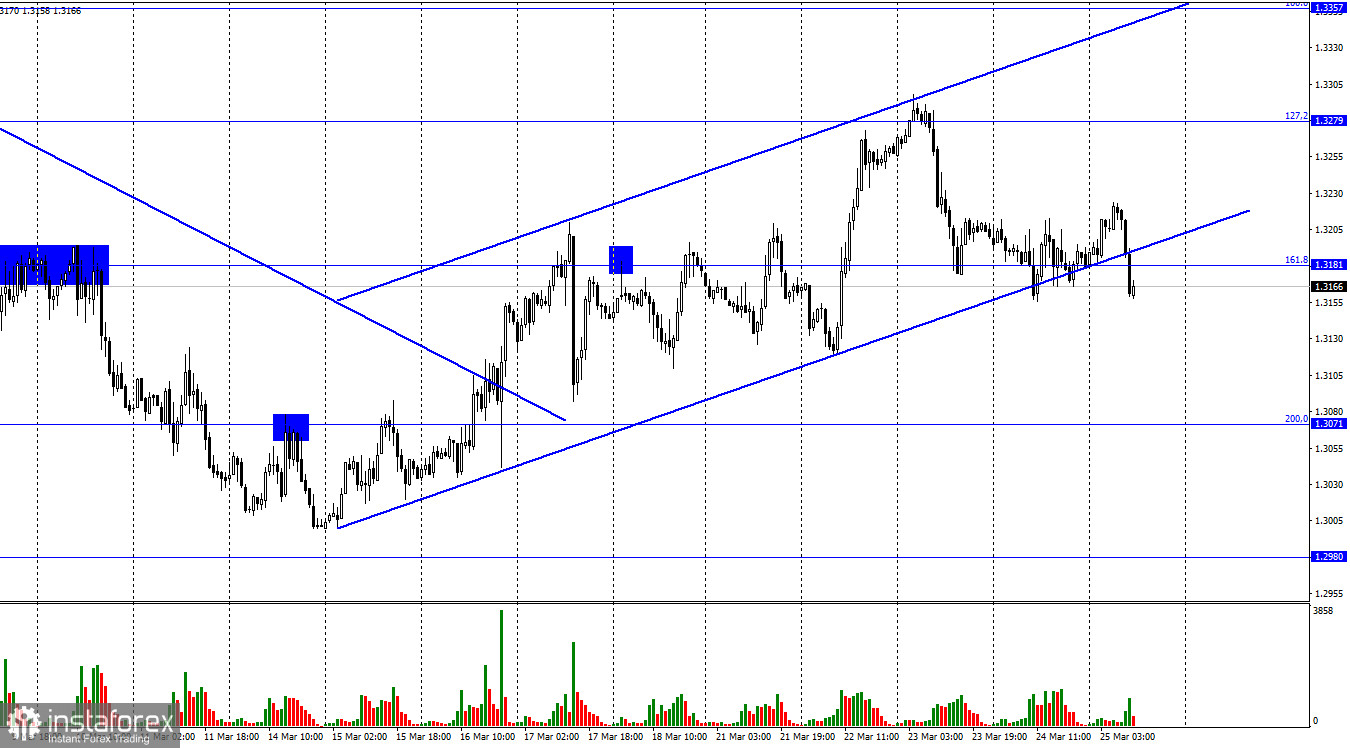

According to the hourly chart, the GBP/USD pair had an absolutely weak day on Thursday. But this morning, the quotes have already managed to grow by 40 points, after which there was a reversal in favor of the US currency and consolidation under the upward trend corridor and the corrective level of 161.8% (1.3181). Thus, the mood of traders is now characterized as "bearish", and the process of falling can be continued in the direction of the next corrective level of 200.0% (1.3071). Yesterday, the information background for the British pound and dollar was also very weak. Although during the day there were at least 6 reports that could affect the mood of traders, in reality, none were affected. There were no critical changes in business activity in the UK or the US. I can only note a drop in the volume of orders for durable goods in the United States. This indicator decreased by 2.2% m/m in February. This morning, it became known that retail trade volumes in Britain also declined in February. They lost 0.3% m/m.

