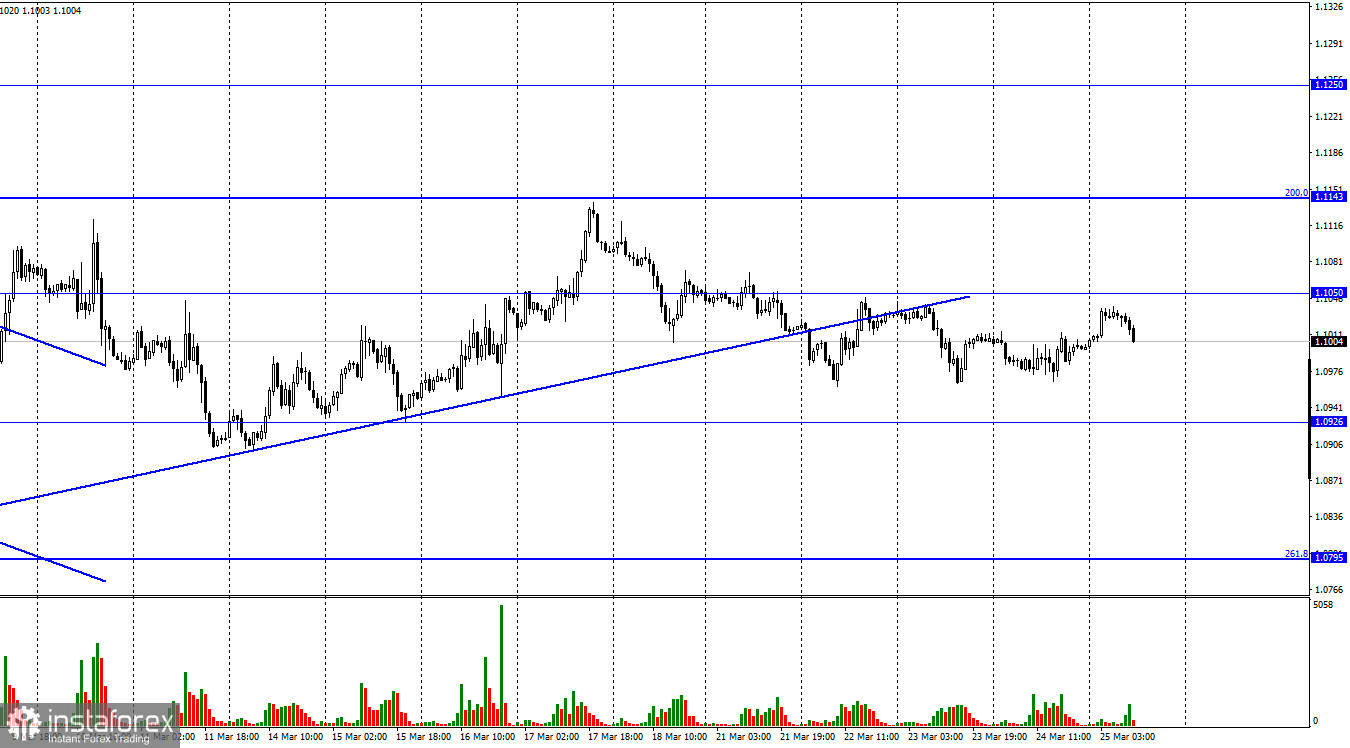

The EUR/USD pair showed obscure movements on Thursday. There was neither growth nor decline, and the activity of traders was minimal. By the beginning of today, the pair's quotes were near the level of 1.1050, but there was no rebound from it. But there was a new reversal in favor of the US currency, which means the bears will try to attack again to drop the pair to the level of 1.0926. The importance of Thursday's information background for traders can be easily understood by the movement of the pair itself during the day - it was absent. So today I would like to focus on politics and geopolitics.

In the last two weeks, an information vacuum has formed in the space of the military conflict between Ukraine and Russia. It seems that the negotiations between Kyiv and Moscow have stopped, and if not, then no one is reporting them to the press. In Russia, Defense Minister Sergei Shoigu disappeared somewhere, and the media also drew attention to the fact that Sergei Naryshkin, Alexander Bortnikov, and Valery Gerasimov have not appeared in public for a long time. In the context of the ongoing military conflict, the disappearance of the Minister of Defense, the Chief of the General Staff, the Secretary of the Security Council, and the director of the foreign intelligence service looks very strange. Official Kyiv continues to make statements several times a day. President Zelensky actively communicates with European and American partners, but he also does not say anything about negotiations with Russia. It seems that the negotiations have failed, but at the same time neither side wants to admit it and declare it publicly. The foreign exchange market also froze. The euro/dollar pair has hardly moved from its place in the last few days, probably also waiting for at least some information regarding the negotiations. After all, if a new escalation of the conflict "smells", the euro and the pound may start falling again. But without specific reasons, traders do not want to get rid of them.

