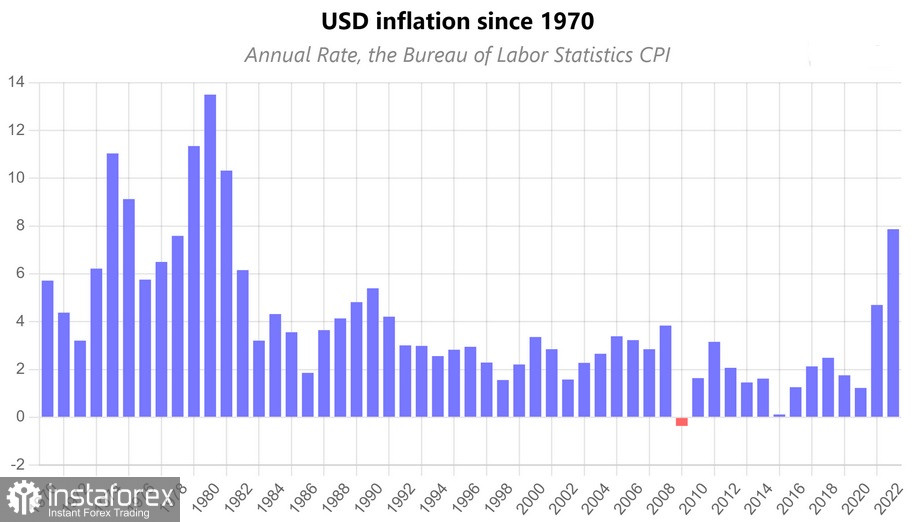

Inflation is currently running at 7.9%, approaching its highest level since 1979. If it goes like this, and the price growth reaches the level from 1979, gold will definitely continue to move higher.

The main factor that has taken gold above $1,900 over the past three days is inflation with a twist.

Notably, inflation began to accelerate long before the conflict in Ukraine. It has been extremely rapid this year, having exceeded the levels not seen over the past 40 years. In 2019, consumer prices were holding between 1.5% and 2.3% in December. In 2022, inflation ranged between 2.5% and 1%. However, 2021 was marked with a cascade effect of inflationary spikes, appearing throughout the year. While the average inflation rate was 4.7%, there were times when it went above 5% and was even holding at 6.2% and 6.8% for a couple of months. The CPI for January came in at 7.5% year-over-year. The CPI for February beat the previous high for the last 40 years and reached 7.9%. The next report for March will be available on April 12.

The geopolitical crisis in Ukraine has affected imports into the EU. Many analysists have said a lot about the key reasons behind these inflationary pressures. At the moment, the Russia-Ukraine conflict is a direct cause of additional inflationary pressure.

Grain continues to be the most important food export in the world. In the first 10 months of 2021, Russia exported $388.4 billion in grain, 42.8% up from the previous year. The primary buyers were China, Germany, and the Netherlands. According to the International Food Policy Research Institute, exports from Russia and Ukraine collectively represent 12% as of March 11, 2022. Ukraine is the second-largest supplier of grains to the EU. Their primary export is barley and wheat. What is more alarming is that Russia is the leading exporter of wheat and one of the top exporters of crude oil, refined petroleum oil, and coal.

These are the facts that were relevant in 2021 and are still relevant today. As a result of the military conflict, the EU will face the reduction of exports of necessary goods and services from Russia and Ukraine. This will inevitably lead to massive supply chain disruptions. The consequences are awful, and there are no solutions yet. For that reason, gold has reacted with a strong rally to higher consumer prices. This month, gold traded just $10 below the record high it reached in August 2020. The current level of inflation was last observed in April 1980 when the rate hit 14.6%.

Today, inflation running at 7.9% could easily reach 15% if nothing is done to stop it. As long as inflation stays uncontrolled, gold will continue to gain value. Until the conflict in Ukraine is resolved, global prices will keep rising higher. Therefore, gold is set to trade at all-time highs in the near future.