However, the fall of the British dollar began two hours before the release of these data, so I do not believe that yesterday's reports were ignored, and today's was worked out. Rather, the pair is now moving solely under the influence of technical factors and is waiting for new geopolitical data. A graphical sell signal is already available, but the fall in the current conditions may not be long-term, since there are few informational reasons for new sales of the British now. Thus, I do not expect that today the pair will perform a fall to 1.3071, but still, it can move in the direction of this level. The EU and NATO summits are over, and US President Joe Biden has gone on a visit to Poland, where he will try to negotiate with the government on the provision of Polish fighter jets and air defense systems to Ukraine. From my point of view, this will be very important information, since Moscow already regards Poland's actions as a threat to itself. Accordingly, Poland is now the first on the list of countries that may enter into conflict in Ukraine.

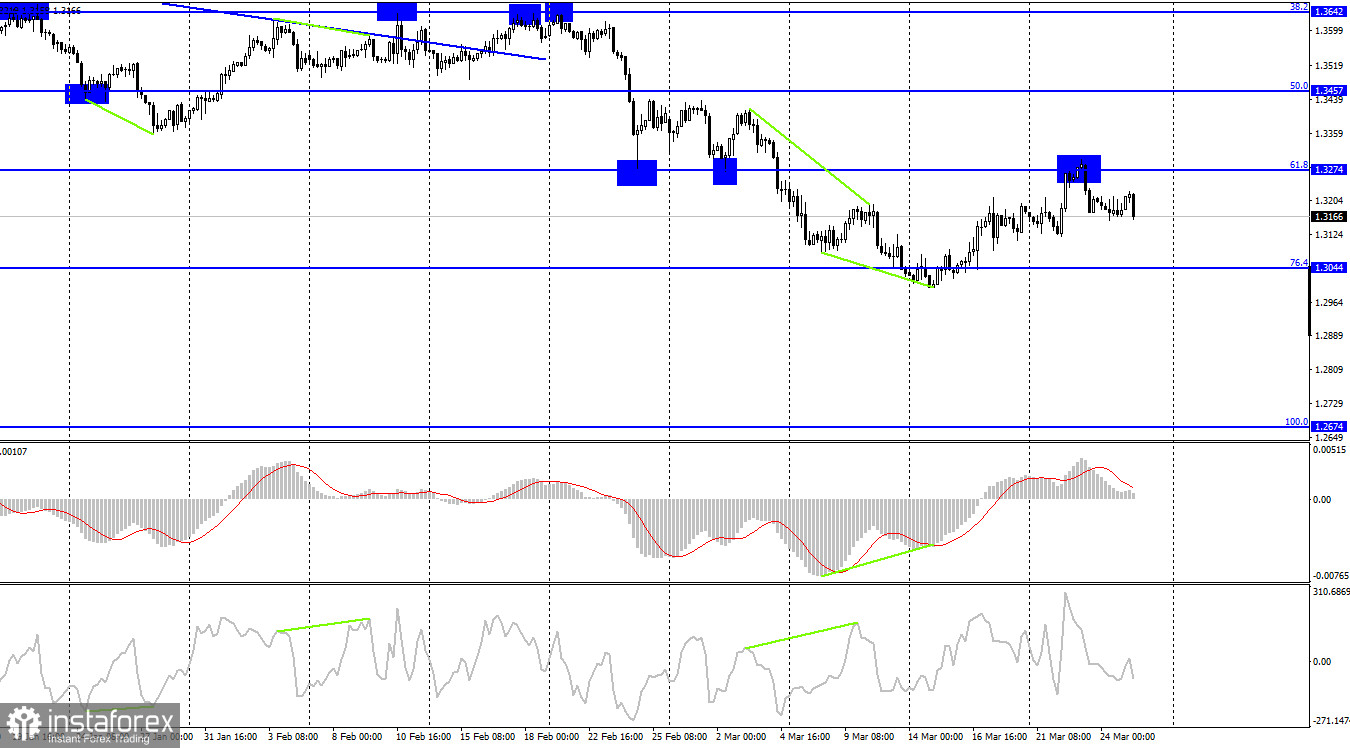

On the 4-hour chart, the pair performed a rebound from the corrective level of 61.8% (1.3274), a reversal in favor of the US currency, and began to fall in the direction of the Fibo level of 76.4% (1.3044). Emerging divergences are not observed in any indicator today. Fixing the pair's rate above 61.8% will allow us to count on further growth of the British dollar in the direction of the corrective level of 50.0% (1.3457).