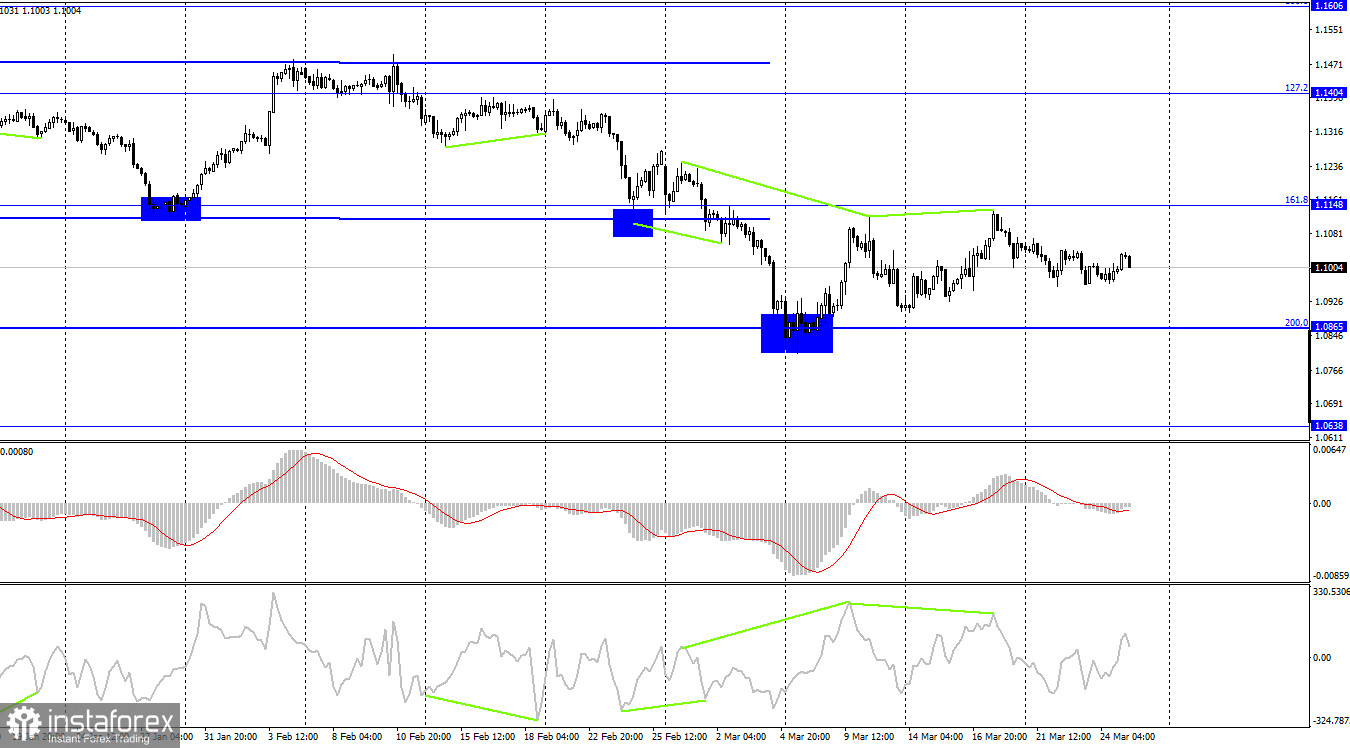

On the 4-hour chart, the pair performed a reversal in favor of the US currency and continues the process of falling towards the corrective level of 200.0% (1.0865) after the formation of a bearish divergence at the CCI indicator. The rebound of quotes from the level of 1.0865 will work in favor of the EU currency and some growth. The consolidation of quotes below the level of 1.0865 will increase the likelihood of a further fall in the direction of the level of 1.0638.

