Buying and selling could both be considered.

Hello, dear traders!

Today, I will begin my overview with the US Federal Reserve and its commitment to normalizing interest rates. Thus, making a speech recently, John C. Williams, a FOMC member and the president of the Federal Reserve Bank of New York, took a hawkish stance on monetary policy. According to Mr. Williams, the imbalance between supply and demand leaves the Fed no choice but to raise rates and return them to target levels. Delivering his speech, the FOMC official also pinpointed certain risks, like the Ukrainian conflict and the side-effects of the COVID-19 pandemic. The president of the Federal Reserve Bank of New York additionally emphasized that monetary policy tightening would not seriously affect supply chains and underlined that amid ongoing developments in Ukraine, the regulator should act quickly and decisively.

The interest rate could be raised by 50 basis points at the next meeting if needed, John C. Williams hinted at the possibility. In his view, incoming macroeconomic data, especially inflation reports, deserve special attention and thorough analysis. Meanwhile, financial markets expect the regulator to raise rates by as many as 200 basis points by the end of the year, according to a highly respected source. Such assumptions are overestimated, I think. We should understand that given such high expectations, which have already been partially priced in, the greenback will hardly stay strong versus its main counterparts. Besides, the mild strengthening of the British pound last week only confirms this fact.

Weekly

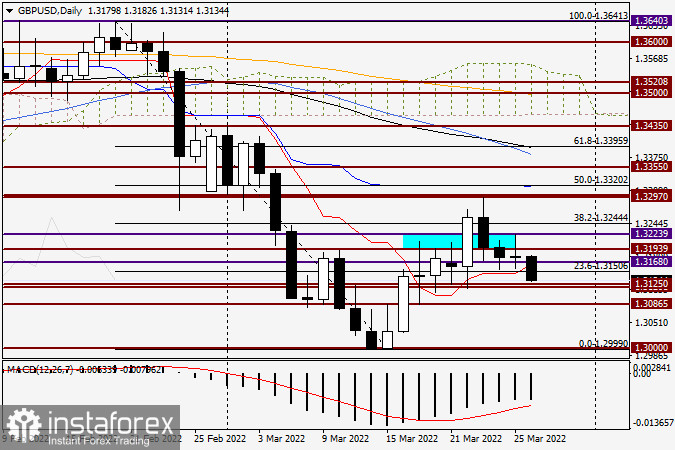

So, unlike the euro, the pound somewhat strengthened against the greenback last week. The latest weekly candlestick with a long upper shadow, which emerged after the price had reached the important and strong technical level of 1.3300, indicates that bulls have faced some difficulties while trading. So far, they can't even break through and consolidate above 1.32000. To the benefit of bulls, the previous two weekly candlesticks closed above support at 1.3168. The recent breakout of the level could be considered false for now.

The pair's further growth potential looks rather vague because bulls now have to push the price up towards 1.3300 in order to break through and settle above it. Given that the red Tenkan Line of the Ichimoku indicator is at 1.3320 and support at 1.3355 has become resistance, it is unlikely possible. Nevertheless, bears are also struggling because, in order to resume the downtrend, they need to return to 1.31658 and then break through the technical support zone of 1.3120-1.3100. If successful, the pair will head towards the key historical psychological and technical level of 1.3300 where the fate of the future movement will be decided.

Daily

In the daily time frame of GBP/USD, we can see that all candlesticks have long shadows. Such a technical picture demonstrates the market's indecisiveness as to where the pair could go further. This means that long positions could be considered as well as short ones. Nevertheless, given fundamental, geopolitical, and technical points of view, going short from the 1.3190-1.3220 price range seems right at the moment. In order to enter short positions at a more profitable price, the pair should reach the 1.3280-1.3295 range first. Meanwhile, in order to open long positions, candlesticks should form in the 1.3130-1.3100 range in the daily or lower time frames. Going long could also be considered at around 1.3165. A detailed analysis of lower time frames on GBP/USD will be given tomorrow.

Good luck!