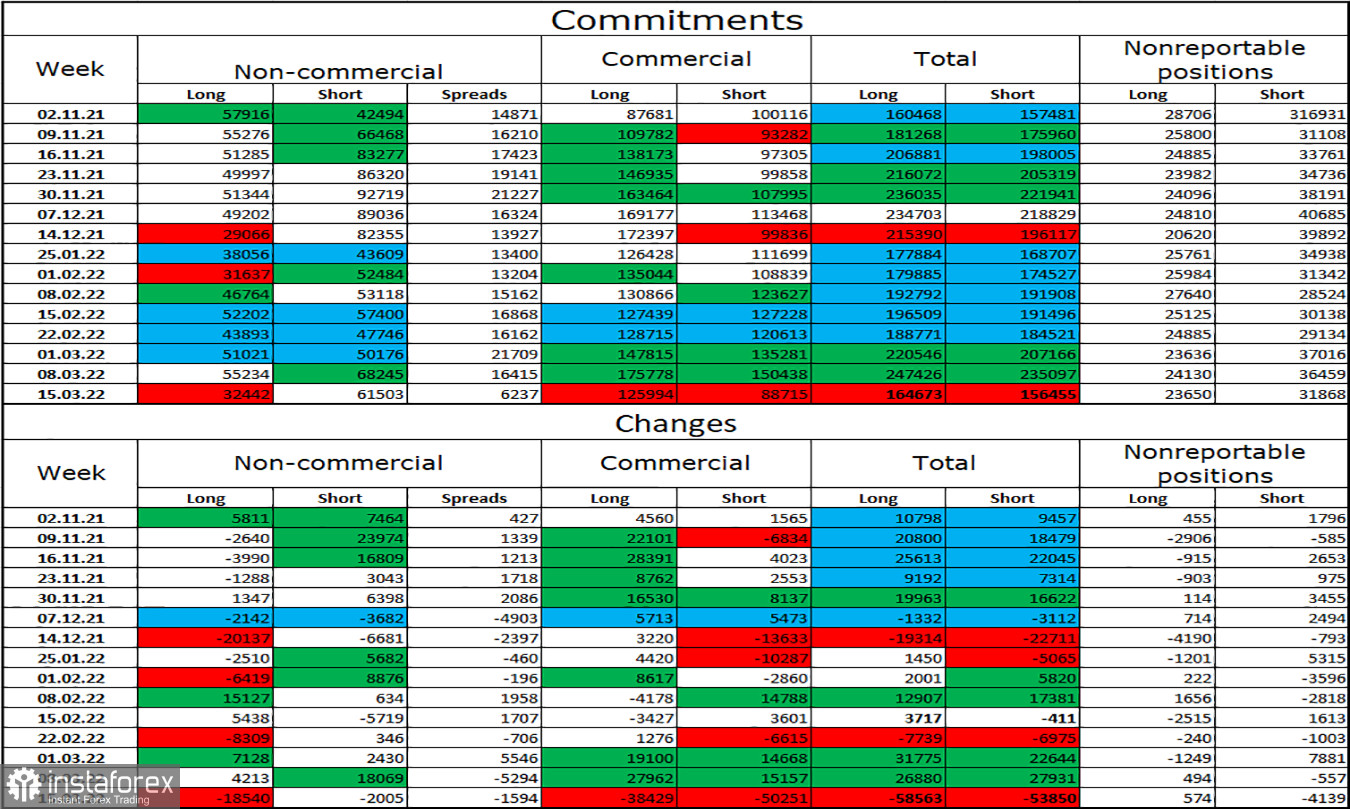

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts decreased in the hands of speculators by 18,540, and the number of short - by 2,005. Thus, the general mood of the major players has become even more "bearish". Thus, everything is in order now, and the ratio between long and short contracts for speculators corresponds to the real state of things. The British dollar is falling, and the big players are selling the pound more than buying it. At this time, the difference between the number of long and short contracts for speculators is twofold. Thus, I expect the pound to continue its decline.

News calendar for the USA and the UK:

UK - change in retail trade volume without and taking into account fuel costs (07:00 UTC).

On Friday, the calendars of US and UK economic events contain only one entry. However, this report has already been released, and no other important events are expected today. Nevertheless, information may come from Poland or Joe Biden on new agreements with Poland. This is very important information.

GBP/USD forecast and recommendations to traders:

I recommended selling the British when closing under the corridor on the hourly chart with a target of 1.3071. Now, these deals can be kept open. I recommend buying the British when rebounding from the 1.3044 level on the 4-hour chart with a target of 1.3274.