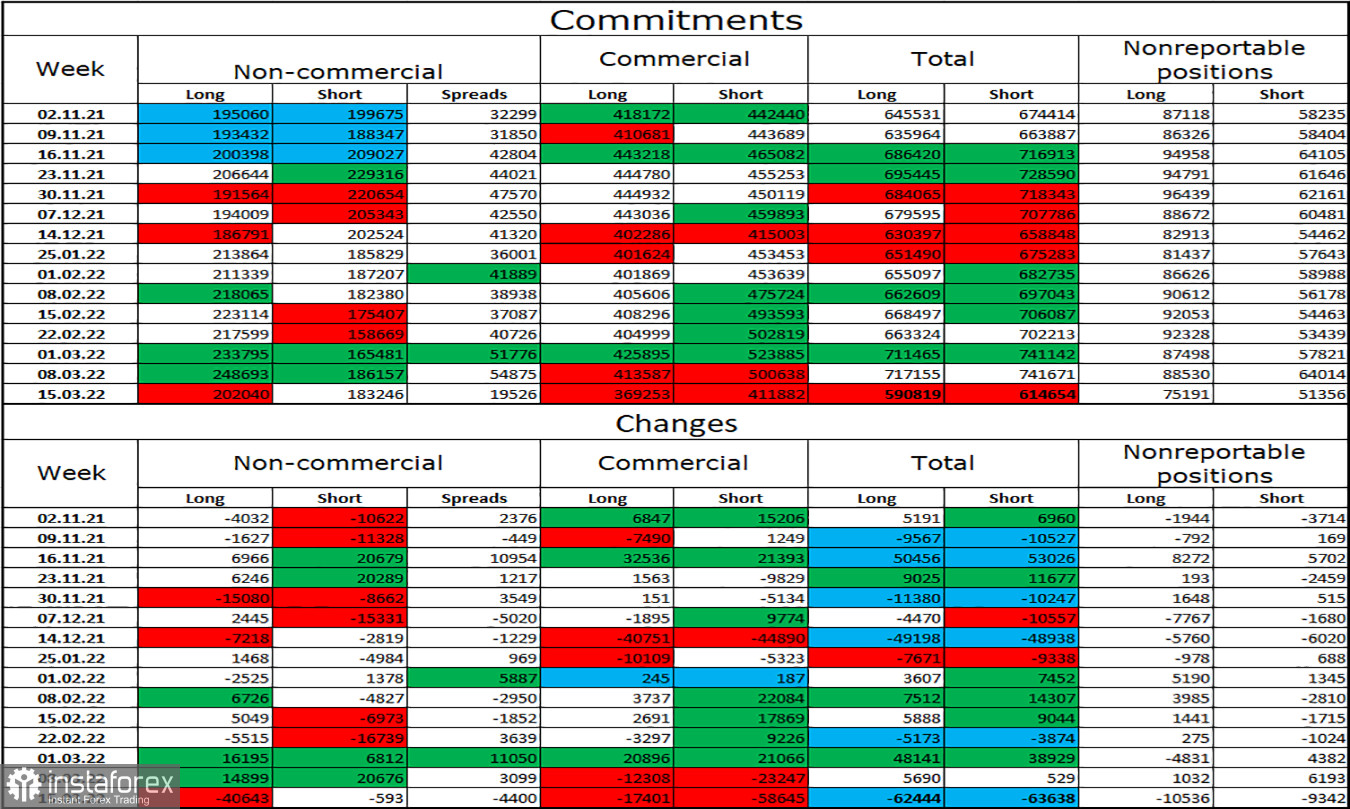

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 40,643 long and 593 short contracts. This means that the bullish mood of the major players has become much weaker. The total number of long contracts concentrated on their hands is now 202 thousand, and short contracts - 183 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish". This would give an excellent opportunity for the European currency to count on growth, if not for the information background, which is now supported only by the dollar. We are now witnessing a paradoxical situation: the "bullish" mood of major players has been maintained since January 25, but the currency itself is falling at the same time. And it falls quite heavily. Thus, geopolitics is now a priority.

News calendar for the USA and the European Union:

On March 25, the calendars of economic events of the European Union and the United States contain several entries, but they are all even less important than yesterday's reports, which did not affect the mood of traders in any way. I believe that even today the information background will not have any impact.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair with a target of 1.0926 on the hourly chart if a close is made under the trend line. Now, these trades can be kept open until they are fixed above 1.1050. I recommend buying a pair if there is a rebound from the 1.0865 level on a 4-hour chart with targets of 1.0926 and 1.1050.